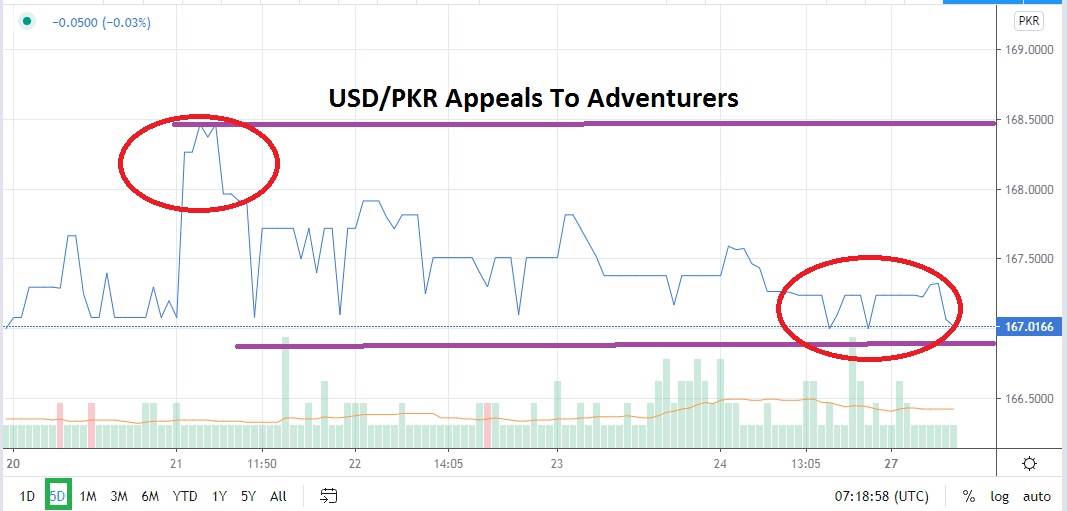

Speculators should stop whatever they are doing and take a look at the USD/PKR right now. The recent wave of USD weakness has taken the USD/PKR to important support levels near the 167.0000 juncture. This currency pair doesn’t have a great deal of transparency, nor does it have a lot of trading volume globally, meaning it can move on whims and without much reason for traders who remain outside observers. And we are nearly all outside observers of the USD/PKR.

However, if you have a taste for adventure and enough money in your trading account to speculate, today and tomorrow could be your lucky day. Or it could wipe out your cash holdings if the trade goes against you, buyer (or seller) beware. If you believe risk sentiment is about to face a challenge the next couple of days within the global markets it may make sense to wager the US Dollar to see buyers emerge as they seek safe havens.

The Pakistani Rupee is the opposite of a safe-haven currency. With all due respect to the nation and its government, questions about its economic health are not uncommon. Pakistan remains a country that gains and declines depending on the sentiment of investors globally as they monitor their risk appetite. The support level of 167.0000 which is within the vicinity of the USD/PKR’s value range this morning looks to be alluring. The reason it is enticing is that it could prove an interesting juncture to provide bullish reversals upwards. Let’s remember, the Pakistani Rupee is still within the weakest parts of its long term value and has been consistently testing resistance without stop.

Speculators should be careful about staying away from market orders when trading the USD/PKR, they should only use limit orders to protect themselves against ‘fills’ which are hard to predict due to a lack of trading volume and volatility. However, if a trader can buy the USD/PKR around its current price levels, use carefully selected leverage amounts and a stop loss around the 166.8000 to 166.9000 levels, they may find the USD/PKR has an opportunity to develop a bullish trend and target resistance near the 167.5000 to 168.0000 junctures short term.

Again, trading the USD/PKR should only be speculated on by experienced people who understand volatility and can manage risks wisely. However, this forex pair did look like an adventurer’s dream earlier today and could prove opportunistically worthwhile.

Pakistani Rupee Short Term Outlook:

Current Resistance: 167.0000

Current Support: 166.9500

High Target: 168.0000

Low Target: 166.8000