Pakistani Prime Minister Imran Khan approved a review of regulatory restrictions to tab the full economic potential, and digitalizing sectors remains a priority. The government seeks a sustainable recovery while recalibrating its economy in a post-Covid-19 world. The International Monetary Fund predicts economic conditions worsened as the fiscal year 2020 concluded on June 30th, for which an annualized GDP contraction of 0.4% is forecast. After the approval of the Rs1.2 trillion stimulus in March, it is now being deployed for the fiscal year 2021. The USD/PKR completed a triple breakdown, and more downside is favored.

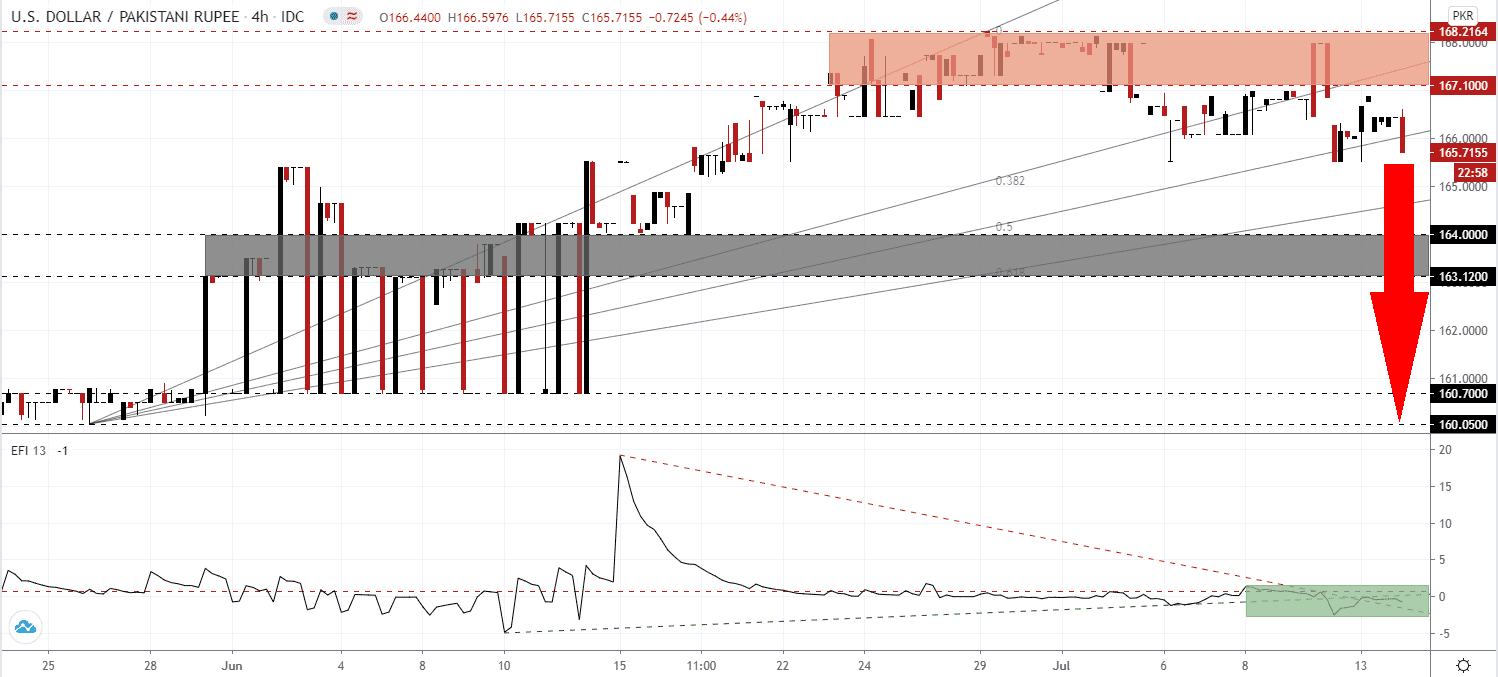

The Force Index, a next-generation technical indicator, presently faces a role reversal between the ascending support level and the descending resistance level, as marked by the green rectangle. A rejection of the present drift higher by its horizontal resistance level is anticipated to magnify downside pressure. Bears remain in charge of the USD/PKR with this technical indicator below the 0 center-line.

With the Covid-19 pandemic ongoing, Pakistan is the twelfth most-infected country, and as part of the relief package, import duties on emergency healthcare equipment were eliminated. Accelerated tax refunds to the export industry are also in place together with financial support for small-to-medium-sized enterprises (SMEs) and the agricultural sector. The procurement of essential supplies has additionally been implemented. After the USD/PKR collapsed below its resistance zone located between 167.100 and 168.2164, as identified by the red rectangle, bearish pressures intensified.

Price action extended its breakdown sequence below its ascending 38.2 Fibonacci Retracement Fan Support Level, converting both into resistance. A contraction below its 50.0 Fibonacci Retracement Fan Support Level followed, clearing the path for the USD/PKR to accelerate into its short-term support zone located between 163.120 and 164.000, as marked by the grey rectangle. Negative progress out of the US, where the uncontrollable Covid-19 pandemic is forcing states to roll-back the economic re-opening process as stimuli are expiring, positions this currency pair for an extension into its next support zone between 160.050 and 160.700.

USD/PKR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 165.7000

Take Profit @ 160.0000

Stop Loss @ 167.5000

Downside Potential: 57,000 pips

Upside Risk: 18,000 pips

Risk/Reward Ratio: 3.17

Should the Force Index eclipse its ascending support level, serving as temporary resistance, the USD/PKR may attempt a reversal. The upside potential remains confined to the 170.0000 psychological resistance level, which will present Forex traders with a secondary short-selling opportunity. Bearish pressures on the US Dollar are building due to magnified economic threats and a rise in the unsustainable debt load.

USD/PKR Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 168.3000

Take Profit @ 170.0000

Stop Loss @ 167.5000

Upside Potential: 17,000 pips

Downside Risk: 8,000 pips

Risk/Reward Ratio: 2.13