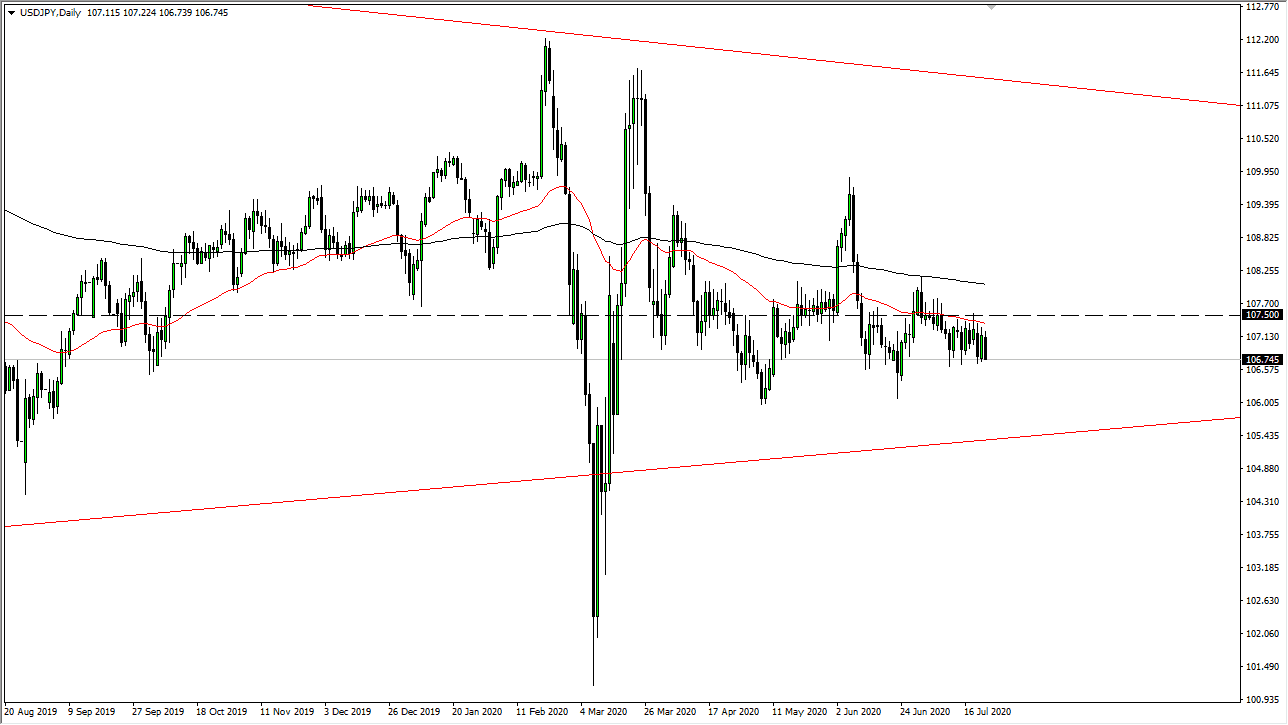

The US dollar continues to trade the bottom of the range against the Japanese yen, as we have dropped towards the ¥106.75 level. Ultimately, I do see a lot of support underneath so it would not be a huge surprise to see this market turn right back around and bounce. After all, there seems to be no real momentum in this pair recently, and it should be noted that it looks like a couple of other currency pairs are going to move in favor the US dollar heading into the weekend.

If you think about it, it does make sense as a lot of traders have massive amounts of profits that they can take into the weekend, so why not collect them? That could drive the US dollar higher again, but when I look at the longer-term chart, I think that we are eventually going to break down due to the fact that the trend in the US dollar is most decidedly lower. Maybe not necessarily in this market, but most certainly in several other currency markets.

If we do bounce, there is the 50 day EMA above that will offer resistance, slicing through the ¥107.50 level. It is sloping a little bit lower, so that could signify that we are going to see more downward pressure. Above there, we see a lot of resistance extending all the way to the 20 day EMA, which is currently near the ¥108 level. I think that is an entire “blanket of selling” that is waiting to jump into the marketplace so if we were to break above all of that then I think the pair could go much higher. At that point in time it is likely that the pair will go looking towards the ¥110 level, which was the most recent spike high that the market had seen back in late May.

All things being equal, the easiest way to trade this market is to simply fade short-term rallies and try to click 20 or 30 pips at a time. Big moves do not seem likely in the short term, but if we were to break down below the ¥106 level, then we could go looking towards the ¥105 level, and then after that the ¥102 level. With this, it is likely that the market continues to do the same thing it has done for some time.