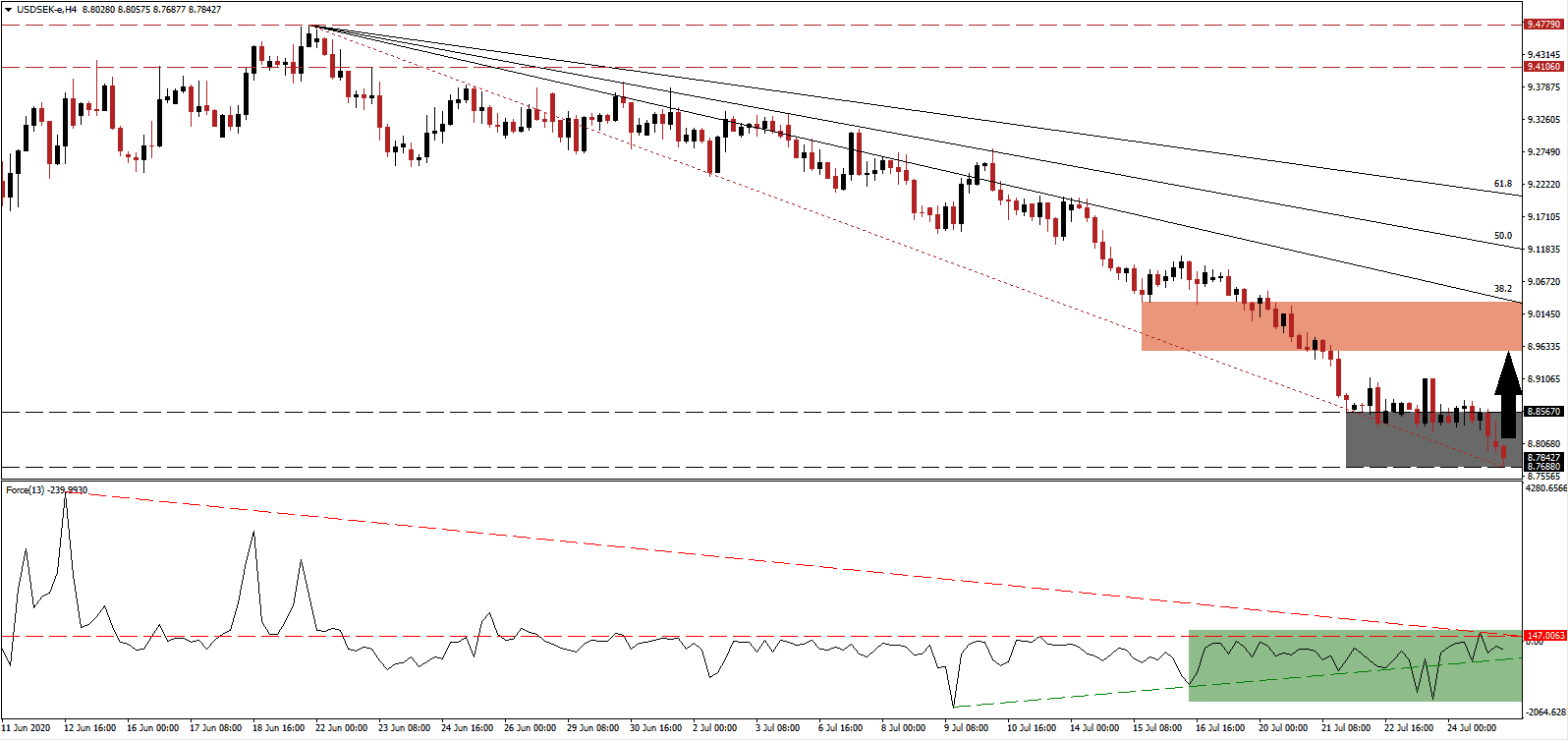

Sweden, usually a leader in humanitarian efforts and Top 5 countries for quality of life, continues to pay the price for its light approach to the Covid-19 pandemic. It resulted in one of the highest death tolls per one million in the world, while the economy has suffered equally or worse to countries where strict lockdowns and social distancing were implemented. It led to the exclusion of Sweden, by Nordic partners Denmark and Norway, from travel zones to ease transit and boost cross-border economic activity. The USD/SEK was unfazed by current developments and extended its breakdown sequence. A minor and necessary counter-trend advance is possible to precede more aggressive selling.

The Force Index, a next-generation technical indicator, suggests a brief price spike is possible with the emergence of a positive divergence. Any upside potential remains limited. Bearish pressures, provided by the horizontal resistance level, are magnified by its descending resistance level. The ascending support level is adding to short-term breakout pressures, favored to experience a swift reversal. This technical indicator maintains its position in negative territory, confirming bears are in control of the USD/SEK.

Why the Public Health Agency of Sweden (Folkhälsomyndigheten) opted against lockdowns remains unconfirmed. Other countries who preferred a similar approach swiftly reversed course as the death toll surged. Unconfirmed claims suggest herd immunity was the undeclared goal. Sweden has also downplayed the importance of testing and insists on mandatory schooling for young children. The USD/SEK is positioned to enter a temporary advance out of its support zone located between 8.7688 and 8.8567, as identified by the grey rectangle, before resuming its well-established corrective phase.

After US government subsidies to the unemployed of $600 per week expired this weekend, together with a moratorium on evictions, Republicans will unveil their proposed replacement today. It will include a second $1,200 direct payment to consumers, with significantly lowered financial support for the unemployed. The fifth stimulus package carries a debt load of $1 trillion, adding to downside pressures in the USD/SEK. It is confirmed by the downward revision of the short-term resistance zone, presently located between 8.9548 and 9.0332, as marked by the red rectangle. The descending Fibonacci Retracement Fan sequence is expected to enforce the dominant bearish chart pattern.

USD/SEK Technical Trading Set-Up - Temporary Reversal Scenario

Long Entry @ 8.7850

Take Profit @ 9.0000

Stop Loss @ 8.7000

Upside Potential: 2,150 pips

Downside Risk: 850 pips

Risk/Reward Ratio: 2.53

Should the Force Index collapse below its ascending support level, the USD/SEK is anticipated to resume its correction with an accelerated sell-off. The Covid-19 pandemic is out o control in the US, where the federal government is more concerned with debt-funded stimuli ahead of the November presidential election than with implementing necessary measures to contain the crisis. Forex traders are advised to sell any price spikes. The next support zone awaits between 8.1967 and 8.2858.

USD/SEK Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 8.6200

Take Profit @ 8.2000

Stop Loss @ 8.7000

Downside Potential: 4,200 pips

Upside Risk: 800 pips

Risk/Reward Ratio: 5.25