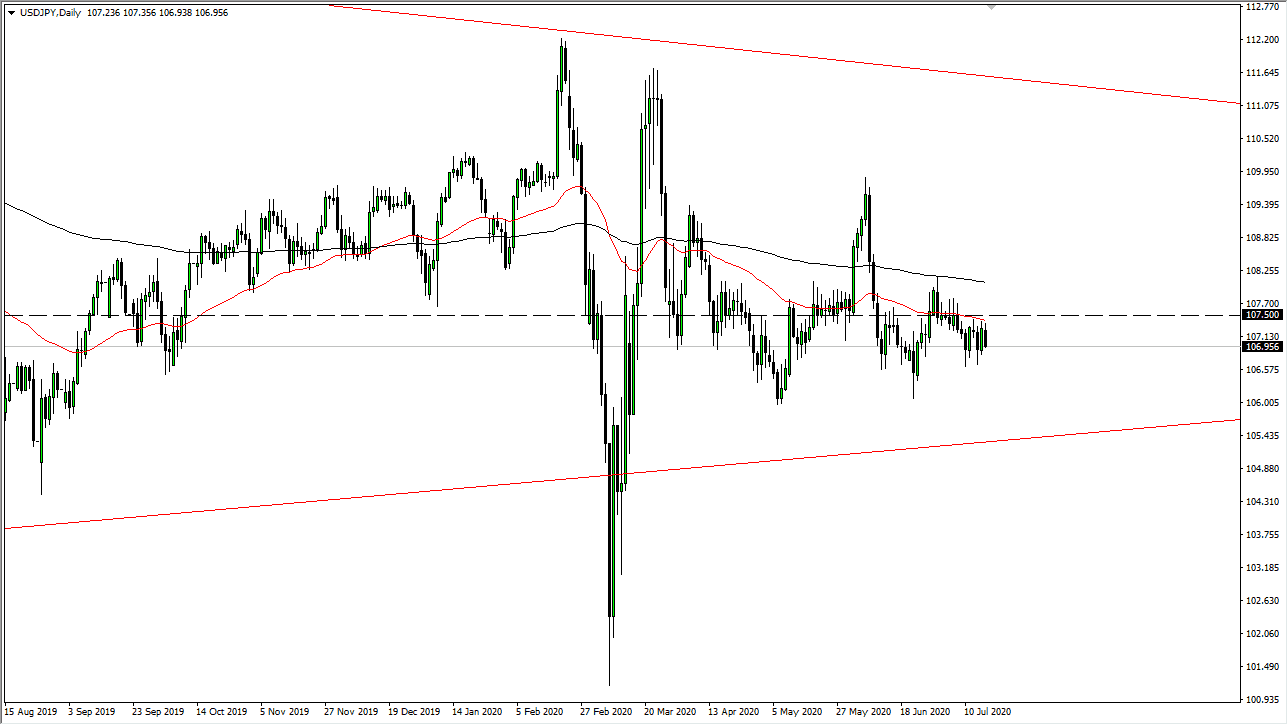

The US dollar has initially tried to rally during the trading session on Friday but gave back the gains as we got a bit too close to the ¥107.50 level. This is a pair that has gone sideways and really did not do much over the last week or so, as we are trying to get used to the idea of the ¥107.50 level offering a significant “ceiling” in the market. The candlestick was closing at the bottom of the overall range, so we could see this market break down from here, and I think that is where we are leaning overall. The US dollar is on its back foot, and it should also be noted that the 50 day EMA suddenly is acting as a major resistance barrier, perhaps extending all the way to the black 200 day EMA.

I think shorting rallies in this market probably paved at best, and I suggested yesterday that we could short this market for a small move. That move has already had its entirety play out from what I told you to expect, so now I am looking for short-term rallies to take advantage of so I can sell yet again. Otherwise, I believe that the market will go looking towards the ¥106 level. Breaking down below that level opens of the floor to the ¥105 level, which then of course opens up a move down to the ¥102 level. This is most likely going to be the move going forward, but obviously we have to have a little bit more momentum to the downside to make that happen. We could bounce, but I would be more than willing to sell closer to the 50 day EMA for a small scalp yet again.

With all of that being said if we can break above the 200 day EMA then I believe that the pair will go looking towards the ¥110 level. That is an area that was massive resistance previously, and at this point, it is hard to imagine the US dollar against much out there, as the Federal Reserve is pumping the markets full of US dollars. With all that being said, I believe that this is a “grind lower” type of scenario going forward. We will eventually get a bigger move, but most traders have simply been sitting here and waiting for a while.