Pakistan is on track to enter the Top 10 list of most infected Covid-19 countries, presently trailing former epicenter Italy and Iran. With the economy under significant stress, the real estate sector has the potential to revive activity an attract foreign direct investment. Only 0.5% of the landmass in Pakistan is considered planned land, valued at roughly $2 trillion. It is anticipated to increase to $4 trillion if Prime Minister Khan and his government undertake proper steps. The unlocked potential adds to breakdown pressures in the USD/PKR following the collapse in price action below its resistance zone.

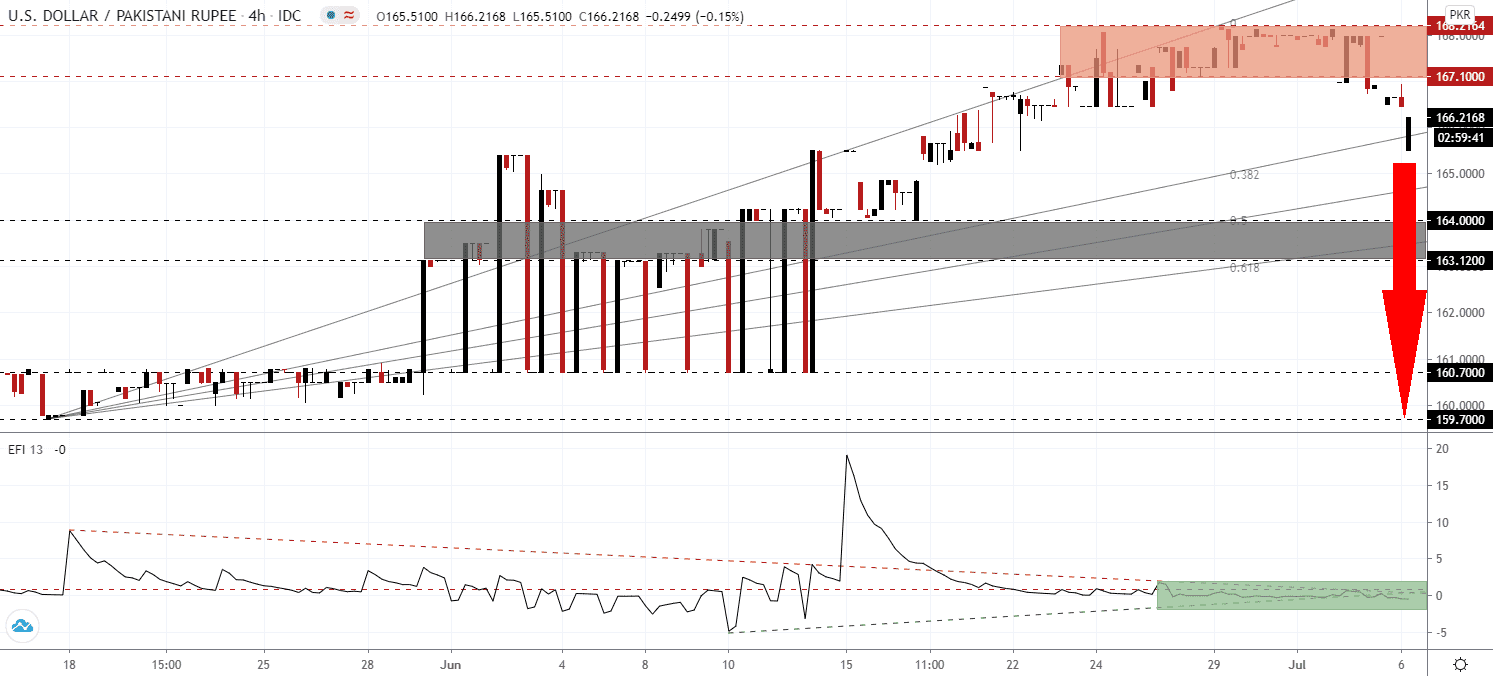

The Force Index, a next-generation technical indicator, flatlined below the horizontal resistance level but adopted a bearish bias, as marked by the green rectangle. With the descending resistance level expanding downside momentum, and the contraction below its ascending support level, an accelerated drop is favored. Bears are in complete control of the USD/PKR, with this technical indicator sliding deeper into negative territory.

Residential housing demand is forecast to rise to 20 million units over the next decade, adding over 5 million jobs, but the government prefers industrial construction. Over the past few decades, residential real estate offered a primary investment hub for domestic and foreign investors, driven by an estimated 68% surge in urban development by 2050. New taxes have decimated the growth and forced a standstill, while the government attempts to salvage the near-defunct China-Pakistan Economic Corridor (CPEC). The breakdown in the USD/PKR below its resistance zone located between 167.100 and 168.2164, as identified by the red rectangle, reflects the rise in bearish pressures.

Prime Minister Khan’s government, who campaigned on the promise to address corruption in CPEC, accuses China of malpractice and inflated costs, while also blaming local contractors. It does employ over 75,000 Pakistanis, adding to pressures to find a proper solution. The now-reversed move in the USD/PKR below its ascending 38.2 Fibonacci Retracement Fan Support Level is vulnerable to a second more violent contraction. It positions the USD/PKR to challenge its short-term support zone located between 163.120 and 164.000, as marked by the grey rectangle. A breakdown into its next support zone between 159.700 and 160.700 is expected to follow, partially driven by negative progress in the US economy.

USD/PKR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 166.2000

Take Profit @ 160.0000

Stop Loss @ 167.5000

Downside Potential: 62,000 pips

Upside Risk: 13,000 pips

Risk/Reward Ratio: 4.77

In the event the Force Index reclaims its ascending support level, serving as resistance, the USD/PKR is likely to retrace its most recent breakdown. With the increasing negative progress, on the Covid-19 and economic front, out of the US, any advance will present Forex traders another short-selling entry opportunity. The upside potential remains limited to the essential 170.0000 psychological resistance level.

USD/PKR Technical Trading Set-Up - Limited Recovery Scenario

Long Entry @ 168.3000

Take Profit @ 170.0000

Stop Loss @ 167.5000

Upside Potential: 17,000 pips

Downside Risk: 8,000 pips

Risk/Reward Ratio: 2.13