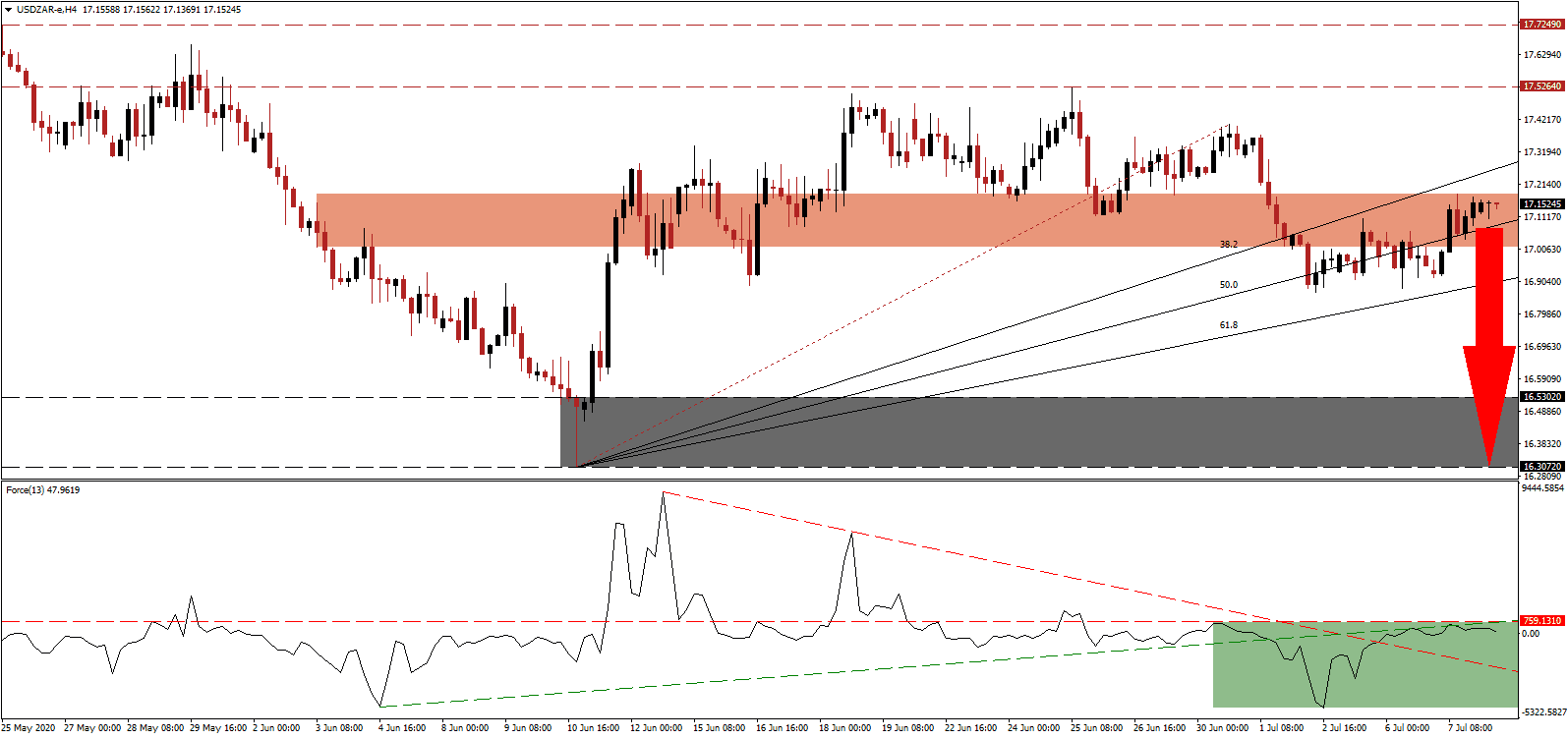

South African Health Minister Zweli Mkhize warned that Covid-19 infections would continue to rise, as the nationwide economic lockdown is unsustainable and economic activities must resume. After Western and Eastern Cape provinces are dealing with virus hotspots, he identified Gauteng as the next epicenter. Inward migration, metropolitan areas like Johannesburg, and mining cites are noted as drivers for new infection clusters. He additionally confirmed the spread of the virus exceeds expectations. The USD/ZAR was able to halt its sell-off and reversed into its short-term resistance zone, while bullish momentum remains dormant.

The Force Index, a next-generation technical indicator, was rejected by its ascending support level, serving as resistance, located just below its horizontal resistance level, as marked by the green rectangle. It reiterates bearish pressures, and this technical indicator is on the verge to cross below the 0 center-line from where an acceleration below its descending resistance level is favored to place bears in complete control of the USD/ZAR.

Adding to concerns is the reluctance and refusal by a growing majority to self-isolate. It is replicated across the globe, allowing the Covid-19 virus to spiral out of control. Healthcare workers account for 5% of infections, confirming the lack of personal protective equipment (PPE). Health Minister Zweli Mkhize pointed out that hospitals are overwhelmed and that the situation is poised to worsen. While the USD/ZAR drifted into its downward adjusted short-term resistance zone located between 17.0145 and 17.1841, as marked by the red rectangle, the corrective phase is well-positioned to rekindle with a new breakdown.

US President Trump announced that he might pressure state governors to reopen schools this fall, despite the Covid-19 pandemic raging uncontrollably across the nation. After states ignored guidelines and rushed to lift restrictions, new infections soared to a level that forced a halt or rollback of measures. It delayed the overall economic healing process, delivering significant setbacks. A collapse in the USD/ZAR below its ascending 61.8 Fibonacci Retracement Fan Support Level is anticipated to drive price action into its support zone located between 16.3072 and 16.5302, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 17.1500

Take Profit @ 16.3000

Stop Loss @ 17.3500

Downside Potential: 8,500 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 3.40

In the event the Force Index accelerates above its ascending support level, the USD/ZAR is likely to spike higher. The upside potential is reduced to its downward revised resistance zone located between 17.5264 and 17.749, granting Forex traders a secondary short selling opportunity. As the US situation is increasingly deteriorating, without a solution in sight, the long-term outlook for this currency pair remains bearish.

USD/ZAR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 17.3500

Take Profit @ 17.5500

Stop Loss @ 17.2500

Upside Potential: 2,000 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.00