Pakistan is under increasing pressures from the Covid-19 economic fallout. It reported a national fiscal deficit of over 7% of GDP, with estimates calling for a rise of up to 10%. Concerns over a budget-induced financial breakdown have increased. The 2020-2021 budget, approved by the National Assembly, includes an Rs3.4 trillion gap. Prime Minister Khan vowed to close it by bank borrowing, adding to the government’s total debt load. The USD/PKR reversed the breakdown below its resistance zone but is faced with ongoing bearish pressures amid a worsening US economic outlook.

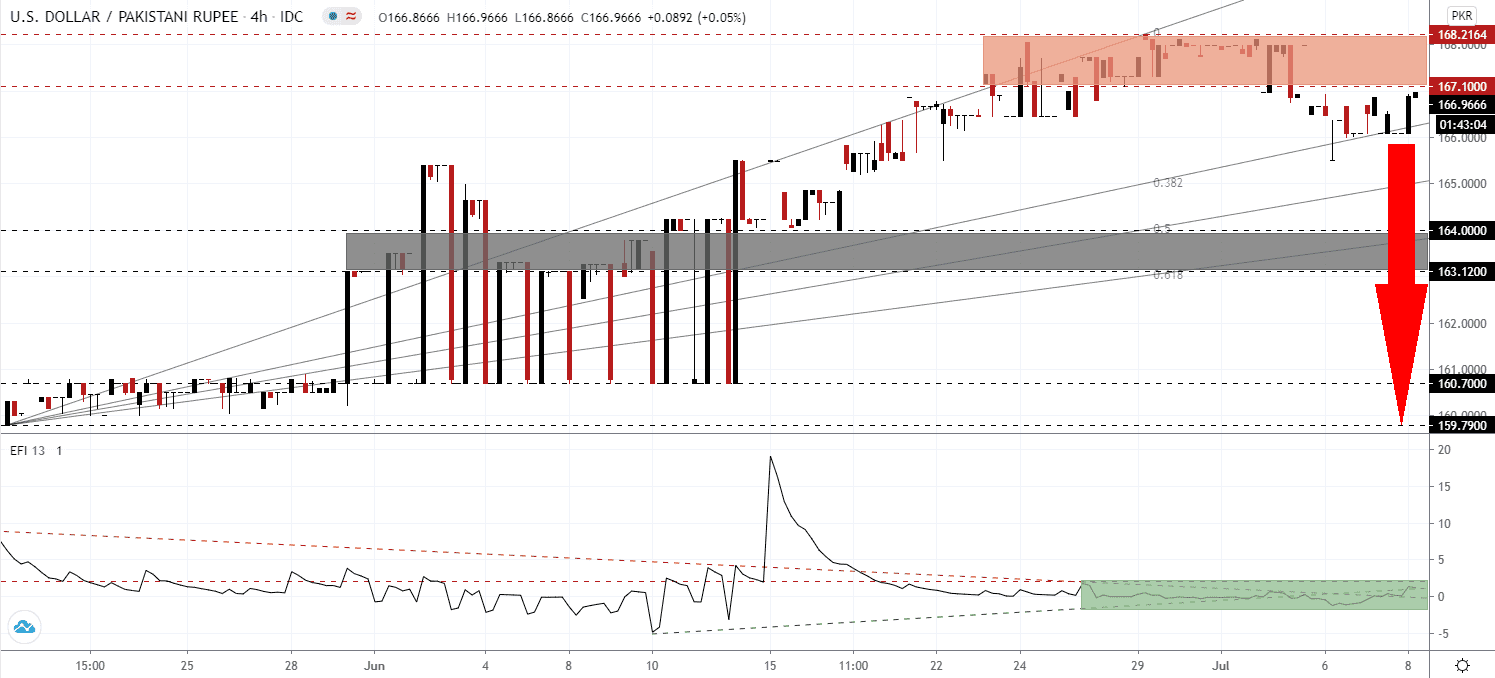

The Force Index, a next-generation technical indicator, is challenging its horizontal resistance level after reclaiming its ascending support level, as marked by the green rectangle. With downside momentum dominating, a reversal is expected to take this technical indicator back below its descending resistance level into negative territory, granting bears complete control over the USD/PKR.

Over the past two years, Pakistan borrowed $6.7 billion from China, $5.5 billion from Saudi Arabia, the United Arab Emirates, and Qatar, and $4.8 billion from the US-based International Monetary Fund (IMF) and the Asian Development Bank. It was also rewarded nearly $1.4 billion from the IMF Covid-19 financing facility. At the same time, inflation is on the rise, up 11.8% per data from the World Bank. While Pakistan is adding debt, the US is doing so at a more destructive pace, keeping breakdown pressures on the USD/PKR beneath its resistance zone located between 167.100 and 168.2164, as marked by the red rectangle.

Foreign reserves tumbled to $13.2 billion, as the Covid-19 pandemic saw the government use funds to fill short-term funding gaps. It suffices for just 3.5 months of imports, but plans were outlined to boost them, per the Minister for Economic Affairs Khusru Bakhtiar. Before Prime Minister Khan assumed office, reserves stood at $9 billion. The rise in tax revenues despite the Covid-19 pandemic is adding a bearish catalyst to the USD/PKR, favored correcting below its ascending 38.2 Fibonacci Retracement Fan Support Level. Price action is then clear to plunge into its short-term support zone located between 163.120 and 164.000, as identified by the grey rectangle. More downside into its next support zone between 159.700 and 160.700 is probable.

USD/PKR Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 166.9000

Take Profit @ 160.0000

Stop Loss @ 168.2000

Downside Potential: 69,000 pips

Upside Risk: 13,000 pips

Risk/Reward Ratio: 5.31

A push higher in the Force Index, inspired by its ascending support level, is likely to result in a breakout attempt in the USD/PKR. While the US is reversing steps taken to reopen its economy, and the labor market data is showing signs of stress after a period of improvement, Forex traders are recommended to view any advance as a selling opportunity. The 170.0000 psychological resistance level reduces the upside potential.

USD/PKR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 168.9000

Take Profit @ 170.0000

Stop Loss @ 168.2000

Upside Potential: 11,000 pips

Downside Risk: 7,000 pips

Risk/Reward Ratio: 1.57