Mexican states resume the economic reopening process despite an increase in Covid-19 infections. As long as the pandemic remains dominant without a cure, the economy will continue to struggle on the demand side, which directly impacts the supply side. The US is now forced to either halt or retrace their ill-advised rush to lift restrictions, dealing a blow to consumer confidence. With initial hopes for a swift V-shaped recovery fading, the present situation in financial markets resembles that of the Great Depression. Mexico could emerge as a victor due to pending supply-chain adjustments. The USD/MXN is well-positioned to extend its breakdown sequence farther to the downside.

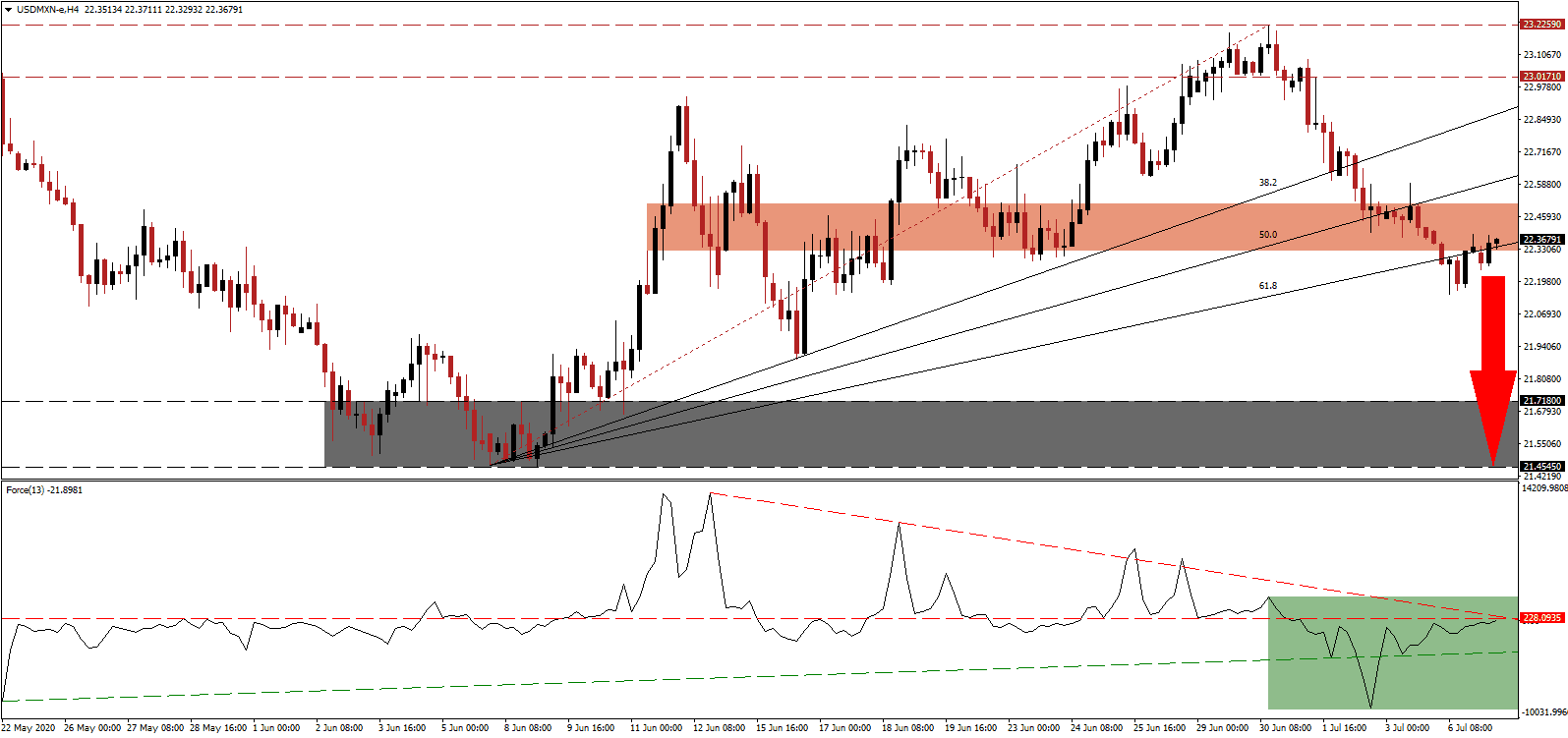

The Force Index, a next-generation technical indicator, dropped to a new multi-week low from where it partially reversed its temporary breakdown below its ascending support level. It is now faced with rejection by its horizontal resistance level, with the descending resistance level magnifying breakdown pressures, as marked by the green rectangle. With this technical indicator below the 0 center-line, bears are in full control of the USD/MXN.

With the economy under significant stress, crime rates have increased across Mexico since President López Obrador took office in December 2018. His approval rating dropped to an all-time low of 56% in June. Respondents had an overall negative view on his handling of the economy, security, and tackling poverty. The USD/MXN is challenging the validity of its short-term resistance zone located between 22.3209 and 22.5116, as identified by the red rectangle, following the initial breakdown.

One of the most significant issues for Mexico to tackle remains crime and security. It hinders the relocation of supply chains within the USMCA trade zone. Attacks on transport lines are adding to concerns, and the June 26th attack by 28 low-skill but highly armed men on Omar García Harfuch, Mexico City’s Secretary of Public Security, confirms that President López Obrador has no control over the situation. The Covid-19 pandemic may force more drastic changes, and the USD/MXN is expected to correct below its ascending 61.8 Fibonacci Retracement Fan Retracement Level, with the US virus condition more out-of-control than Mexican crime. It will clear the path for an accelerated sell-off into its support zone located between 21.4545 and 21.7180, as marked by the grey rectangle.

USD/MXN Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 22.3700

Take Profit @ 21.4500

Stop Loss @ 22.6000

Downside Potential: 9,200 pips

Upside Risk: 2,300 pips

Risk/Reward Ratio: 4.00

In case the Force Index pushed through its descending resistance level, the USD/MXN is likely to attempt a breakout. Yesterdays’ June ISM non-manufacturing index employment sub-component confirmed the depressed stated of the labor market, adding to expanding downside pressures on the US Dollar. Forex traders are advised to sell any rallies from present levels, as the upside potential remains reduced to its downward revised resistance zone between 23.0171 and 23.2259.

USD/MXN Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 22.7800

Take Profit @ 23.1300

Stop Loss @ 22.6000

Upside Potential: 3,500 pips

Downside Risk: 1,800 pips

Risk/Reward Ratio: 1.94