Ravi Menon, the Managing Director of the Monetary Authority of Singapore (MAS), the country’s central bank, cautioned that the economy remains in a dire state due to the Covid-19 pandemic. While the US lost control over it during an ill-advised rush to reopen the economy, without a proper test, trace, and isolate (TTI) infrastructure in place, parts of Asia where the pandemic appeared to recede, report an uptick in new cases. The US additionally suffers from a general public that ignores the advice of healthcare officials, refuses to wear masks, and does not implement social distancing. It positioned the USD/SGD for an accelerated breakdown sequence.

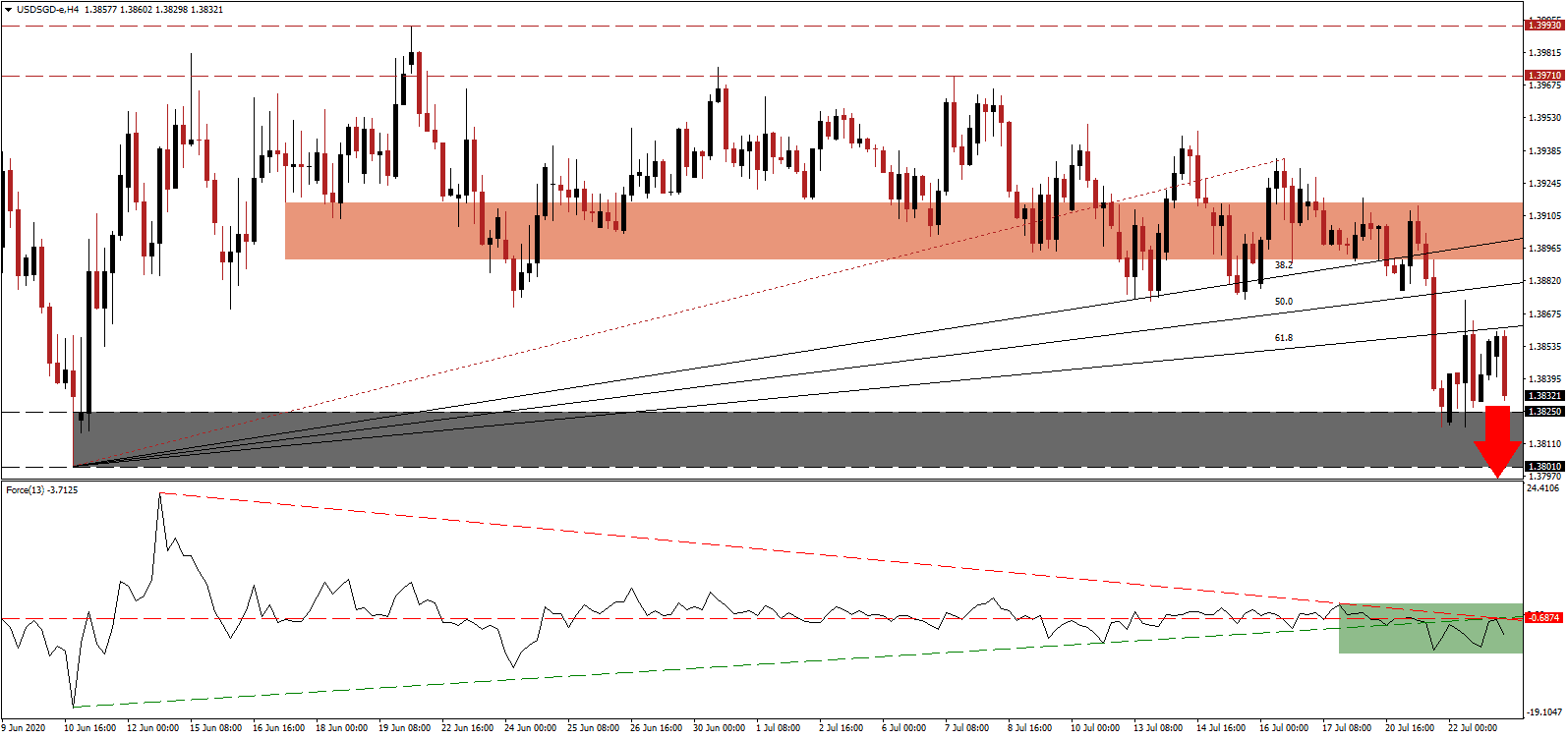

The Force Index, a next-generation technical indicator, confirms the dominance of bearish momentum below its horizontal resistance level. Adding to downside pressures, following the slide below its ascending support level, is the descending resistance level, as marked by the green rectangle. Bears are in complete control of the USD/SGD with this technical indicator below the 0 center-line.

Corporate bankruptcies and unemployment are forecast to increase with global Covid-19 cases setting new daily records. Menon singled out elevated private and corporate debt levels, which will act as a drag on an uneven recovery, and add vulnerabilities. Adding a minor bullish catalyst to the Singapore Dollar is the S$10.6 billion profit MAS generated for the fiscal year ending March 2021, of which half will be returned to the government. After the USD/SGD collapsed below its short-term resistance zone located between 1.3891 and 1.3916, as marked by the red rectangle, the correction is favored to extend.

Despite the deepening global problems posed by Covid-19, MAS assured that its banks and insurers have adequate capital reserves, even under the most severe conditions. The situation in the US is on the verge of getting worse, with the $600 weekly government stimulus to initial jobless claims set to expire next week. An extension until December may see the subsidy slashed to just $100. It adds to downside pressures on the USD/SGD, which converted its ascending 61.8 Fibonacci Retracement Fan Support Level into resistance. It is now on course to correct below its support zone located between 1.3801 and 1.3825, as identified by the grey rectangle. Price action will then be clear to descend into its next support zone between 1.3690 and 1.3752.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3835

Take Profit @ 1.3690

Stop Loss @ 1.3875

Downside Potential: 145 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.63

A breakout in the Force Index above its ascending support level, serving as resistance, could lead to a temporary price spike in the USD/SGD. Forex traders should take advantage of any advance from present levels amid a worsening economic outlook for the US economy and the US Dollar. The upside potential confined to its intra-day high of 1.3935, which is pending a downward revision.

USD/SGD Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 1.3895

Take Profit @ 1.3935

Stop Loss @ 1.3875

Upside Potential: 40 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.00