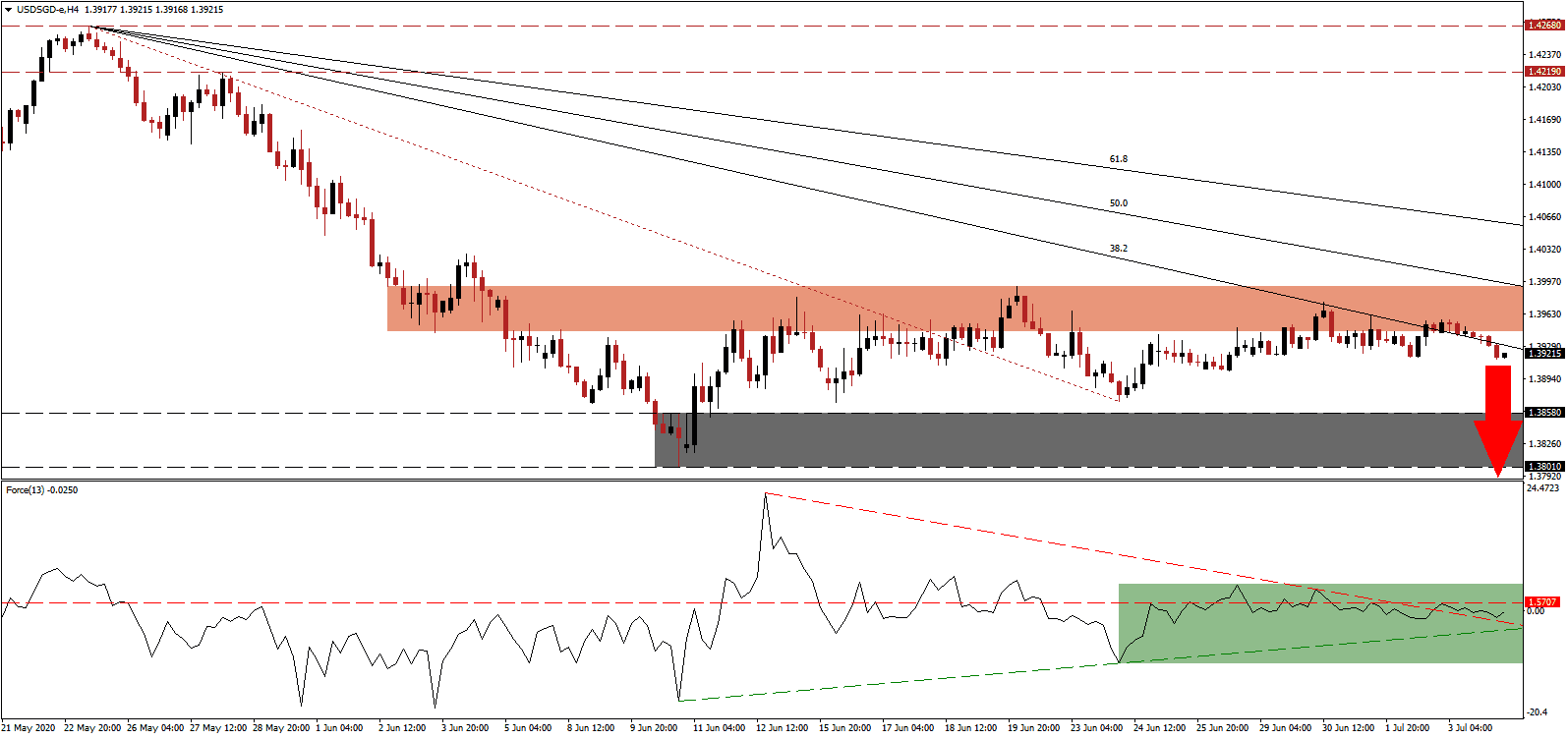

Singapore recorded 880 visitors in May amid tight border controls and the absence of a cure for the global Covid-19 pandemic. It marked improvement over April’s 750 visitors but is well below the 1.49 million in May 2019. Over the five months ending in May, arrivals are down 65.7%. The length of each visit surged to 51.7 days, up from April’s 39.1 days. Before February, the average stay was four days. Some estimates outline two years for tourism to recover to pre-pandemic levels. The USD/SGD continues its correction with the breakdown sequence likely to accelerate to the downside.

The Force Index, a next-generation technical indicator, ended its drift higher, initiated after grazing its ascending support level. A brief push to the upside was rejected by its descending resistance level, as marked by the green rectangle, and subsequently by its horizontal resistance level. The move by this technical indicator below the 0 center-line granted bears full control over the USD/SGD.

May retail sales collapsed by 52.1% year-on-year, the most massive contraction since 1986, the start of the data set. It follows the 40.3% drop in April and represents the 16th consecutive month of declines, suggesting consumers were under pressure since the Christmas shopping season of 2018. Since June 2nd, Singapore initiated a phased reopening of its economy, likely to lead to a notable reversal in retail sales. The USD/SGD pushed below its short-term resistance zone located between 1.3944 and 1.3992, as marked by the red rectangle, partially driven by intensifying US Dollar weakness.

On July 10th, Singapore will become the first major economy to vote for a new leader in the Covid-19 era. Prime Minister Lee Hsien Loong is favored to add to his 16-year reign, but with faltering support. While the city-state reported less than 45,000 infections and only 26 deaths, its economy reflects the significant negative impact and overreliance on outside factors like trade and tourism. Lack of innovation remains an essential challenge. Election certainty adds to bearish pressures in the USD/SGD, driven lower by its descending 38.2 Fibonacci Retracement Fan Resistance Level. A breakdown below its support zone located between 1.3801 and 1.3858, as identified by the grey rectangle, is anticipated to lead price action into its next support zone between 1.3690 and 1.3752.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3920

Take Profit @ 1.3690

Stop Loss @ 1.3980

Downside Potential: 230 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.83

Should the ascending support level pressure the Force Index higher, the USD/SGD is likely to attempt a reversal. Given the out-of-control pandemic in the US and recent worsening of the labor market, Forex traders are advised to view any advance as an excellent selling opportunity. The upside potential is reduced to its descending 61.8 Fibonacci Retracement Fan Resistance Level.

USD/SGD Technical Trading Set-Up - Reduced Reversal Scenario

Long Entry @ 1.4010

Take Profit @ 1.4060

Stop Loss @ 1.3980

Upside Potential: 50 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 1.67