After mentioning in the technical analysis that the USD/JPY pair has reached strong oversold areas and that it’s recent levels are the best ones for selling. The pair has already moved in a positive manner at the beginning of this week’s trading, as it moved towards the 107.31 resistance after losses as a result of sell-offs, reached to the 106.63 support, the lowest level in three weeks. Yesterday, the rebound was supported by the optimism that prevailed in the markets after announcing that a vaccine to eliminate the deadly Coronavirus had been reached. However, this optimism is offset by fears of rising new pandemic infections in the United States.

This pandemic caused the collapse of all Trump's accomplishments, especially at a very sensitive time with the approaching US presidential elections. Trump has criticized the World Health Organization for the way they dealt with pandemic and accused them of bending to the Chinese influence. The Trump administration officially notified the United Nations last week of its withdrawal from the World Health Organization, although the withdrawal will not take effect until July 6, 2021.

For its part, the United Nations also warned on Monday that the pandemic could starve 130 million people around the world this year. United Nations officials estimate that there are about 690 million people in hunger around the world in 2019, most of them in Asia and Africa. "While it is too early to assess the full impact of closures and other containment measures, at least 83 million more people will face hunger as a result of the pandemic,” the agency said.

The World Health Organization said on Monday that the most recent increase in cases was in the Americas. The United States and Brazil alone account for more than a third of global deaths due to the disease. In Japan, there have been more than 30 Marines who tested positive at the US Futenma Air Station in Okinawa, where cases among U.S. service members have risen rapidly to more than 90 since last week. Okinawa has more than half of the approximately 50,000 US soldiers stationed in Japan.

In other parts of the world, the number of infections has risen dramatically in India, South Africa, and Brazil, whose positive test results have proven positive for the president who denies the virus. India, which has the most confirmed cases after the United States and Brazil, reported on Monday a record daily high of 28,701 new cases reported over the past 24 hours. Authorities in many cities are re-imposing strict closures after trying to ease restrictions to revive the faltering economy. In South Africa, which accounts for more than 40% of all reported cases in Africa, President Cyril Ramaphosa has re-imposed the ban on alcohol sales and a night curfew to reduce the number of people who need emergency treatment in hospitals and who still have more beds to treat COVID- 19 patients.

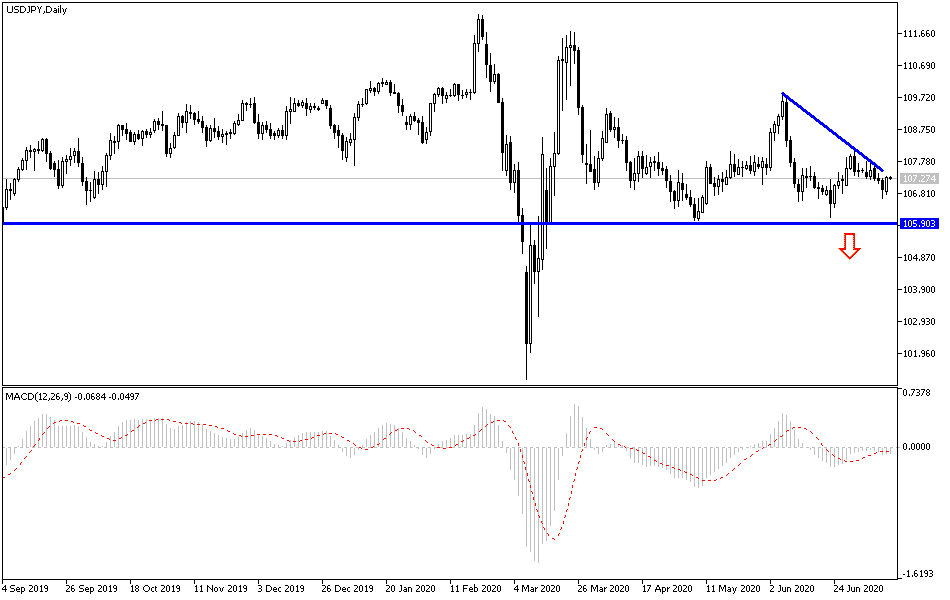

According to the technical analysis of the pair: Despite the positive USD/JPY performance at the beginning of trading this week, and according to the performance on the daily chart below, it still needs more momentum to complete the opportunity for an upward correction, which may happen if the pair moved towards the resistance levels at 108.10 And 109.65, which in turn supports the move towards the 110.00 psychological resistance, which is still a symbol of stronger bull’s control over performance. On the other hand, stability around and below the 107.00 support will remain supportive of stronger bear control.

As for the economic calendar data today: First, Japanese industrial production will be announced, and then the US CPI will be announced.