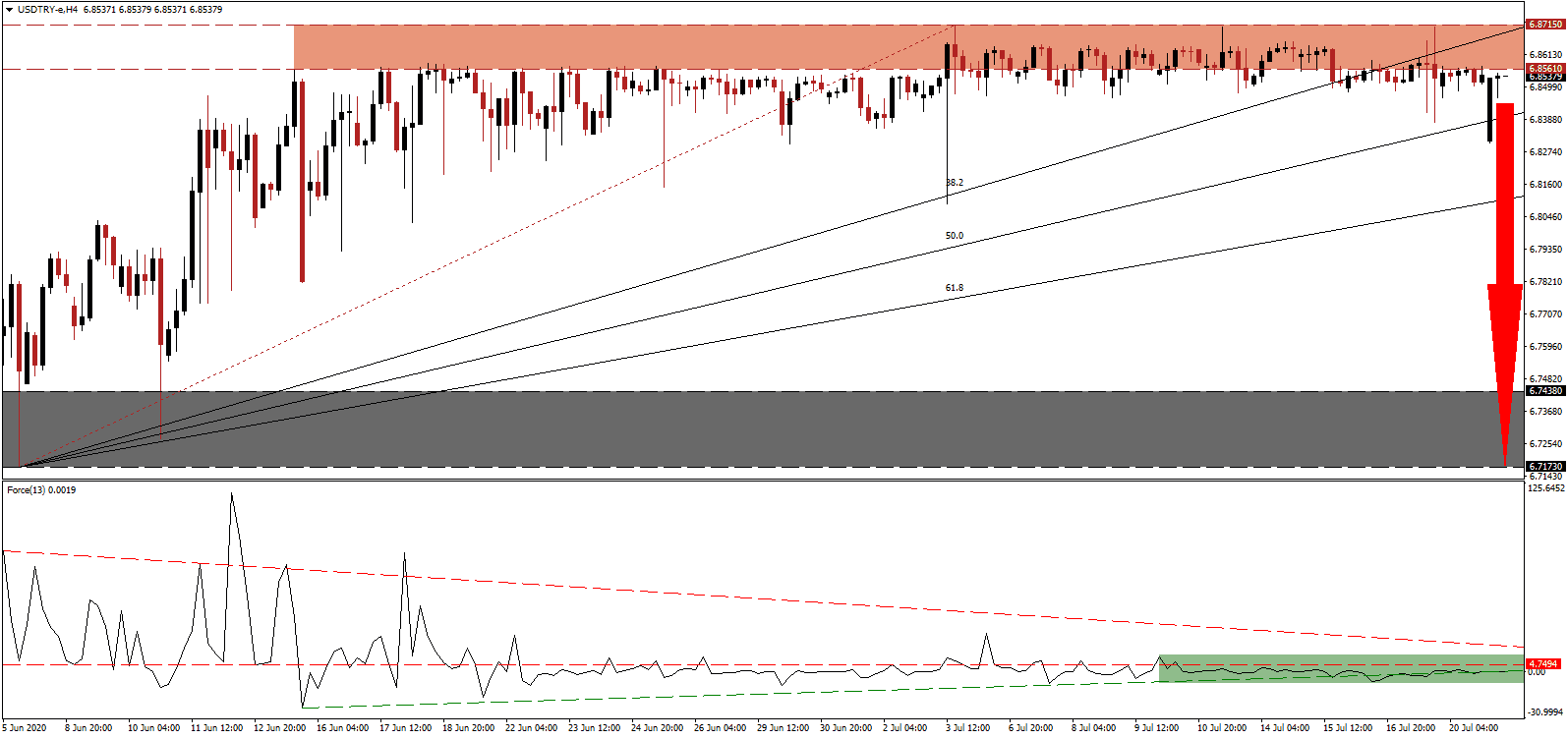

Turkey appears to have the Covid-19 pandemic under control, with new daily cases trending lower. It is presently the fifteenth-most infected country, but trending lower. After the record quantitative easing program by the Türkiye Cumhuriyet Merkez Bankası (TCMB), the country’s central bank, it now holds ₺89 billion of government debt, including ₺23 billion in bonds from the unemployment fund that maintains wages amid the Covid-19 disruptions. It represents a significant increase from the ₺19 billion in debt from twelve months ago. The USD/TRY, following an extended sideways trend, is now under intensifying selling pressure since the breakdown below its resistance zone.

The Force Index, a next-generation technical indicator, confirmed the sideways trend in price action, while the descending resistance level is increasing bearish pressures, as marked by the green rectangle. The Force Index remains below its horizontal resistance level and is in the process of correcting below its ascending support level. Bears wait for this technical indicator to move below the 0 center-line to regain full control over the USD/TRY.

Foreigners sold over $11 billion worth of Turkish assets. Ownership in government bonds dropped to just 4.3%, resulting in the lowest foreign-investor presence across emerging markets. While inflation risks remain elevated, Turkey has an abundance of private gold ownership, with programs in place to monetize it. It adds to the support of the Turkish Lira by the TCMB, where some reports indicate $60 billion worth of Forex interventions in 2020. Central bank buying is anticipated to diminish due to depleted resources. The USD/TRY is well-positioned to extend its breakdown below the resistance zone located between 6.8561 and 6.8715, as marked by the red rectangle.

With the Covid-19 pandemic in the headlines, the stand-off between Turkey and the EU intensified under the radar. The EU has given Turkey one month to stop drilling in what Greece considered territorial waters. Drilling commenced after Turkey signed a deal with Libya, essentially cutting Greece off access to the Mediterranean, for which Greece is pushing Brussels to implement crippling sanctions against Turkey. With the EU unlikely to sour relations further, the USD/TRY is favored to correct below its ascending 61.8 Fibonacci Retracement Fan Support Level and accelerate into its support zone located between 6.7173 and 6.7438, as identified by the grey rectangle.

USD/TRY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 6.8525

Take Profit @ 6.7175

Stop Loss @ 6.8800

Downside Potential: 1,375 pips

Upside Risk: 275 pips

Risk/Reward Ratio: 5.00

A breakout in the Force Index above its descending resistance level may pressure the USD/TRY into a temporary price spike. Forex traders should consider any advance as a secondary selling opportunity due to the out-of-control Covid-19 pandemic in the US and the lack of interest in the federal response to essential healthcare measures. Price action will face its next resistance zone between 6.9557 and 7.0071.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.9200

Take Profit @ 7.0000

Stop Loss @ 6.8800

Upside Potential: 800 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 2.00