Ksenia Yudaeva, the First Deputy Governor of the Central Bank of Russia (CBR), during an online conference hosted by daily business newspaper Vedomosti confirmed the central bank’s cautious economic assessment. The best case scenario calls for a 4.5% to 5.5% GDP contraction in 2020, followed by an expansion of 3.5% to 4.5% in 2021, before slowing to between 2.5% and 3.5% in 2022. Russia is the fourth-most infected Covid-19 country globally and the most-infected in Europe. The USD/RUB is nearing the end of its counter-trend advance that took it into its short-term resistance zone.

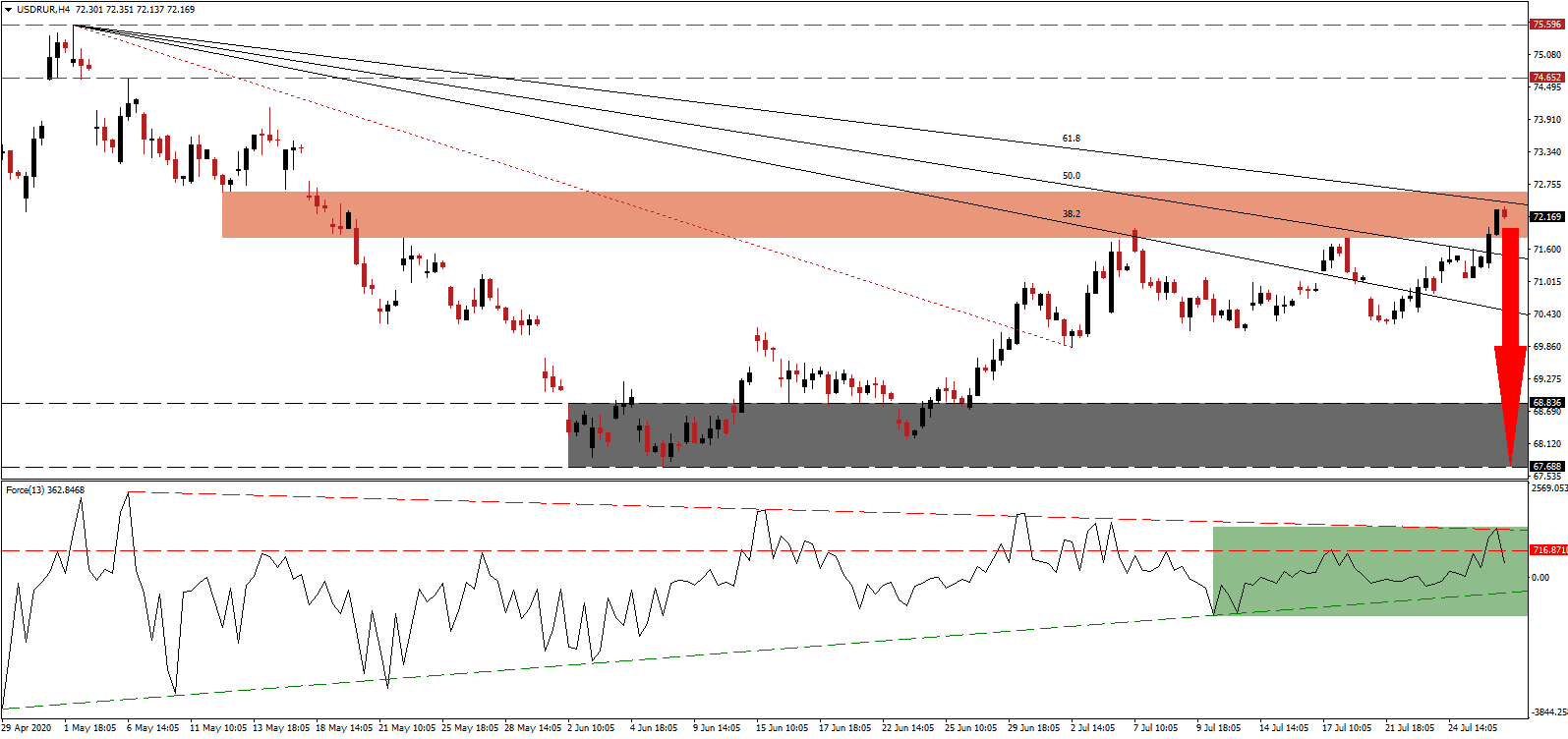

The Force Index, a next-generation technical indicator, briefly eclipsed its horizontal resistance level, as marked by the green rectangle, before the descending resistance level pressured it into a reversal. It is now well-positioned to accelerate to the downside, through its ascending support level, and into negative territory. Once this technical indicator corrects below the 0 center-line, bears will resume complete control over the USD/RUB.

Inflationary pressures in Russia are receding, resulting in a 25 basis points interest rate cut by the CBR to 4.25%. The domestic and external contraction in demand due to the Covid-19 pandemic is creating deflationary forces globally. Inflation will clock in between 3.7% and 4.2% in 2020, slow to between 3.5% and 4.0% in 2021, before stabilizing near the inflation target of 4.0% in 2022. After the USD/RUB advanced into its short-term support zone located between 71.783 and 72.622, as marked by the red rectangle, breakdown pressures are expanding.

Prime Minister Mikhail Mishustin reassured that despite the negative economic impact due to Covid-19, Russia has adequate reserves to implement proposed growth plans and support businesses and consumers alike. He added that the National Welfare Fund will remain above ₽8 trillion and that foreign reserves and gold holdings exceed $540 billion. The descending 61.8 Fibonacci Retracement Fan Resistance Level is expected to force the USD/RUB into a breakdown. It will clear the path for a profit-taking sell-off into its next support zone located between 67.688 and 68.836, as identified by the grey rectangle.

USD/RUB Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 72.150

Take Profit @ 67.700

Stop Loss @ 72.900

Downside Potential: 4,450 pips

Upside Risk: 750 pips

Risk/Reward Ratio: 5.93

Should the Force Index push above its descending resistance level, the USD/RUB could seek more upside. The upside potential is reduced to its resistance zone located between 74.652 and 75.596. Forex traders are advised to take advantage of any advance from current levels with new net short positions on the back of an intensifying bearish outlook for the US. The government debates a reduction in assistance to the unemployed with the Covid-19 pandemic out of control.

USD/RUB Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 73.500

Take Profit @ 74.650

Stop Loss @ 72.900

Upside Potential: 1,150 pips

Downside Risk: 600 pips

Risk/Reward Ratio: 1.92