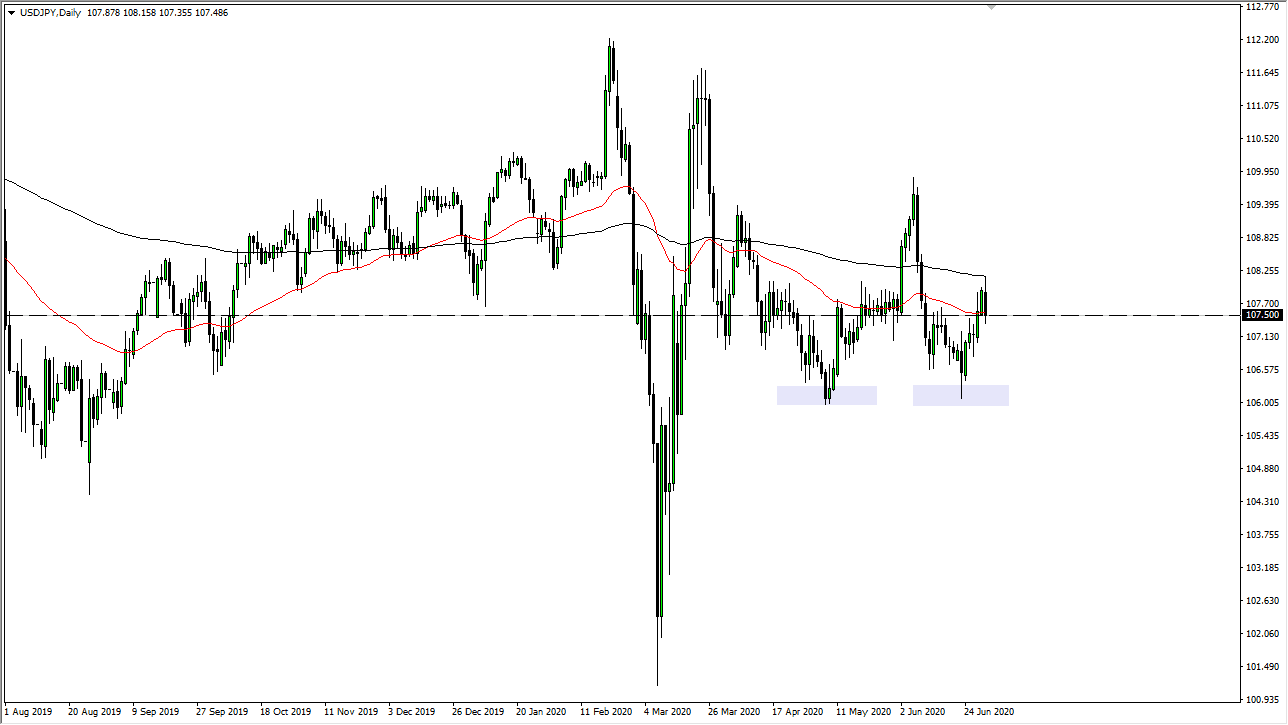

The US dollar initially tried to rally during the trading session on Wednesday but found the 200 day EMA to be a bit overly resistive to continue going higher. The fact that we have pulled back there and reach towards the 50 day EMA tells me that we still are not quite ready to take off to the upside. The ¥107.50 level is basically where I believe that most traders look at the market as being in “fair value”, so it is a level that continues to see a lot of movement in both directions. Because of this, the fact that the jobs number comes out on Thursday I think it makes quite a bit of sense that we sat right here at the clothes.

If we can break down below the bottom of the candlestick for the trading session, then I believe we go looking towards the ¥106 level over the longer term. The ¥106 level is an area where we have seen a bit of a “double bottom” as of late, so with that being the case, the market is likely to find buyers there as well. The alternate scenario of course is that we break above the 200 day EMA, which could open up a move towards the ¥110 level. That is difficult to imagine though unless we get a sudden “risk-on rally” due to the jobs number or something.

It is worth noting that the area between the 50 day EMA and the 200 day EMA tends to be an area of interest, and that means that it will offer quite a bit of support or resistance depending on the situation. I think at this point it makes sense that we continue to see a lot of choppy trading in general because this is a pair that has had trouble picking up any longer-term direction. The candlestick for the trading session on Wednesday was almost like an engulfing bearish candlestick, and I think it tells the same story. However, keep in mind that the jobs number will be a major influence on where we go next, so it will not be surprising at all to see this market move during the Asian session, which will be more than likely be extraordinarily quiet. With all that in mind, I favor the downside but recognize that we have to keep an open mind due to the announcement.