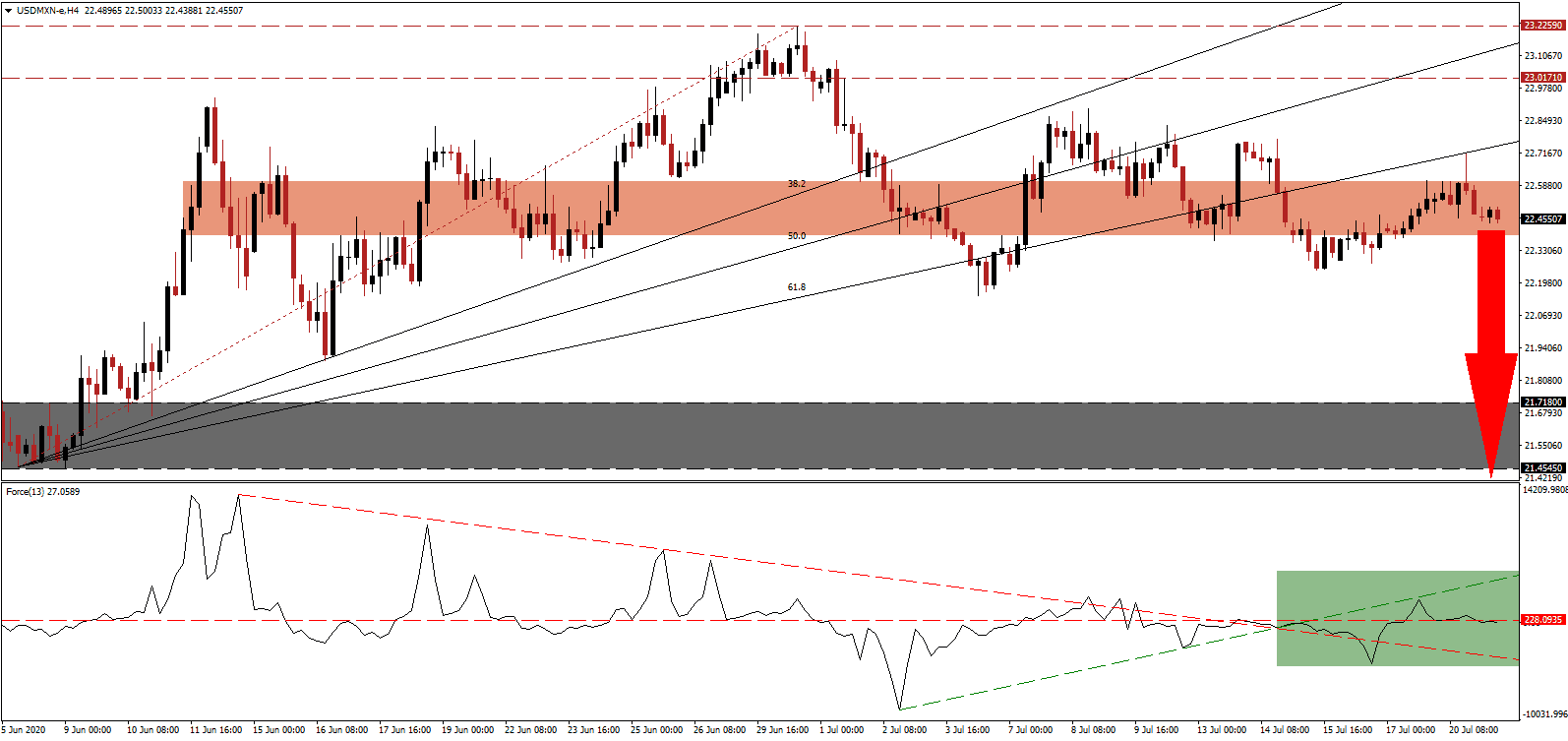

Mexico lacks proper Covid-19 testing capabilities, with just over 820,000 carried out on a population above 129,000,000. Despite the inadequate capacity, Latin America’s second-largest economy is the seventh most infected country globally. President López Obrador remains under criticism for his handling of the pandemic, but it remains premature to judge his approach. Unlike developed economies where debt soared to support the corporate sector, Mexico focused on the poor and let the economy handle companies in distress. The USD/MXN remains in a bearish chart pattern and is favored to accelerate its breakdown sequence after price action was rejected.

The Force Index, a next-generation technical indicator, was equally rejected by its ascending support level, which switched roles with the descending resistance level, as marked by the green rectangle. It was followed by a slide in the Force Index below its horizontal resistance level, as downside momentum is expanding. This technical indicator is on course to move below the 0 center-line, granting bears complete control over the USD/MXN.

Graciela Márquez Colín, the Mexican Minister of Economy, confirmed that Mexico is actively seeking US companies with manufacturing plants in China, Singapore, and Vietnam, to explore potential relocation to Mexico. European companies with exports to the US are additionally included. Under President López Obrador, Mexico is increasing its reliance on manufacturing, which is likely to provide a medium-term boost to the economy while creating concentration issues. The USD/MXN was rejected by its ascending 61.8 Fibonacci Retracement Fan Resistance Level and is presently passing through its short-term resistance zone located between 22.3891 and 22.6044, as marked by the red rectangle.

One essential problem Mexico faces is the anticipated rise in poverty. The United Nations Economic Commission for Latin America and the Caribbean forecasts 9.6 million will slide into poverty in 2020. It concluded that 49.5% of Mexicans would live in poverty, while extreme poverty will increase to 17.4%. President López Obrador remains confident that his mega infrastructure projects will tackle most of the issues, but his support is fading slowly. With the US economy under intensifying pressure from the Covid-19 virus and a lack of federal leadership, the USD/MXN is expected to complete a breakdown and correct into its support zone located between 21.4545 and 21.7180, as marked by the grey rectangle. More downside cannot be excluded, driven by US Dollar weakness.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 22.4500

Take Profit @ 21.4500

Stop Loss @ 22.7200

Downside Potential: 10,000 pips

Upside Risk: 2,700 pips

Risk/Reward Ratio: 3.70

Should the Force Index reclaims its ascending support level, serving as resistance, the USD/MXN could attempt a second breakout attempt. The upside potential remains reduced to its resistance zone located between 23.0171 and 23.2259. With the US considering a fifth debt-funded stimulus package, the US Dollar is positioned to extend its corrective phase. Forex traders should take advantage of any price spike with new net short positions.

USD/MXN Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 22.8500

Take Profit @ 23.1300

Stop Loss @ 22.7200

Upside Potential: 2,800 pips

Downside Risk: 1,300 pips

Risk/Reward Ratio: 2.15