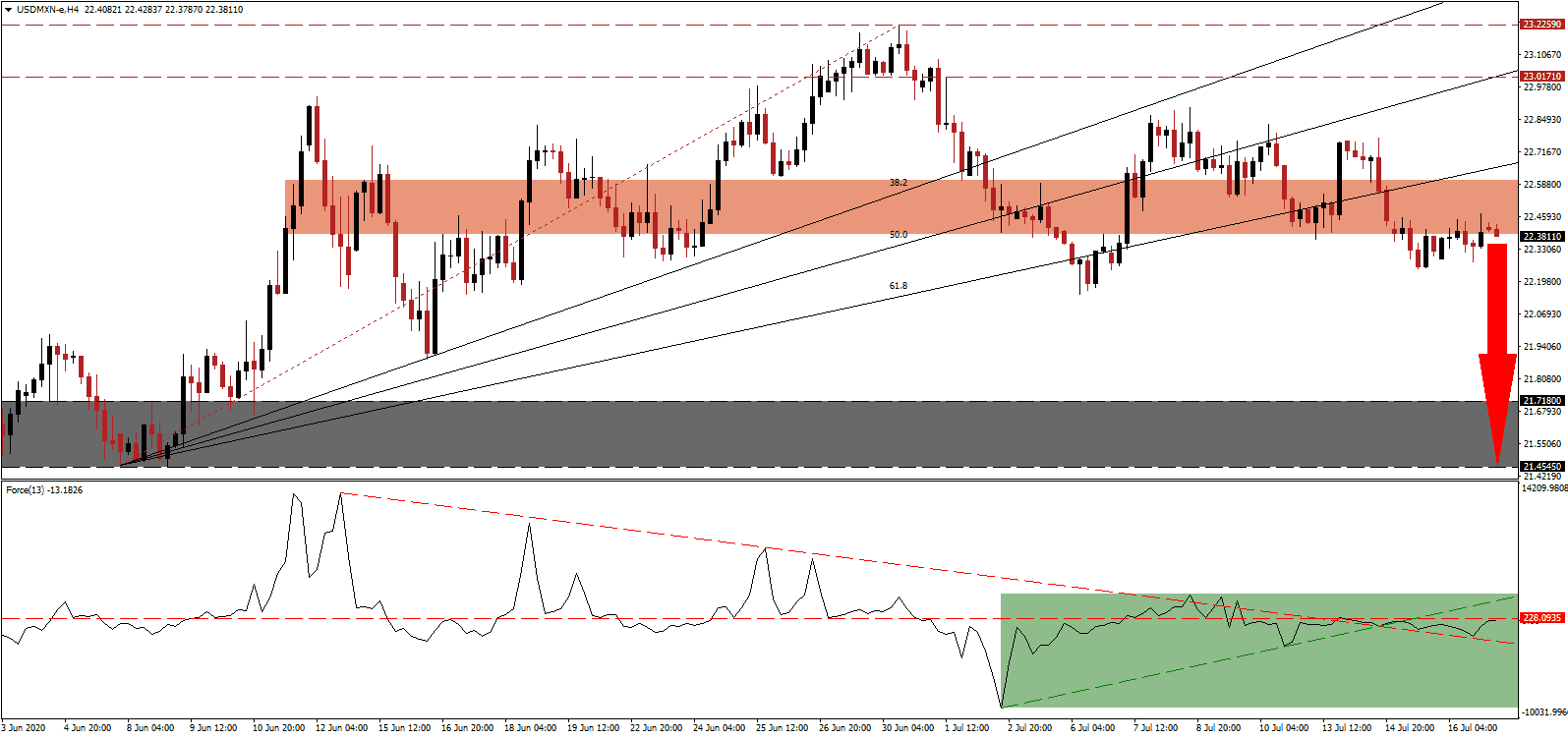

Spain-based consultancy group FocusEconomics downgraded the Mexican economic GDP forecast for 2020 from a contraction of 7.5% to a drop of 8.5%. It pointed out that predictions for Latin America's second-largest economy range from a decrease of 6.2%, issued by Commerzbank out of Germany to a plunge of 11.0% highlighted by Prognosis. Driving GDP lower is a collapse in domestic consumption and private investment, predicted to fall 7.8% and 15.6%, respectively. The USD/MXN ended its counter-trend advance and embarked on a new breakdown sequence, magnified by a series of lower highs.

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, as marked by the green rectangle. It faces a role reversal between its ascending support level and its descending resistance level, anticipated to reverse as downside momentum is building. Bears remain in control of the USD/MXN and presently wait for a renewed push lower in this technical indicator.

Mexican pension funds witnessed record withdrawals in June of Mex$1.86 billion, lifting the total first-half number to Mex$8.57 billion, amid soaring unemployment. Formal June job losses clocked in at 83,000, down from May’s 345,000. Mexican President López Obrador assured his country that job losses would end in July. The USD/MXN maintains its bearish chart pattern following the breakdown below its ascending 61.8 Fibonacci Retracement Fan Support Level, converting it into resistance. It is magnified by the move below its short-term resistance zone located between 22.3891 and 22.6044, as identified by the red rectangle.

With the Covid-19 pandemic intensifying, Mexico is the eight-most infected country, the economy remains under significant stress. The loss of remittances is further adding to concerns for Mexico, where ten million families depend on them. While Mexico struggles to regain its footing, the situation in the US remains out-of-control. The sole federal response is to increase debt and provide assistance. It adds to breakdown pressures in the USD/MXN, well-positioned to accelerate into its support zone located between 21.4545 and 21.7180, as marked by the grey rectangle. US Dollar weakness is likely to result in more downside.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 22.3800

Take Profit @ 21.4500

Stop Loss @ 22.6000

Downside Potential: 9,300 pips

Upside Risk: 2,200 pips

Risk/Reward Ratio: 4.23

A breakout in the Force Index above its ascending support level, serving as resistance, could pressure the USD/MXN into a temporary reversal. Forex traders are recommended to take advantage of any advance with new net short positions, as the outlook for the US economy and US Dollar are increasingly bearish. The upside potential is confined to its resistance zone located between 23.0171 and 23.2259.

USD/MXN Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 22.7800

Take Profit @ 23.1300

Stop Loss @ 22.6000

Upside Potential: 3,500 pips

Downside Risk: 1,800 pips

Risk/Reward Ratio: 1.94