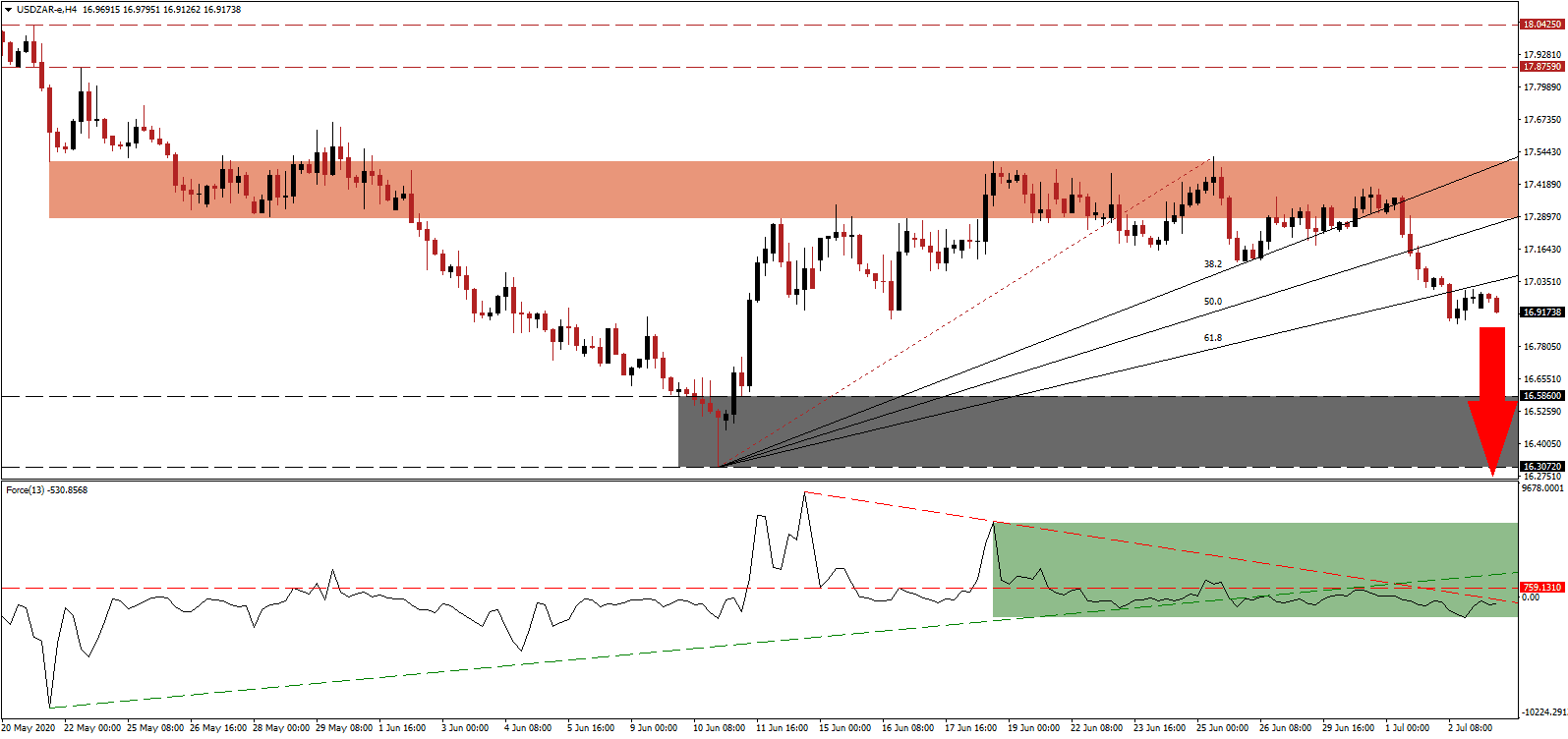

After the South African economy posted a 2.0% contraction in the first quarter, the South African Reserve Bank forecasts a 32.6% collapse in the second quarter. It will represent the most significant quarterly drop since 1990. It follows GDP contractions of 0.8% and 1.4%, in the third and fourth quarter of 2019, respectively, the first time since 2009 that a recession exceeded two quarters. The 2020 full-year outlook is for a decline of 7.0%, per the central bank, the most severe reading since the 1931 Great Depression. Intensifying negative progress out of the US fueled the breakdown in the USD/ZAR below its ascending 61.8 Fibonacci Retracement Fan Support Level, converting it into resistance.

The Force Index, a next-generation technical indicator, faces enhanced downside pressure provided by its descending resistance level, as marked by the green rectangle. Following the move below its ascending support level, bearish momentum gained dominance. The Force Index remains below its horizontal resistance level, with more downside favored. Bears are in control of the USD/ZAR, as this technical indicator slides deeper into negative territory.

Finance Minister Tito Mboweni announced the struggling Land Bank would receive an R3 billion equity injection from the government, hoping to grant it access to financial markets. The state-owned development bank seeks to raise an additional R3 billion to cover operating expenses and fulfill existing loan guarantees. Finance Minister Mboweni stressed that the Land Bank is the only government-owned enterprise to receive a cash injection. The breakdown sequence in the USD/ZAR, which commenced inside of its short-term resistance zone located between 17.2813 and 17.5081, as identified by the red rectangle, is well-positioned to accelerate to the downside.

Adding to breakdown pressures in this currency pair is the rise in US initial jobless claims while continuing claims surpassed the previous week’s level. It confirms that the unemployed remains without a job for longer, while more filed for government assistance. With the employment to population ratio below 53% and low-skill, low-income job creation accounting for the bulk of added positions, the outlook for the US economy remains depressed. The USD/ZAR is anticipated to correct into its support zone located between 16.3072 and 16.5860, as marked by the grey rectangle, with an extension highly probable.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 16.9200

Take Profit @ 16.2200

Stop Loss @ 17.1200

Downside Potential: 7,000 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 3.50

A breakout in the Force Index above its ascending support level, acting as short-term resistance, is likely to push the USD/ZAR higher. Forex traders are recommended to view any reversal from current levels as a secondary selling opportunity. With early indicators suggesting an improving South African economy, the US is faced with a more significant health crisis than in April. The upside potential is limited to its ascending 38.2 Fibonacci Retracement Fan Resistance Level.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.2700

Take Profit @ 17.5200

Stop Loss @ 17.1200

Upside Potential: 2,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.67