Mexico is on course to overtake Peru as the sixth-most infect Covid-19 country this week. It masks one of the major problems that is likely to intensify once a vaccine becomes available, migration. Before the outbreak, over one million Central Americans reached the Southern US border, a move that started in 2017. It resulted in a crackdown by the Trump administration on illegal immigration, while Mexico was forced into cooperation for much-needed border security. The global pandemic resulted in a halt of the migration pattern favored to reignite, as poverty is soaring. More downside in the USD/MXN is expected after sliding below its resistance zone.

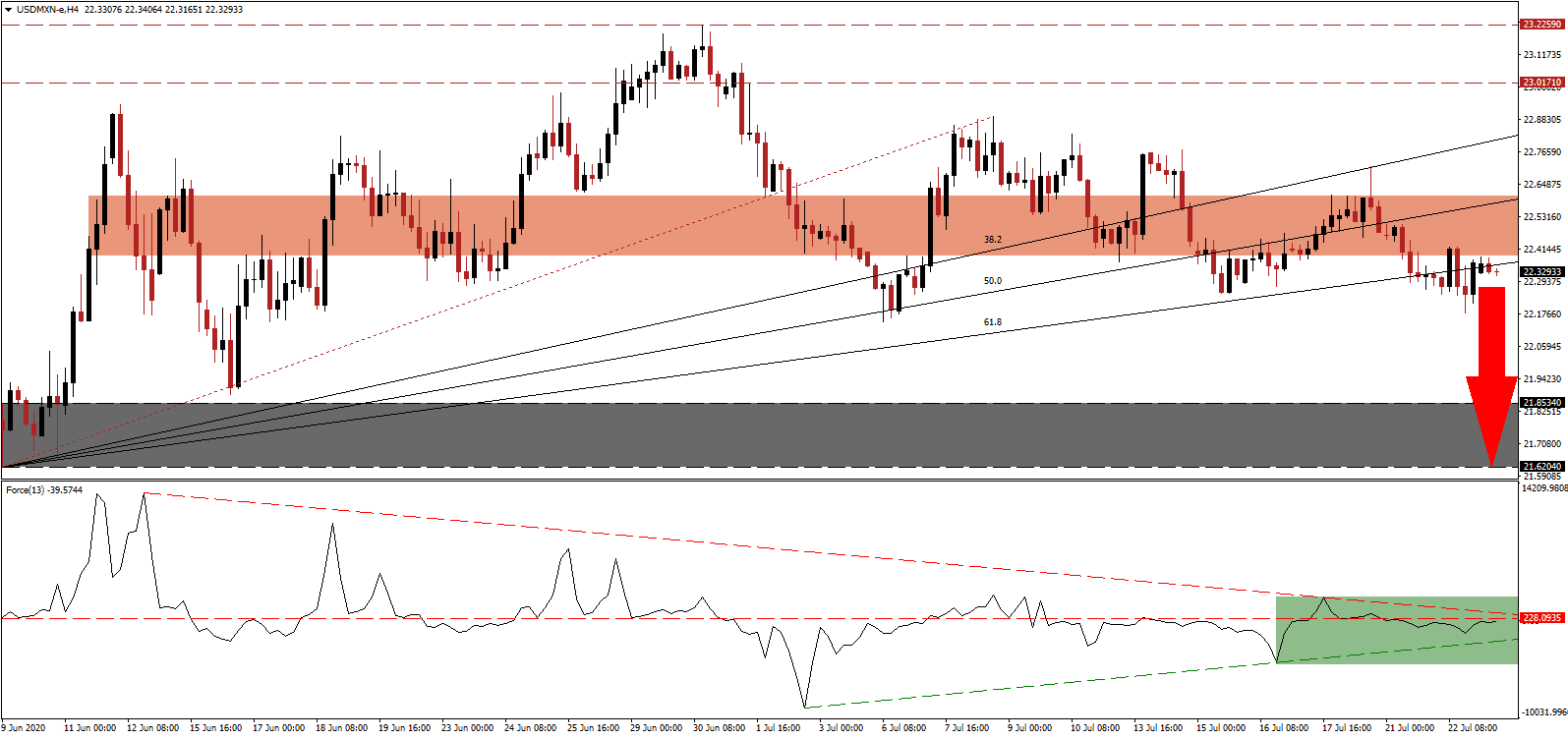

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level, as marked by the green rectangle, while the descending resistance level is expanding bearish momentum. A breakdown below its ascending support level will take this technical deeper into negative territory, strengthening the control bears have over the price action in the USD/MXN.

One significant difference over the expected next illegal migration wave will be Mexicans joining in. It poses a threat to bilateral cooperation on essential issues from counternarcotics to water rights. Border towns face a potentially devastating fallout. Over the past fifteen years, more Mexicans have left the US than entered it, but the spike in poverty-related to the Covid-19 pandemic could reverse that trend. The USD/MXN is well-positioned to extend its corrective phase following the breakdown below its short-term resistance zone located between 22.3891 and 22.6044, as identified by the red rectangle.

While Mexico relies on remittances, a new migration surge into the US which will benefit Latin America’s second-largest economy. President López Obrador thanked citizens who work outside and send vital funds to their families in Mexico for their support. Per the latest United Nations Economic Commission for Latin America and the Caribbean, by the end of 2020, 49.5% of Mexicans will live in poverty and 17.4% in extreme poverty. With the US outlook increasingly bearish, the USD/MXN is set to extend its correction below the ascending 61.8 Fibonacci Retracement Fan Support Level. Price action is likely to collapse into its support zone between 21.6204 and 21.8534, as marked by the grey rectangle.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 22.3300

Take Profit @ 21.6200

Stop Loss @ 22.5200

Downside Potential: 7,100 pips

Upside Risk: 1,900 pips

Risk/Reward Ratio: 3.74

In case the Force Index moves above its descending resistance level, the USD/MXN could attempt a brief breakout. With the US government debating a reduction in the weekly initial jobless stimuli from $600 to $100, while the Covid-19 pandemic remains out of control and localized shutdowns likely, the US Dollar is poised to deteriorate further. Forex traders should sell any rallies, as the upside potential is limited to its resistance zone located between 23.0171 and 23.2259

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 22.7200

Take Profit @ 23.0200

Stop Loss @ 22.5200

Upside Potential: 3,000 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 1.50