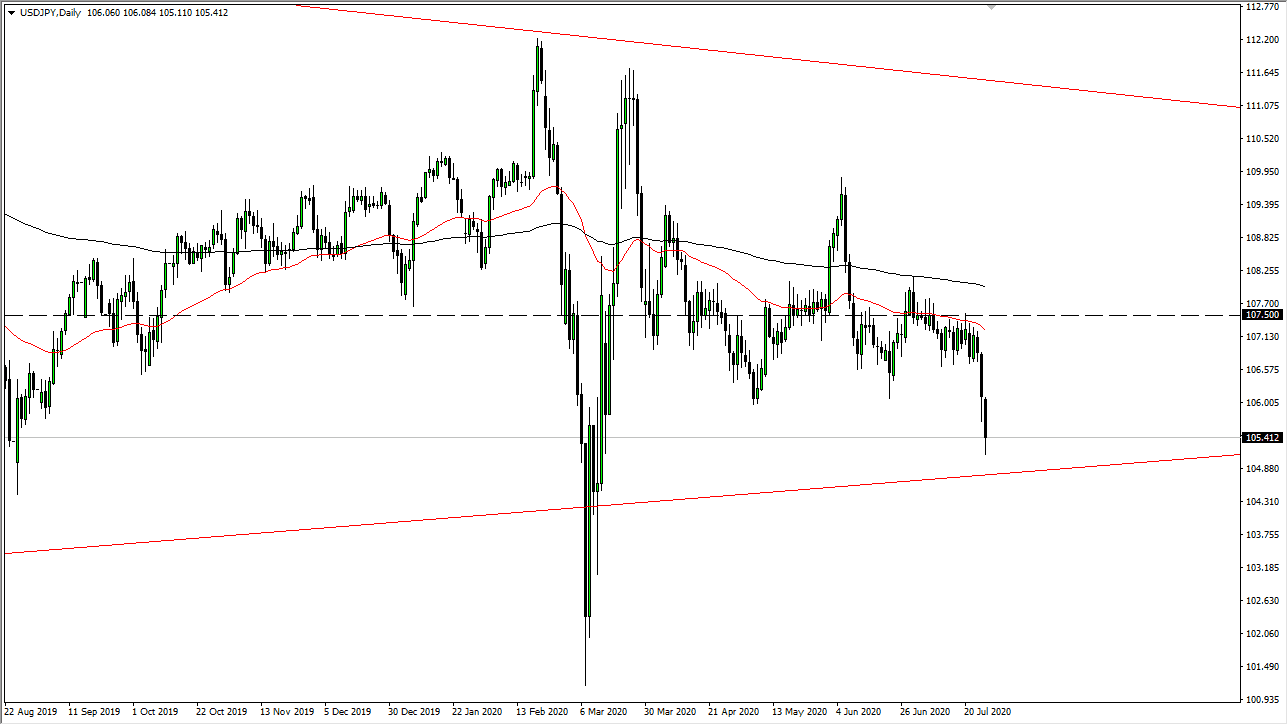

The US dollar fell significantly during the trading session on Monday to kick off the week and threatened the crucial ¥105 level. This is an area that has been important more than once, and it is very likely that it will continue to be going forward. At this point in time, it is likely that the market will eventually break down, but I think we might get a short-term rally that we can start selling again. The length of the candlestick is relatively impressive, but more importantly, we see a lot of resistance near the ¥106.50 level, which was previous short-term support. Simply looking for signs of failure after a short-term rally will be the best way to go forward.

To the downside, if we break below the ¥105 level it is likely that we will then go looking towards the ¥102 level, which has been an important figure for quite some time and therefore I think we will get a bit of a reaction in that general vicinity. After that, the next target will be the ¥100 level, an area that will most certainly get the attention of the Bank of Japan. Do not get me wrong, I think the US dollar is more than likely going to sell off against most currencies but with the Bank of Japan being ultra-loose with its monetary policy for so long, this could be a little more of a grind than anything else.

There is a longer-term uptrend line of sorts just underneath, so it is worth paying attention to, but I think in the end we are simply trying to figure out where were going to go for the longer-term move. The Federal Reserve loosening monetary policy the way it has should continue to work against the value of the greenback, even against the Japanese yen. The one thing that tends to move this market to the upside is risk appetite, which is being artificially pumped due to the currency move against the greenback. Stock markets may cause a little bit of a boost, but longer-term I think the US dollar is in trouble as it has been historically expensive against most currencies, with perhaps the major exception in this pair. At this point, I look to fade short-term rallies that show signs of trouble.