For the 5th consecutive day, the USD/JPY was moving in an upward correction range, but with very limited gains not exceeding the 108.00 level, where the pair is settled at the time of writing. The kick off investor’s optimism yesterday was due to the announcement of a rise in the Chinese industrial sector to the highest level in 3 months, as the latest survey by the Chinese national statistics office showed a reading of 50.0 of the industrial PMI, higher than expectations for a 50.4 reading and the 50.6 reading recorded in May. It is also higher than the 50.0 mark separating growth from contraction.

On the American side, US consumer confidence rose in June, reflecting the benefit of the partial reopening of the country, but with fears that higher Covid-19 cases in the country might be a risk for future gains. Therefore, the Conference Board, a research organization based in New York, announced that the consumer confidence index rose to 98.1 in June after a no change in May with a reading of 85.9.

Even with the recovery in June, the confidence index is still lower than the pre epidemic levels. The consumer confidence index is closely watched in search for evidences around future consumer spending, which accounts for 70% of the economic activity. Current Conditions index rose in June, like the expectations index, based on short term consumer expectations and labor market and conditions, but both indexes are still at lower levels.

Commenting on the results, Lin Franco, Sr. Manager of Economic Indexes at the Conference Board said: “The reopening of economy and the relative improvements in claimants helped improve consumer’s evaluation of current conditions”. However, looking ahead, Franco said: “Facing an unconfirmed and unbalanced recovery path, with the potential return of Covid-19, it is still premature to say that consumers have turned the corner and are now ready to start spending at pre-pandemic levels.” Confidence Index was at its highest level this year at 132.6 in February before dropping sharply in March and April, as the closure efforts stopped the US economy.

From the content of the joined testimony of Jerome Powell, Federal Reserve Chairman and Treasury Secretary Munchin, markets concluded that the US economy is still in need of more stimulants, and that future plans will be directed to the mostly affected by the crises.

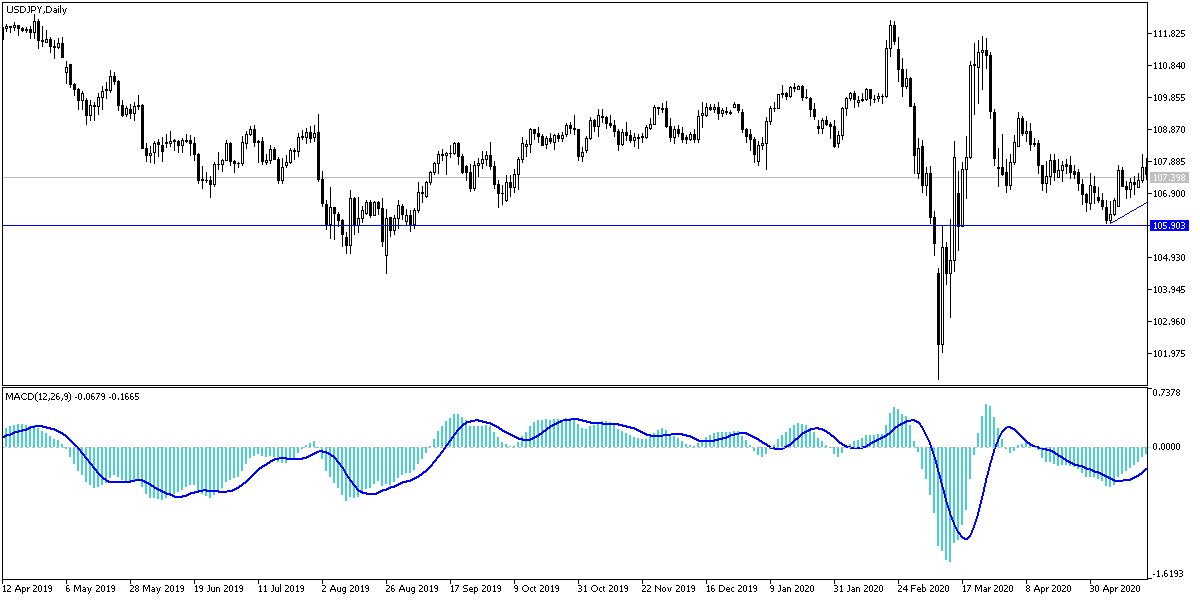

According to technical analysis of the pair: Despite recent correction attempts, the USD/JPY still hasn’t reached the trend reversal level, as the downtrend continues. Stability below the 108.00 support will improve the bears control and will indicate a move towards lower levels. There will be no true trend reversal without breaking the 110.00 psychological resistance. The pair awaits trust returning to markets and containing the new spread of coronavirus.

The pair will react today to the announcement of the Federal Reserve’s last MoM and the Non-Farm jobs report from ADP. Before that, we have the TANKAN Japanese reading.