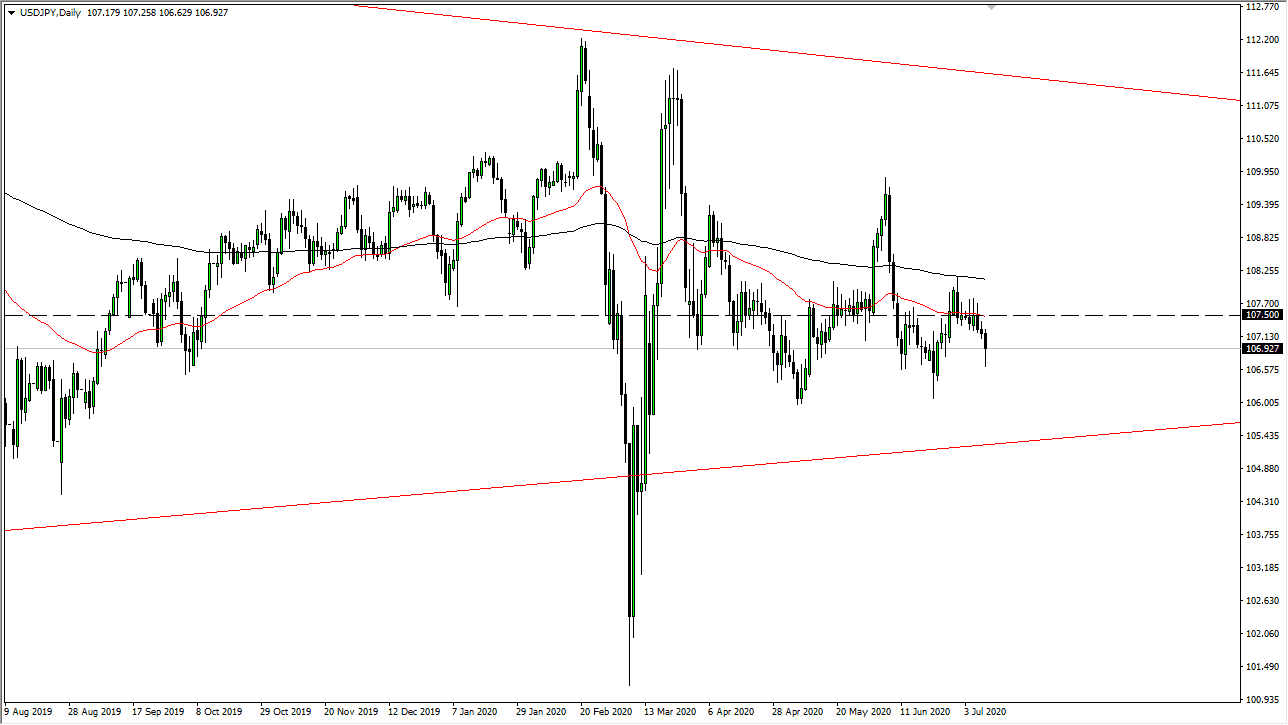

The US dollar has broken down a bit during the trading session on Friday, showing signs of weakness yet again. However, we have bounced a bit towards the end of the day to at least recover some of the losses, but one has to wonder whether or not it has to do with the weekend coming, and therefore if we were talking about Tuesday at these levels, I anticipate that there would be a lot less short covering and therefore we probably would have closed at the bottom. That being said, if we break down below the bottom of the candlestick for the Friday session it is likely we go down towards the ¥106 level. That is an area where we have seen a bit of a double bottom, so it would not be very surprising to see the market bounce from there.

However, if we did break down below the ¥106 level it is likely that the market could go down to the ¥105 level. Below there, the USD/JPY is likely to go looking towards the ¥102 level. Once we get closer to that area, I suspect that the Bank of Japan will lose its sense of humor. To the upside, the ¥107.50 level will be significant resistance, as we have seen quite a bit of selling until the last couple of days. Any move towards the ¥107.50 level is likely to see a lot of pressure.

Even if we break above there, then the 200 day EMA would be resistance, which is at roughly ¥108. If we were to break above, there then it is likely that we could try to reach towards the ¥110 level. That seems to be a massive resistance barrier, and it also seems to be very unlikely the way that this pair has been behaving. Notice how the 50 day EMA is currently sitting at the ¥107.50 level, and it looks as if it is drifting lower. With this, I think it is only a matter of time before we find sellers on these rallies and more of a choppy move to the downside. The long tail on the candlestick during the Friday session like I said can probably be ignored, as it is an area that was probably influenced more by time than anything else as it was late on Friday.