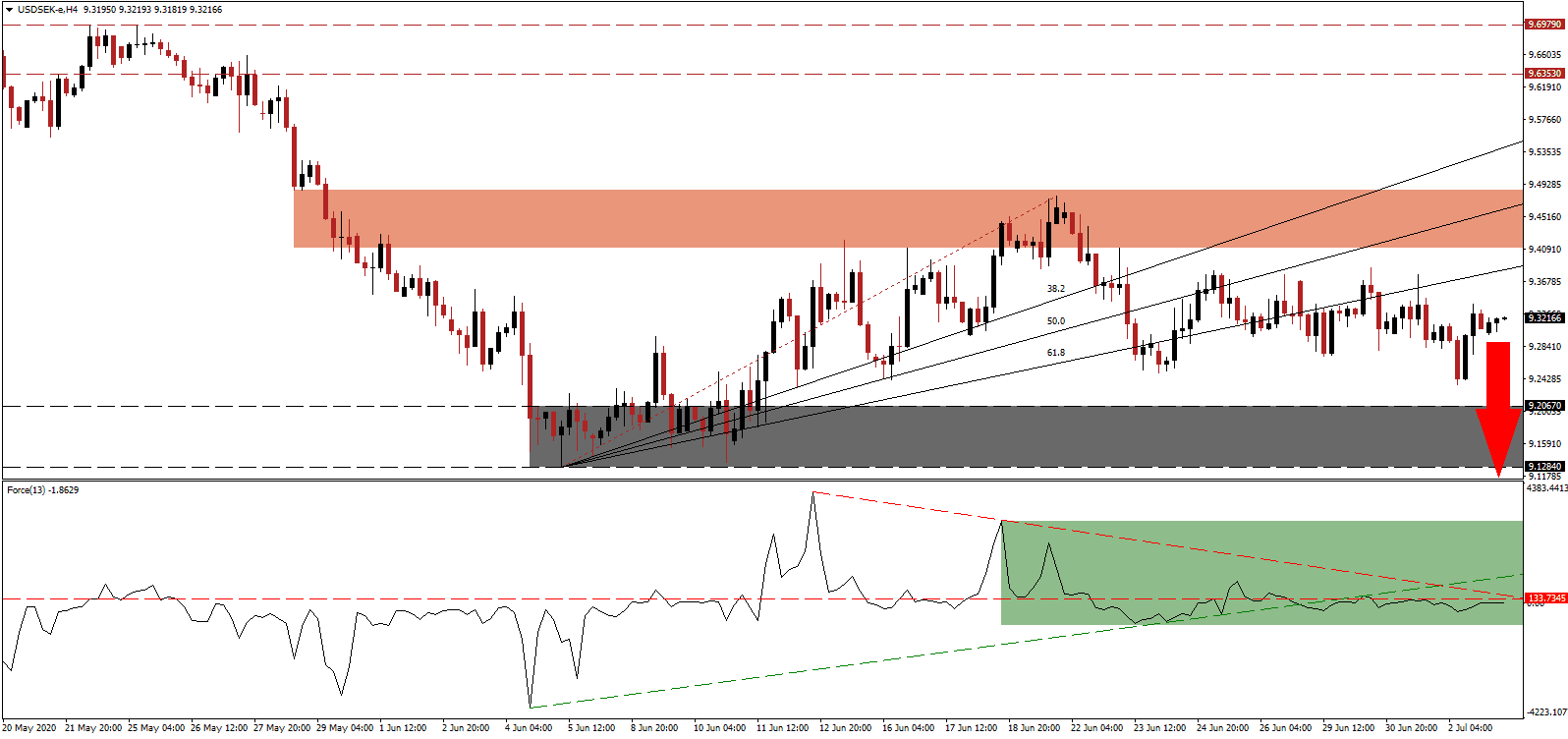

Sweden’s economy is forecast to shrink by 6.0% in 2020, a figure prone to downward revisions. Despite the absence of a nationwide lockdown, economic indicators are on par or worse than across Europe. Consumers voluntarily remained at home and avoided crowds, as evident in data. It did cost Sweden in the form of significantly more confirmed Covid-19 infections and deaths. Given the out-of-control pandemic across the US, the USD/SEK is well-positioned to extend its correction to the downside, following the rejection by its ascending 61.8 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level. After the breakdown below its ascending support level, bearish momentum became dominant. The descending resistance level is applying additional downside pressure, as marked by the green rectangle. Bears remain in complete control of the USD/SEK with this technical indicator in negative territory.

A 6.0% GDP drop will represent the worst contraction for Sweden since 1940. It prompted the Sveriges Riksbank, the country’s central bank, to expand its asset purchase program to 500 billion kr. The timeline was also extended to June 2021, while interest rates were maintained at 0.00%. It mirrors the move by the European Central Bank, which boosted its quantitative easing program to €1.35 trillion, extended until June 2021, and no change in interest rates. The healthy counter-trend advance in the USD/SEK concluded following a lower high and breakdown below its short-term resistance zone located between 9.4106 and 9.4857, as identified by the red rectangle.

While yesterday’s US June NFP report beat expectations with a record 4.8 million job additions, the period ended mid-month. The second half saw a rollback of economic reopening measures. Initial jobless claims increased, and continuing claims surpassed the previous week’s figure, suggesting the May-June job additions are temporary. Low-skill, low-income jobs account for the majority of created employment, indicative of weak economic performance moving ahead. The USD/SEK is anticipated to drop into its support zone located between 9.1284 and 9.2067, as marked by the grey rectangle. A collapse into its support zone between 8.9539 and 9.0392 is favored to follow.

USD/SEK Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 9.3200

Take Profit @ 8.9700

Stop Loss @ 9.3900

Downside Potential: 3,500 pips

Upside Risk: 700 pips

Risk/Reward Ratio: 5.00

Should the Force Index accelerate above its descending resistance level, the USD/SEK could attempt to push farther to the upside. Forex traders are advised to take advantage of any advance from current levels with new net short positions, due to the intensifying Covid-19 pandemic across the US, expected to inflict significant harm on the economy well into 2021. A move past the top range of its short-term resistance zone remains unlikely.

USD/SEK Technical Trading Set-Up - Reduced Upside Scenario

Long Entry @ 9.4300

Take Profit @ 9.5100

Stop Loss @ 9.3900

Upside Potential: 800 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 2.00