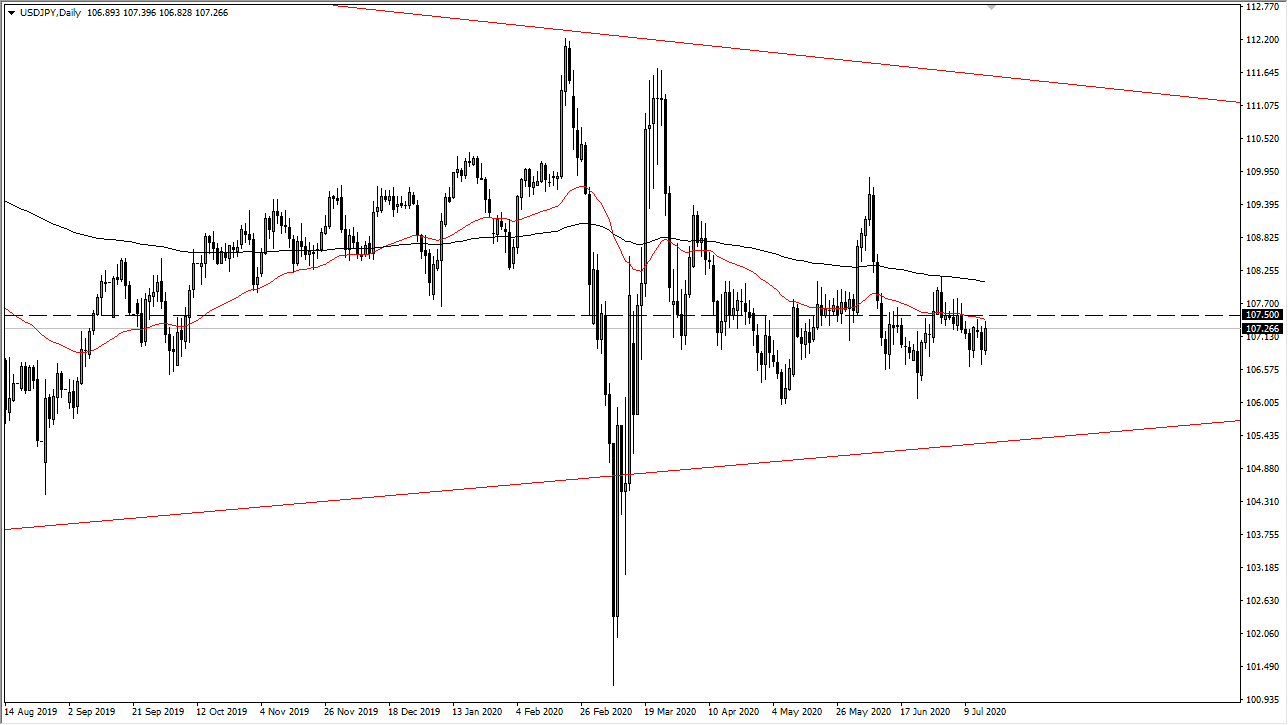

The US dollar rallied a bit during the trading session on Thursday against the Japanese yen but gave back the gains at the very end of the day. What is most important to pay attention to is that the ¥107.50 level continues to see a lot of selling pressure. Because of this, it is probably worthwhile to take a shot at shorting this market, simply because the US dollar continues to struggle overall. Furthermore, the 50 day EMA is in the same neighborhood so it would make sense that sellers would be here. In fact, there is an entire zone of resistance that extends all the way to the 200 day EMA above, so this is a market that I think will probably end of the week somewhat soft, or even if it does rally I doubt it will hang on to the gains for long.

The candlestick is somewhat impressive, but at the end of the day we have been going back and forth in this tight range for several sessions, and the moving averages are starting to slope a little bit lower. Because of this, I think we are likely to see a lot of noisy trading in general, with the fact that both of these are considered to be safety currency’s and of course there is so much uncertainty right now, it does make sense that we struggle to go anywhere. Having said that, currency pairs do not sit still forever so it is highly likely that we will eventually get some type of move.

To the downside I see the ¥106 level as a major “double bottom” that will more than likely be tested again. If we can break down below there, then it is likely that we go looking towards the ¥105 level next. To the upside, it is not until we break above the 200 day EMA that I am comfortable buying this pair, which I think could open up a move towards the ¥110 level. Expect choppiness going into the weekend but I cannot imagine a scenario where somebody wants to jump “all in” with this pair going almost nothing over the last couple of weeks. Obviously, headlines can change all of that but right now it looks likely to be a scalping type of market at best. This does not mean you cannot make money, just that you are going to need to be quick about it.