Singapore will hold elections this Friday, where incumbent Prime Minister Lee Hsien Loong will face off against challenger Pritam Singh, where his re-election is widely anticipated. One development to monitor is if he loses votes and sees his majority shrink. Under his premiership, Singapore failed to innovate and is falling behind as neighbors are closing the gap. The Covid-19 pandemic confirmed the unhealthy dependence on outside factors for the prosperity of the city-state, highlighting the need for economic reform. Breakdown pressures on the USD/SGD are rising inside of the resistance zone, partially driven by cautious optimism over the election result.

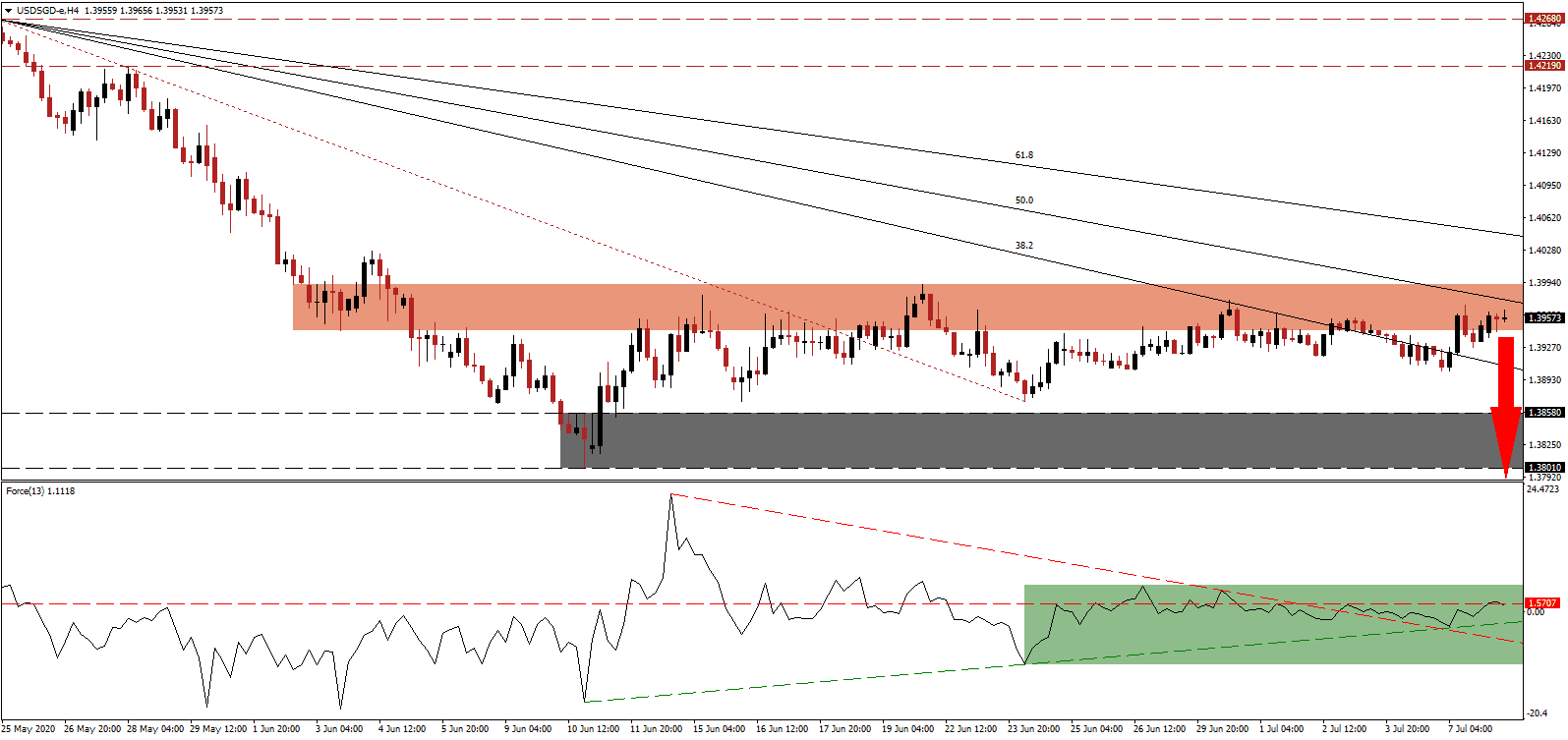

The Force Index, a next-generation technical indicator, reversed a brief advance above its horizontal resistance level, as marked by the green rectangle. It is now favored to gather downside momentum for a collapse below its ascending support level. A move below the 0 center-line by this technical indicator will increase bearish pressures, and a breakdown below its descending resistance level, serving as temporary support, will place the USD/SGD under the control of bears.

Providing more evidence that Singapore requires a reboot is the average annual growth rate over the past five years, clocking in just below 2.5%. Singapore is increasing its dominance in biotechnology, pharmaceuticals, precision manufacturing. It seeks to further expand into energy, logistics, healthcare, and software. This week’s election will show if voters believe Prime Minister Lee Hsien Loong is the right candidate to deliver. After the USD/SGD reversed back into its short-term resistance zone located between 1.3944 and 1.3992, as identified by the red rectangle, bearish momentum is well-positioned to force a renewed sell-off.

Increasing breakdown pressures is the descending 50.0 Fibonacci Retracement Fan Resistance Level. While Singapore is struggling with stagnant wages and rising anti-immigration sentiment, the US lost control over the Covid-19 pandemic. It adds to bearish progress in the USD/SGD as the US government considers more debt-funded assistance. Price action is expected to collapse into its support zone located between 1.3801 and 1.3858, as marked by the grey rectangle. From there, an acceleration into its next support zone between 1.3690 and 1.3752 is likely to emerge.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.3955

Take Profit @ 1.3690

Stop Loss @ 1.3995

Downside Potential: 265 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 6.63

In case the ascending support level pushes the Force Index higher, the USD/SGD could attempt a breakout. The upside potential is limited to its descending 61.8 Fibonacci Retracement Fan Resistance Level, amid a deteriorating labor market in the US. Forex traders are recommended to consider any advance as a selling opportunity, supported by an increasingly bearish outlook in the US Dollar with unsustainable and rising debt.

USD/SGD Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 1.4010

Take Profit @ 1.4040

Stop Loss @ 1.3995

Upside Potential: 30 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.00