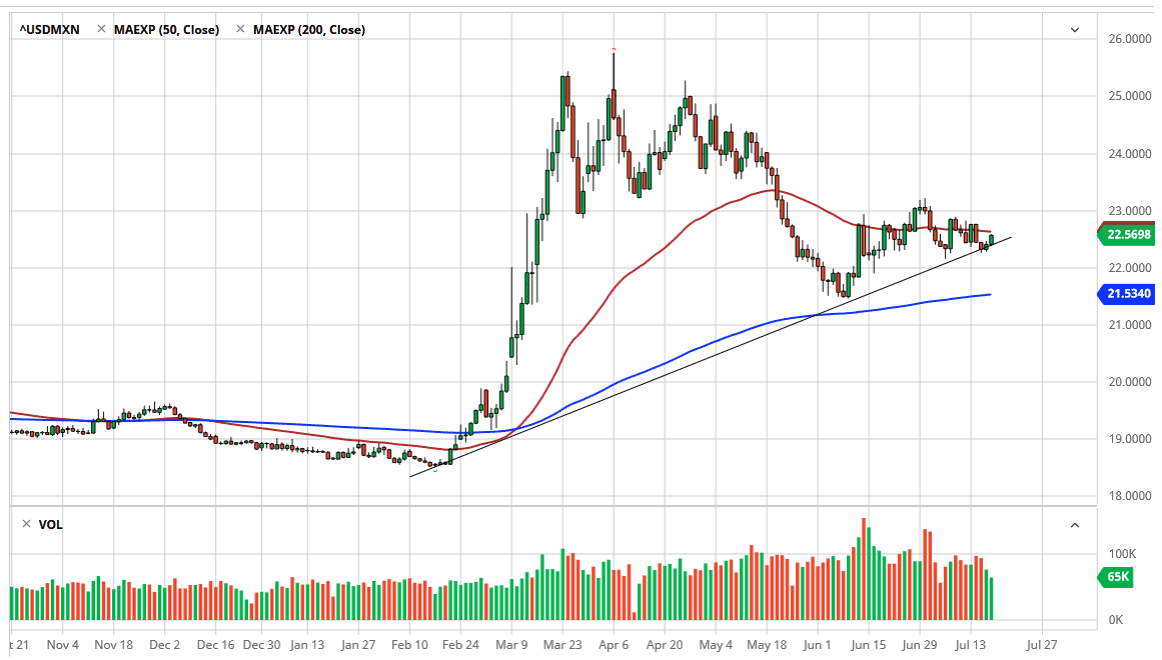

The US dollar has rallied a bit against the Mexican peso to close out the week, reaching towards the 50 day EMA. While the US dollar has been taking it on the chin against several currencies around the world, other less fortunate countries are struggling quite a bit, with Mexico being a major Latin American currency, it is a way that people will express their opinion on the whole of the LatAm region, along with perhaps the Brazilian real. All things being equal, this is a market that I believe will follow this little trend line, and perhaps try to reach to higher levels. However, if we do break down from here I see a potential target in so much as there is the 200 day EMA.

To the upside, I see the 23 pesos level as important, and if we can overcome that level it is likely we go looking towards the 24 pesos level. After that, then you have a move towards the 25 pesos level. This suggests that perhaps there would be some type of “risk-off” type of event, or perhaps money continues to flow away from Latin American. It should be noted that the US dollar has been getting crushed against most currencies, so if the Mexican peso continues to have problems against the US dollar, that shows you just how bad things are.

Another thing to pay attention to is whether or not money is flowing from the United States into Mexico through remittances. There is a huge push of dollars into Mexico from migrant workers who are quite often supporting family members back home. As employment gets worse in the United States, that cuts down a need for the migrant worker, and therefore it will continue to weigh upon the idea of money flowing from north to south.

Mexico is also a major exporter into the United States, as a lot of goods cross the border every day. If the global market continues to struggle overall, then the Mexican peso will suffer as it is a producer of things, not necessarily a customer. For example, a lot of engines are made in Mexico for the automobile industry in the United States. While you have to cross the border, the labor is so much cheaper. On the other side of the equation, Mexico is most certainly going to be the beneficiary of some of the deterioration between the Americans/China trade situation. At this point, I suspect there is a short-term bounce.