Singapore entered a technical recession as it reported a second-quarter GDP plunge of 41.2% quarter-over-quarter. It follows the upward revised first-quarter decrease of 3.3%, initially reported as a drop of 4.7%. Year-over-year, GDP slumped 12.6% in the second quarter. It compares to the 0.3% first-quarter GDP slide, reflecting an upward revision from the initial 0.7% contraction. While the economy likely bottomed out, economists forecast job losses and wage cuts to expand. Despite the GDP disappointment and cautious outlook, elevated bearish pressures in the USD/SGD are likely to lead to a breakdown extension.

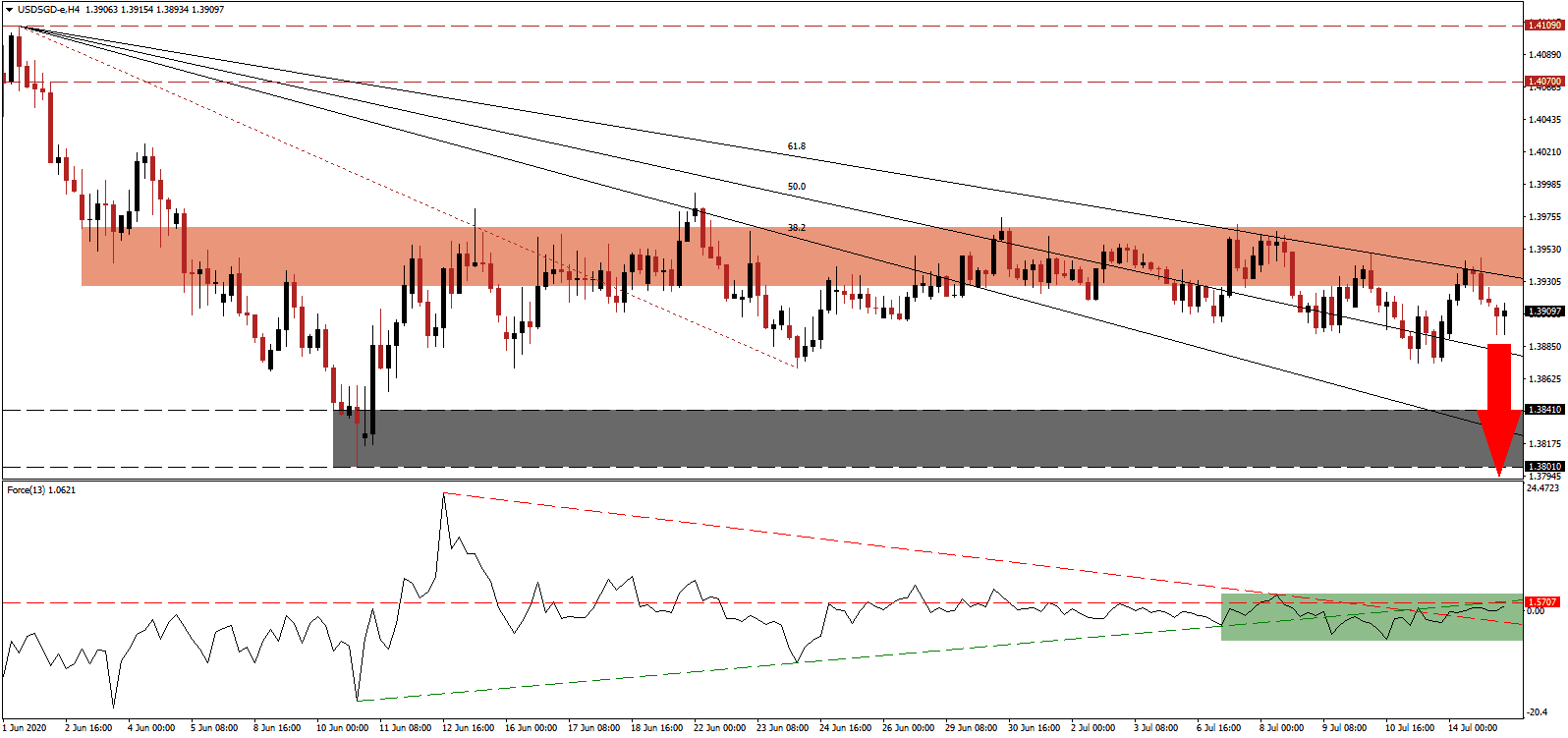

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level. It is presently exposed to a role reversal between its ascending support level and descending resistance level, as marked by the green rectangle. While this technical indicator drifted above the 0 center-line, bearish momentum maintains its dominance, favored to pressure for a reversal, and placing the USD/SGD under complete bearish control.

Following the bruised re-election of Prime Minister Lee Hsien Loong, the governing People's Action Party (PAP), ruling Singapore since becoming independent from Malaysia in 1965, will embark on a swift recalibration of the economy. While the opposition secured 10 out of 95 seats, a record, the margin of victory for the ruling party narrowed. Singapore also battles rising competition from neighboring countries. After the USD/SGD was rejected by the downward revised short-term resistance zone located between 1.3927 and 1.3968, as identified by the red rectangle, more selling is anticipated.

With the surge in Covid-19 cases forcing states to halt or revise the economic reopening and lifting of restrictive measures, the US Dollar remains under pressure. The seven-day average for new infections crossed above 60,000, government assistance for the unemployed and laws protecting renters from eviction due to failed rent payments set to expire, more debt is considered. It positions the USD/SGD for a breakdown below its descending 50.0 Fibonacci Retracement Fan Support Level and into its compressed support zone located between 1.3801 and 1.3841, as marked by the grey rectangle. A collapse into its next support zone between 1.3690 and 1.3752 is expected to materialize.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3910

Take Profit @ 1.3690

Stop Loss @ 1.3950

Downside Potential: 220 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 5.50

Should the Force Index accelerate above its ascending support level, serving as resistance, the USD/SGD may attempt a temporary reversal. The upside potential is limited to its intra-day high of 1.3993, the peak from where the most recent drift to the downside materialized. Since the US federal government, in the middle of the election campaign, shows no willingness to implement a nationwide response to the out-of-control pandemic, the well-established correction is on course to extend.

USD/SGD Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 1.3965

Take Profit @ 1.3990

Stop Loss @ 1.3950

Upside Potential: 25 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 1.67