Norway, who is not a member of the European Union, is seeking to be included in Covid-19 regulations and travel advisories referred to as Re-Open EU. It is a member of the European Economic Area but accepted the EU recommendation to open borders with EU members. A unique travel region with EU-member Denmark is already in place. Foreign Minister Ine Eriksen Søreide confirmed that the EU Commission was contacted to discuss inclusion. The USD/NOK completed a breakdown below its short-term resistance zone, and bearish momentum is set to extend the sequence.

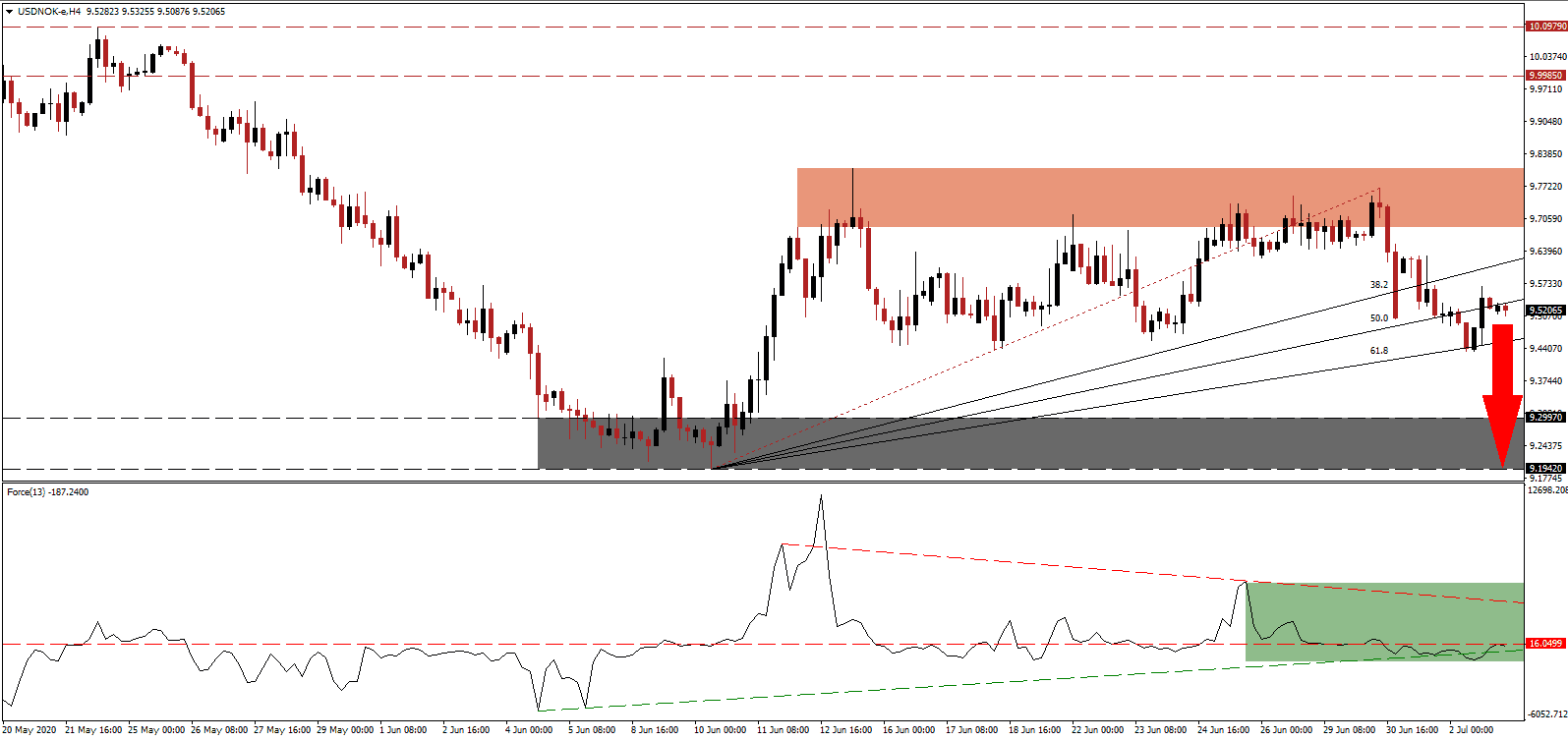

The Force Index, a next-generation technical indicator, created a significantly lower high, confirming the dominance of bearish pressures. It is now faced with rejection by its horizontal resistance level, as marked by the green rectangle. With the descending resistance level magnifying downside momentum, this technical indicator is expected to collapse below its ascending support level, granting bears full control over the USD/NOK.

A recent survey identified that 75% of Norwegians do not want to allow foreign tourists entry against just 15% in favor. Skepticism increased after one Swedish doctor, and one nurse, was permitted into Norway without being tested for the Covid-19 virus, and later tested positive. It prompted state officials to implement mandatory tests for Swedish medical personnel needed to avoid staff shortages across Norway. Following the breakdown in the USD/NOK below its short-term resistance zone located between 9.6885 and 9.8095, as marked by the red rectangle, more downside is favored to materialize.

City officials across Norway warned citizens that bars could be ordered closed again after wild parties emerged without regard for protective measures and social distancing. Police forces confirmed the out-of-control behavior. Many countries are struggling with a population ignoring precautions. It caused Covid-19 infections to spike, and the virus presumably to mutate to a more violent string. The US is the prime example of this, adding downside pressures on the US Dollar. A breakdown in the USD/NOK below its ascending 61.8 Fibonacci Retracement Fan Support Level will clear the path for a contraction into its support zone located between 9.1942 and 9.2997, as identified by the grey rectangle.

USD/NOK Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 9.5225

Take Profit @ 9.1950

Stop Loss @ 9.6125

Downside Potential: 3,275 pips

Upside Risk: 900 pips

Risk/Reward Ratio: 3.64

In the event the Force spikes above its descending resistance level, the USD/NOK is likely to reverse. Given the intensifying infection rate across the US, with the CDC noting the country lost control of the situation, the economy will struggle more than previously forecast. The upside potential for a counter-trend advance is confined to the top range of its short-term resistance zone. Forex traders are advised to consider it as an excellent selling opportunity.

USD/NOK Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 9.6700

Take Profit @ 9.7700

Stop Loss @ 9.6125

Upside Potential: 1,000 pips

Downside Risk: 575 pips

Risk/Reward Ratio: 1.74