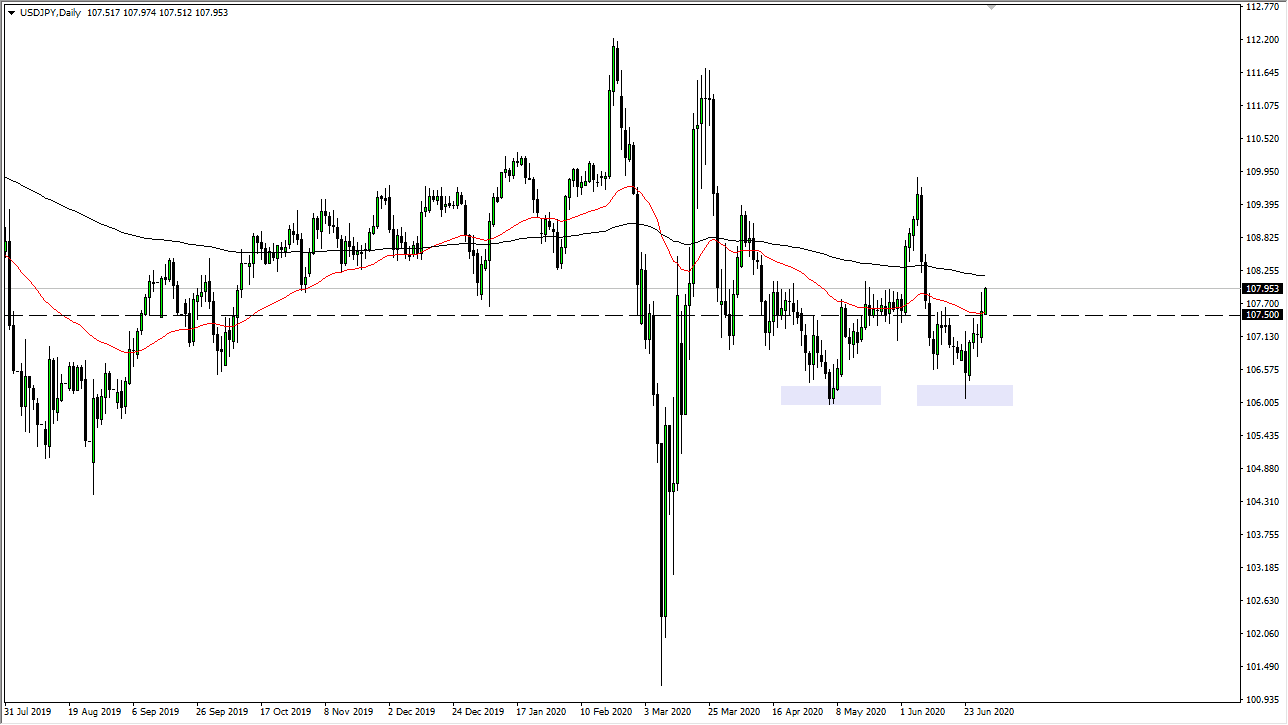

The US dollar has rallied a bit during the trading session again on Tuesday, breaking slightly above the highs from the trading session on Monday. Having said that, the market looks as if it is ready to take on the 200 day EMA. The 200 day EMA of course is crucial, and therefore looking for opportunities to pick up a move above there could send this market towards the ¥110 level. Having said that, there is also high potential for this market to turn around and sell off in that area as well. With this, the next couple of days could be rather interesting in this currency pair.

The breaking of the previous candlestick is crucial, so that does suggest that we are in fact going to try to break to the upside. The ¥108 level is an area that has been important more than once, so whether or not we break above here will be remarkably interesting to pay attention to. Above the ¥108 level of course is that 200 day EMA, so there are a couple of reasons to think that perhaps we may struggle. However, if the US dollar does continue to strengthen against the Japanese yen, then the move could be rather quick.

We look at the longer-term chart, you can see that the dollar/yen pair has been consolidating for some time, and therefore we are trying to build up the necessary momentum for a bigger move in my estimation. I do not know when that happens but given enough time, I certainly think that it does. Once it happens, we could be looking at a major change in attitude. This would be a longer-term move that traders would be looking to hang onto and could influence where a lot of different markets go for some time. This is a market that will continue to be very noisy, so with that all in mind, this is a market that we are going to see a lot of volatility in and therefore short-term scalping in both directions probably will be the best way to go. Ultimately, the market will continue to be very noisy, and therefore you should be cautious about your position size but if you trade smaller positions and simply go back and forth, you should do quite well. Keep in mind that this pair is somewhat sensitive to risk appetite, rising and falling with it.