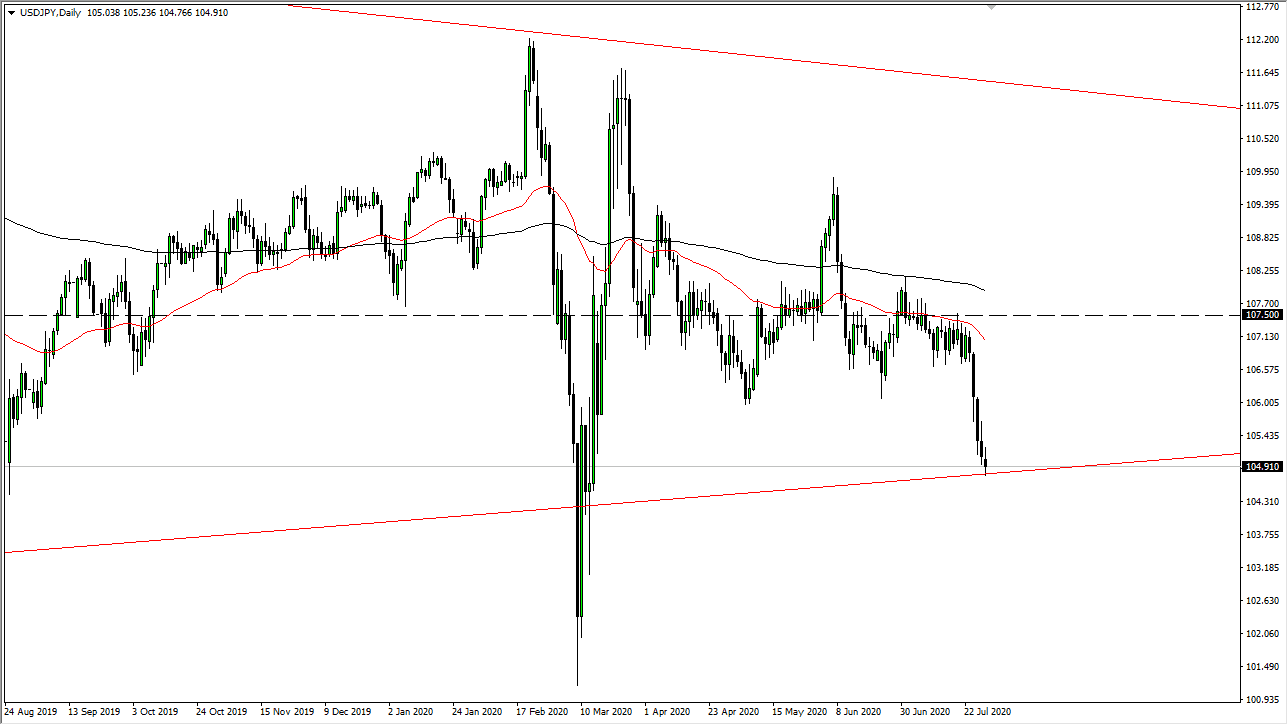

The Japanese yen has gained slightly during the trading session on Wednesday after the Federal Reserve reiterated its determination to liquefy the markets. At this point, it is likely that a break down below the bottom of the candlestick for the day opens up a move down to the ¥102 level, and then possibly even as low as the ¥100 level. At this point, any time the market rallies is likely that we will see sellers jumping in to fade the US dollar in general. The Japanese yen is considered to be a safety currency and it can move opposite of the stock market, but at this point I think the only game in town is going to be what the Federal Reserve is doing, which of course is throwing dollars at anything that moves.

That will drive down the value of the US dollar in general, and this market will not be any different. Ultimately, this is a trade that I think has been in the making for some time, but I think that rallies will be sold into near the ¥106 level. The ¥107 level will certainly be the ceiling going forward, as we have seen a major breakdown.

This does have a bit of a knock on effect around the Forex markets, as other currencies against the Japanese yen will be pulling higher, it could slow down the descent of this pair, but in general this is a negative market. If we get closer to the ¥100 level, it is likely that the Bank of Japan will lose it since humoring get involved. Anything below the ¥100 level starts to invite intervention by Tokyo, but we are quite a ways from that level, so at this point that is just something to keep in the back of your mind. I do not have any scenario in which a willing to buy this pair, and if you want to short the Japanese yen you should probably do it against other currencies such as the British pound or the Australian dollar. The 50 day EMA is starting to curl to the downside as well, so that should continue to push this market lower. After all, there are a lot of technical traders out there that will be paying attention to this indicator, not to mention the fact that the entire week has been negative. The candlestick for the day is relatively neutral, so it does show that there some fight left in the US dollar, which is why I think a break down below the daily candlestick certainly is something worth paying attention to.