South Africa business lobby group Business for South Africa (B4SA) identified twelve areas for reform that could boost Africa’s most industrialized country GDP by R1 trillion. Proposed projects include affordable electricity supply, digitalizing the economy, and improving essential infrastructure, including ports, railroads, and water. It is estimated to add 1.5 million jobs and add R100 billion in annual tax revenues. The Covid-19 pandemic is forcing the South African government to address long-running problems, adding a bearish catalyst to the USD/ZAR, expected to accelerate its breakdown sequence following a brief reversal.

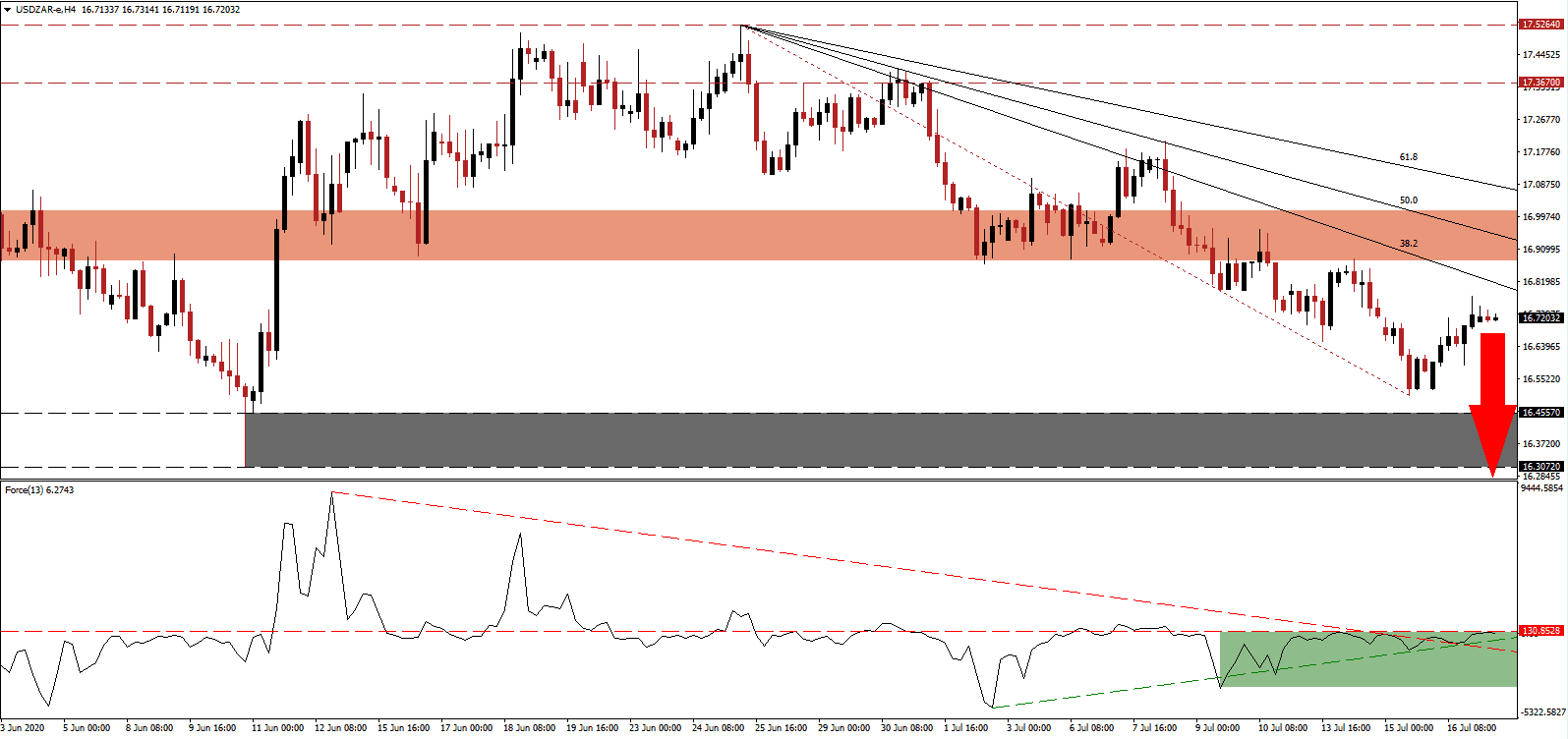

The Force Index, a next-generation technical indicator, drifted into its horizontal resistance level, as marked by the green rectangle, from where it faces rejection amid a rise in bearish pressures. A breakdown below its ascending support level is anticipated to extend through its descending resistance level. It will take this technical indicator into negative territory and allow bears to regain complete control over the USD/ZAR.

Financing remains a key hurdle with proposed projects estimated to require R3.4 trillion in funding. The South Africa Reserve Bank is unable to provide the necessary capital sustainably through monetary policy. Therefore, public-sector debt is expected to increase to R6.4 trillion over the next three years. B4SA argues that the private sector should assist in financing infrastructure in a regulated and competitive environment. The willingness to address complex issues in South Africa adds to a bullish outlook, favored to extend the collapse in the USD/ZAR below its short-term resistance zone located between 16.8770 and 17.0152, as marked by the red rectangle, farther to the downside.

One essential sector for the South African economic recovery remains the small and medium-sized enterprises (SMEs), accounting for over 98% of the country’s businesses, employ more than 60% of the labor market, but lag in GDP contribution at just 39%, as compared to other economies. It suggests that there is untapped potential, which needs to be addressed through reforms and assistance programs. The descending 38.2 Fibonacci Retracement Fan Resistance Level is likely to force the USD/ZAR into a breakdown below its support zone between 16.3072 and 16.4557, as identified by the grey rectangle. Price action will challenge its next support zone between 15.4522 and 15.7482.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 16.7200

Take Profit @ 15.5200

Stop Loss @ 17.0200

Downside Potential: 12,000 pips

Upside Risk: 3,000 pips

Risk/Reward Ratio: 4.00

Should the ascending support level guide the Force Index into a breakout, the USD/ZAR may attempt to seek more upside. Given the out-of-control Covid-19 pandemic in the US, the absence of a nationwide response, disagreements between states, and prospects of several trillion more in debt, the bearish outlook for the US Dollar expands. Forex traders are advised to sell any rallies, which are reduced to its downward revised resistance zone between 17.3700 and 17.5264.

USD/ZAR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 17.1200

Take Profit @ 17.3700

Stop Loss @ 17.0200

Upside Potential: 2,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.50