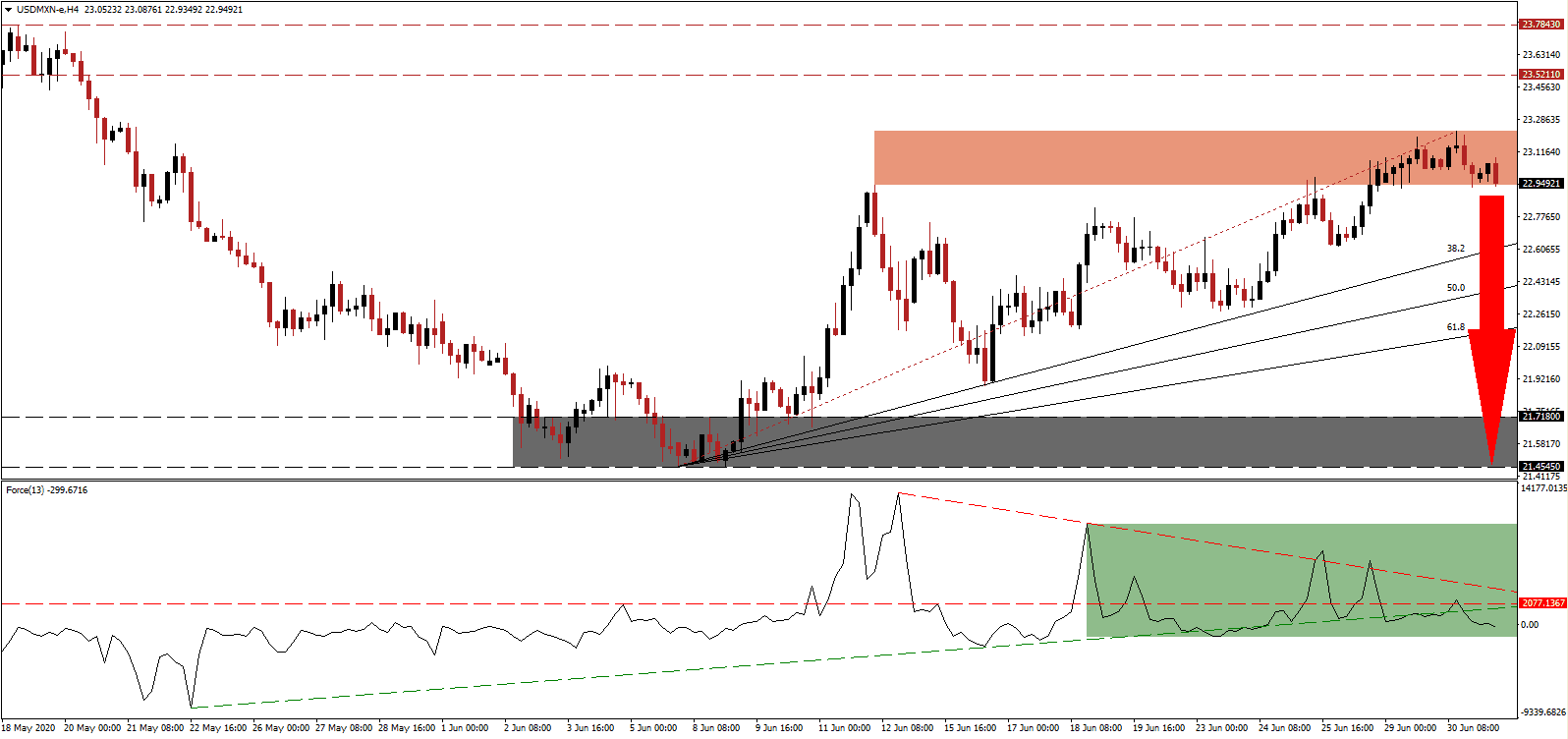

Mexico is on the verge of becoming the tenth most infected Covid-19 country, overtaking Iran, and could surpass Italy by the end of this week as the ninth. It highlights the ongoing severity of the pandemic, and the negative impact it has on the economy. Regardless of lockdowns that are in place, consumer behavior has changed and will result in depressed activity until a cure is available. Fears over the surge in new infection over the past few weeks initially drove demand for the US Dollar. It is now reversing amid dismal economic data. The USD/MXN pushed into its short-term resistance zone from where a build-up in bearish momentum is signaling that a breakdown is imminent.

The Force Index, a next-generation technical indicator, provided the initial warning that price action is vulnerable to a reversal. While this currency pair drifted higher, the Force Index moved to the downside, creating a negative divergence, as marked by the green rectangle. An insignificant peak above its horizontal resistance level was swiftly converted into a breakdown below its ascending support level. The descending resistance level is exercising additional downside pressures, and bears are in complete control of the USD/MXN with this technical indicator below the 0 center-line.

Job losses in Mexico are mounting, especially in the informal economy. President López Obrador placed the formal job losses for June at 85,000, with lay-offs reaching as high as 130,000. He expects more than one million job losses related to the Covid-19 pandemic, which he plans to counter with two million job additions by the end of 2020 through his mega infrastructure projects. It adds a bullish intermediary catalyst to the Mexican Peso, magnifying the breakdown pressures in the USD/MXN below its short-term resistance zone located between 22.9384 and 23.2259, as marked by the red rectangle.

While the Mexican labor market is under stress, the condition of the US labor market is more severe. This week’s NFP report for June will offer a significant data point following the May surprise. More job additions are likely, but a more important metric to focus on is the employment-to-population ratio, which plunged to 52.8% in May. Most job additions were low-skill, low wage jobs, with a material spike in temporary positions to comply with the reopening process. It adds to intensifying bearish pressures on the US Dollar. The USD/MXN is well-positioned for a collapse below its ascending 50.0 Fibonacci Retracement Fan Support Level, from where it can extend into its support zone located between 21.4545 and 21.7180, as identified by the grey rectangle.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 22.9500

Take Profit @ 21.4500

Stop Loss @ 23.3000

Downside Potential: 15,000 pips

Upside Risk: 3,500 pips

Risk/Reward Ratio: 4.29

Should the Force Index accelerate above its descending resistance level, the USD/MXN may attempt to push farther to the upside. With numerous US states halting or rolling back the economic reopening process, and new data pointing towards a significantly shallower recovery in June, any breakout attempt will grant Forex traders a secondary short-selling opportunity. The upside is confined to its resistance zone between 23.5211 and 23.7843.

USD/MXN Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 23.4500

Take Profit @ 23.7500

Stop Loss @ 23.3000

Upside Potential: 3,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 2.00