Sweden is known for economic experiments but usually ranks in the Top 5 on a series of essential developments. When the kingdom decided to ignore the nationwide lockdown procedures implemented by other governments to contain the spread of the Covid-19 pandemic, it raised concerns and anger alike. While the initial Swedish response to criticism was defiance, acknowledgment of failure has since become dominant. The death rate per million is at 539, above that of the 405 in the US, the most infected country. Despite the errors in the primary response, the USD/SEK initiated a correction, expected to resume with a breakdown below its resistance zone, amid a lack of bullish momentum.

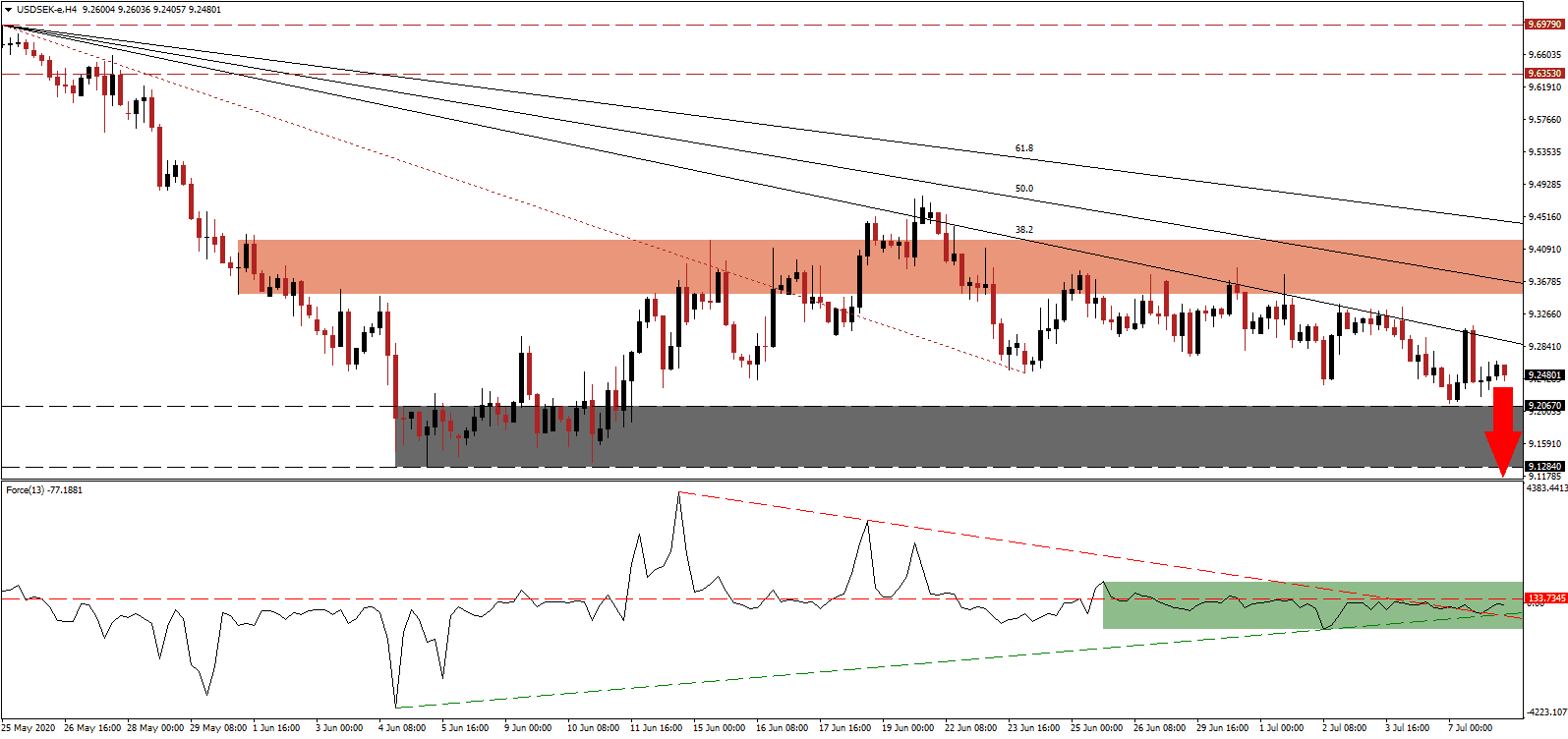

The Force Index, a next-generation technical indicator, confirms the dominance of bearish pressures as it remains below its horizontal resistance level. While the ascending support level assisted a push above its descending resistance level, as marked by the green rectangle, a renewed rejection is favored to emerge. Bears are in full control over the USD/SEK with this technical indicator in negative territory.

Due to Sweden’s failed Covid-19 response, border towns like Stromstad, a primary Norwegian shopping destination for cheaper goods, are paying the price economically. Countries are opening borders to allow the flow of commerce to resume, and while Norway and Denmark created a travel zone, they excluded Sweden due to the excessive infection and death rate. The USD/SEK is positioned to accelerate to the downside, with intensifying negative progress out of the US. Maintaining the bearish chart pattern is the breakdown below its short-term resistance zone located between 9.3511 and 9.4213, as marked by the red rectangle.

Providing one long-term catalyst is the decision by Sweden’s central bank, the Sveriges Riksbank, to increase its interest rate on December 16th, 2019, by 25 basis points from -0.25% to 0.00%. It was not only the first raise by a developed central bank in six months, but it became the first one to exit negative interest rates. The Covid-19 pandemic took the focus away from it, but with other central banks cutting interest rates since then, the positive effect on the Swedish Krona is evident. The descending 38.2 Fibonacci Retracement Fan Resistance Level is anticipated to pressure the USD/SEK below its support zone located between 9.1284 and 9.2067, as identified by the grey rectangle. A breakdown extension into its next support zone between 8.9539 and 9.0392 is probable.

USD/SEK Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 9.2480

Take Profit @ 8.9580

Stop Loss @ 9.3200

Downside Potential: 2,900 pips

Upside Risk: 720 pips

Risk/Reward Ratio: 4.03

Should the ascending support level inspire the Force Index to more upside, the USD/SEK may spike higher, temporarily. The Covid-19 pandemic is out of control in the US, with new confirmed infections topping 50,000 daily. It has forced the roll-back of the premature rush to reopen the economy, while more debt-funded economic assistance is considered. Forex traders are advised to sell any rallies. The upside potential remains confined to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/SEK Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 9.3700

Take Profit @ 9.4500

Stop Loss @ 9.3200

Upside Potential: 800 pips

Downside Risk: 500 pips

Risk/Reward Ratio: 1.60