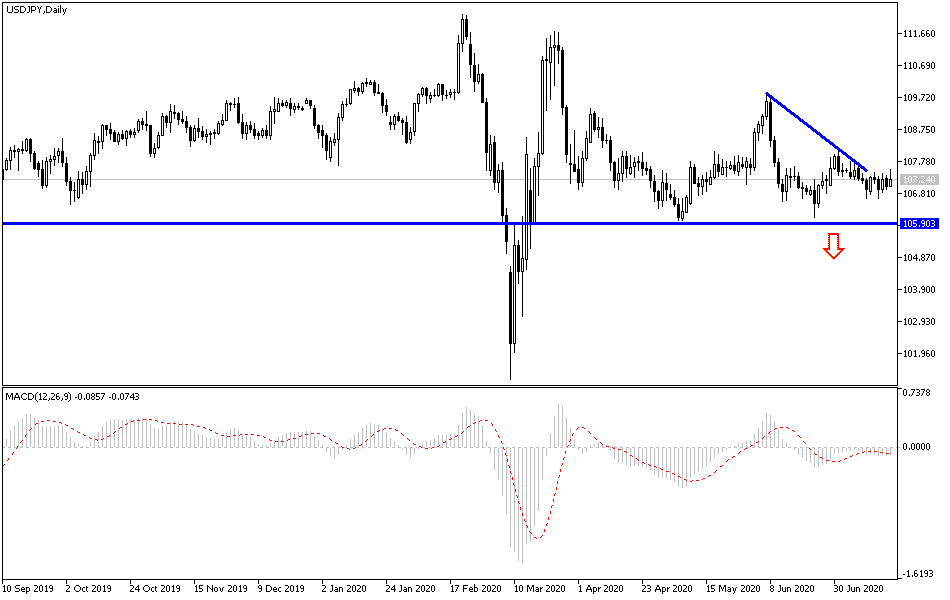

For two weeks in a row, the USD/JPY currency pair was moving in a dull performance in the vicinity of limited levels where it is unable to overcome the 108.00 resistance when preparing to move up. In return, it is easy to move below the 107.00 support amid stronger bears’ control of performance. The pair stabilized around 107.30 at the time of writing. This pair is under pressure due to fears of the strength of the second Coronavirus wave in the United States of America, which increases the pressure on the American administration and Trump's future in the presidential elections that will be held next November. The darker future prompted Trump to accuse China of deliberately spreading the virus and promised more painful decisions on China as punishment for what happened and is happening. All this was ideal for the Japanese yen in achieving its strong gains against other major currencies as it is the preferred safe haven for investors in times of uncertainty.

The US economic situation in the Corona era is disastrous and the massive stimulus plans that the government and the Federal Reserve have done were blown by the wind. Organizers of a national workers strike said tens of thousands of people who were due to be out of work on Monday in more than twenty US cities to protest against systemic racism and economic inequality that only worsened during the coronavirus pandemic. The so-called “strike for a black life” trade unions, along with social and racial justice organizations from New York City to Los Angeles, will participate in a range of planned actions. In the event that it is not possible to stop work for a full day, the participants either intend to participate during the lunch break or have moments of silence to honor the black souls lost due to police violence, the organizers said.

On US economic news, a University of Michigan report showed an unexpected deterioration in US consumer sentiment in July. The preliminary report said that the consumer confidence index fell to a reading of 73.2 in July after jumping to 78.1 in June. The downturn surprised economists who expected the index to rise to 79.0. Meanwhile, data from the Commerce Department showed that US housing starts rose by 17.3% in June after jumping by 8.2% a month ago. Economists had expected housing to rise 20%. The report also said building permits rose 2.1% in June, against expectations for a jump of 5.7%.

As for COVID-19 news, daily coronavirus cases in the United States broke the record for several days in a row, with the number of infections exceeding 70,000 for the first time. According to the latest Johns Hopkins University data, the total number of cases in the country was 3,576,430 after reporting about 77,000 additional cases in the past 24 hours. The highest number of coronavirus cases were reported in Florida, South Carolina and Texas, these states reported the highest case registration in a single day.

Reclosing the US economy will be disastrous for the global economy as a whole.

According to technical analysis of the pair: Until the moment, bears still have stronger control over the USD/JPY performance, especially with stability below the 108.00 support. The closest support levels for the pair are currently at 107.10, 106.65 and 105.80 respectively, which are the top areas for the bear's control over performance for a longer period. On the other hand, there will be no opportunity for the bulls to take control without the pair moving towards the 110.00 psychological resistance. In general, I still prefer to buy the pair from every lower level.

Today, the pair does not expect any significant and influential economic data, whether from Japan or the United States of America. Investor sentiment will have the greatest impact on performance.