Norway’s economy recovered in May as the government eased lockdown restrictions, following two months of steep declines. Statistics Norway, providing official statistics for the kingdom since 1876, released data identifying a 2.4% monthly GDP expansion in May in the mainland economy, which excludes massive off-shore oil and gas production. Since February, it is down by 8.9%, but the outlook remains bullish. Norway was one of the first European economies to implement strict lockdown measures. The USD/NOK recovered into its short-term resistance zone from where rejection is anticipated.

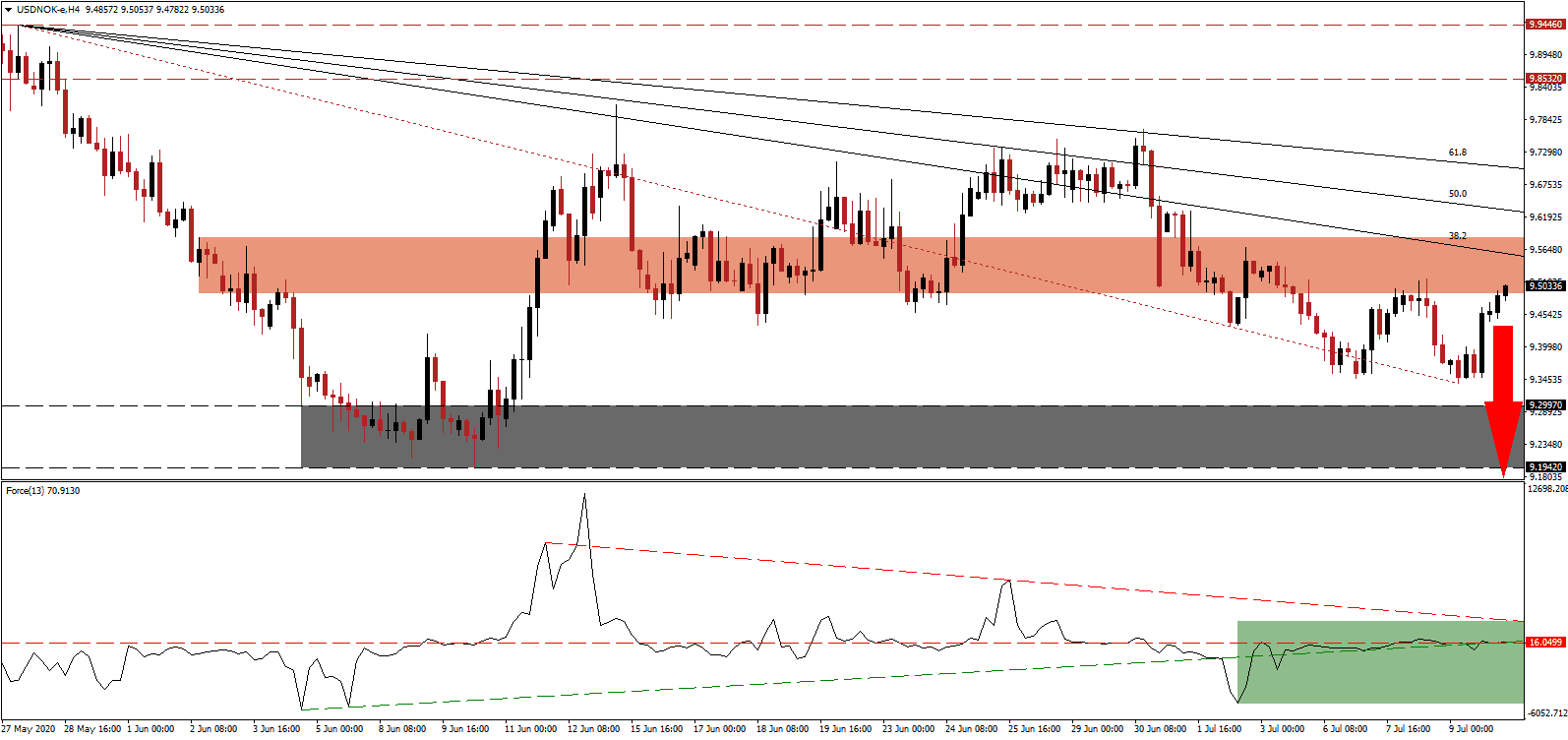

The Force Index, a next-generation technical indicator, flatlined around its horizontal resistance level following a breakdown. Bearish momentum is rising, with the descending resistance level increasing downside pressures, as marked by the green rectangle. This technical indicator is on course to move below the 0 center-line, after sliding below its ascending support level, granting bears complete control over the USD/NOK.

Health authorities confirmed just nine Covid-19 hospitalizations across Norway. Foreign tourism remains heavily restricted, and the government deployed massive funds from its $1 trillion-plus sovereign wealth fund to support the economy. The unemployment rate decreased to 5.1%, and consumer confidence is expanding together with retail sales. With the short-term resistance zone, located between 9.4896 and 9.5852, as identified by the red rectangle, enhancing breakdown pressures, the USD/NOK likely ended its advance.

SSB and the Norges Bank, the country’s central bank, revised their 2020 GDP product higher, stating the Covid-19 impact will be less severe than previously forecast. It represents a rare upbeat outlook, with many other economies faced with downward revisions to previous estimates. It adds a bearish catalyst to price action. The descending 38.2 Fibonacci Retracement Fan Resistance Level is favored to force the USD/NOK into its located between 9.1942 and 9.2997, as marked by the grey rectangle. An extension of the corrective phase into its next support zone between 8.9997 and 9.0609 is probable.

USD/NOK Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 9.5025

Take Profit @ 9.0000

Stop Loss @ 9.6575

Downside Potential: 5,025 pips

Upside Risk: 1,550 pips

Risk/Reward Ratio: 3.24

Should the Force Index accelerate above its descending resistance level, the USD/NOK may attempt to seek more upside. Given the worsening economic condition in the US and localized shutdowns and increased likelihood, while more debt is discussed, Forex traders are advised to consider any advance as a selling opportunity. The upside potential is limited to its resistance zone between 9.8532 and 9.9446, pending a downward revision.

USD/NOK Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 9.7500

Take Profit @ 9.9000

Stop Loss @ 9.6575

Upside Potential: 1,500 pips

Downside Risk: 925 pips

Risk/Reward Ratio: 1.62