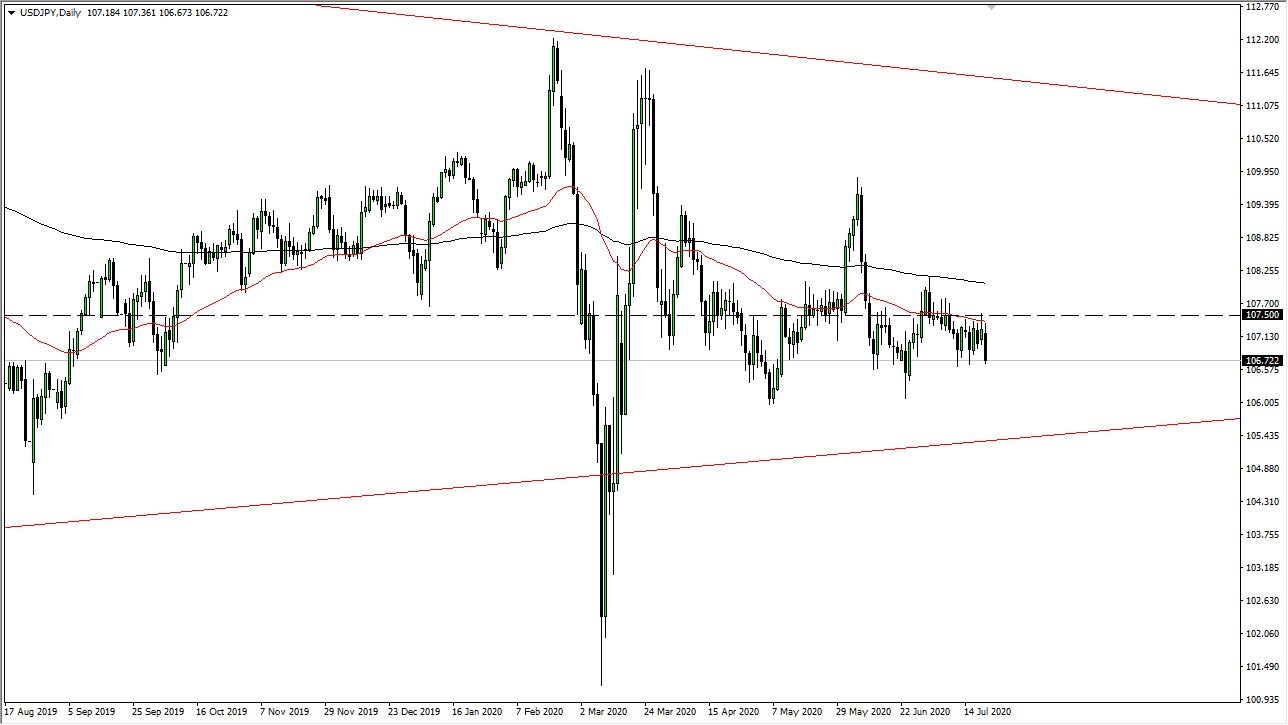

The US dollar has initially tried to rally during the trading session on Tuesday but failed again at the 50 day EMA. This is also where we see the ¥107.50 level coming into play, an area that is significantly resistant. That being said it looks like the market is going to continue to struggle in this general vicinity, extending all the way to the 200 day EMA. The 200 day EMA currently sits near the ¥108 level, an area that has a certain amount of interest attached to it. There is an entire zone of resistance between the 50 day EMA and the 200 day EMA, as we have seen of the last couple of weeks.

Rallies at this point in time will continue to be faded, and if we can break down below the candlesticks of the last couple of days, then I think the market could go down to the ¥106 level, an area that we have seen buyers at a couple of times. If we break down below there, then it is likely that we go down to the ¥105 level. That is a large, round, psychologically significant figure, but ultimately if we break down below there then it is likely that we go down to the ¥102 level. That is an area that has been important in the last several years as well, so I think it is only a matter of time before we break down below there and then find even more support at the ¥100 level.

If we were to somehow break above the 200 day EMA near the ¥108 level, it is likely that we will go looking towards the ¥110 level above, where we have seen a lot of resistance. This is a large figure that will attract a lot of attention in and of itself, but as you can see the US dollar is on its back foot so I think it is only a matter of time before we see downward pressure again, as the US dollar has been selling off against almost everything. With that being the case, it is likely that the downward pressure will continue, so I have no interest in buying this pair even though I recognize that we are close to significant support. Therefore, expect a lot of volatility but in the end, the US dollar has been beaten up again by so many different currencies during the session that I think we have clearly seen a shift in overall sentiment.