While the Indian agricultural sector shows signs of recovery, it is uncertain if it will spill over to urban centers. Before the Covid-19 pandemic forced a nationwide lockdown to contain its spread, India struggled with declining GDP. Rural India is less likely to support the consumer-driven Indian economy, and with India, the most infected country in Asia and third globally, significant obstacles remain. The outlook for the US economy continues to deteriorate, keeping breakdown pressures in the USD/INR intact.

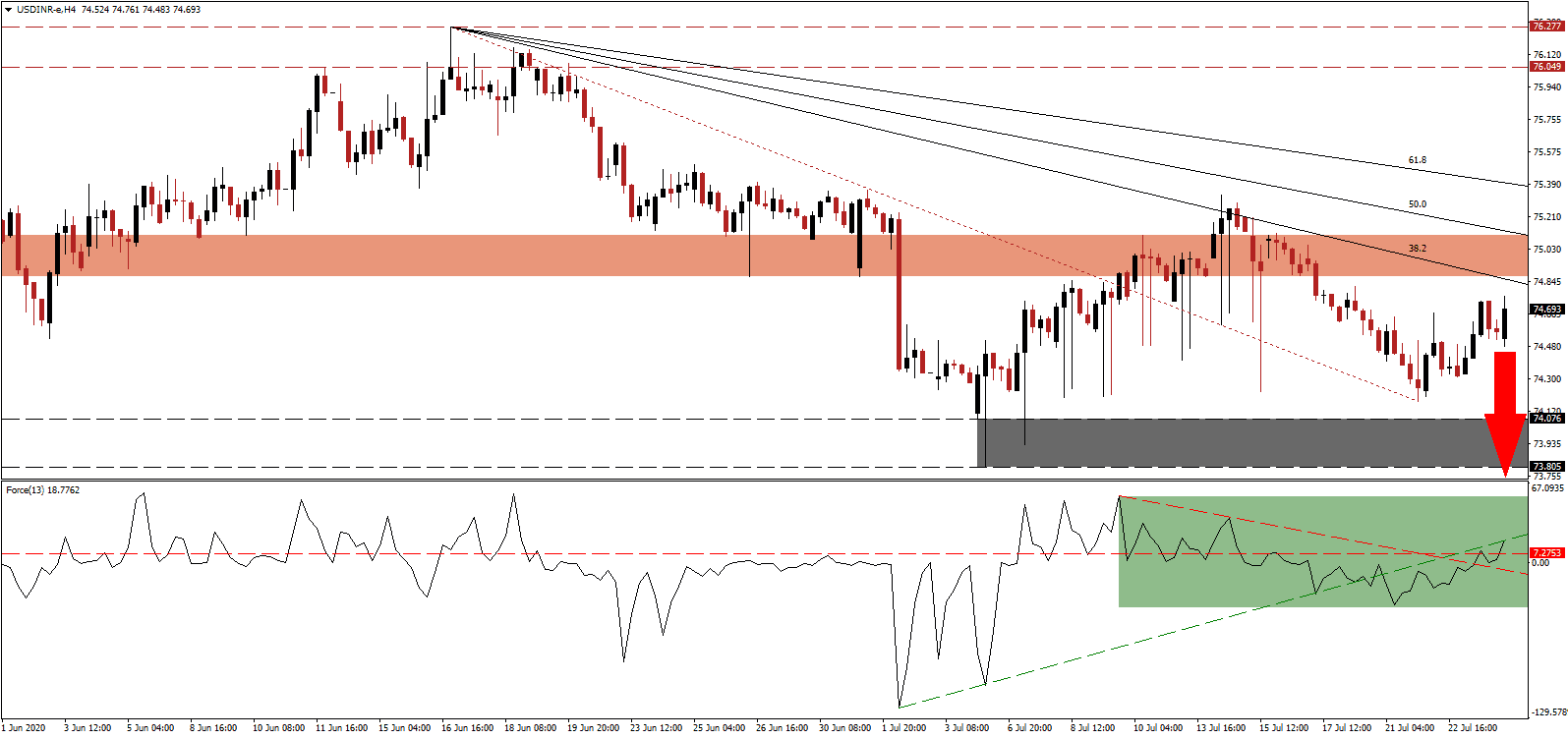

The Force Index, a next-generation technical indicator, confirmed to push to the upside, assisted by its ascending support level. It led to the conversion of its horizontal resistance level into support, as marked by the green rectangle. Despite the temporary momentum recovery, price action failed to advance significantly, and the descending resistance level is anticipated to pressure this technical indicator lower, allowing bears to regain control of the USD/INR.

India has growth potential but has now intensified its anti-China stance after a deadly border clash a few weeks ago. After banning 59 Chinese apps, the government of Prime Minister Modi plans to sanction at least seven Chinese firms with alleged tied to the People’s Liberation Army (PLA). Alibaba, Tencent, Huawei, Xindia Steel, are among those on the list, creating uncertain disruptions across the Indian economy. It added to the count-trend recovery in the USD/INR, but a push above its short-term resistance zone located between 74.872 and 75.108, as identified by the red rectangle, remains unlikely.

US initial jobless claims increased yesterday with several economists warning the July non-farm payroll (NFP) report may show job losses. The $600 weekly government subsidiary for initial jobless claims will expire next week, with a proposed replacement of just $100. It adds to more bearish pressures on the US Dollar. The descending 38.2 Fibonacci Retracement Fan Resistance Level is anticipated to force the USD/INR into its support zone located between 73.805 and 74.076, as marked by the grey rectangle. An extension into its next support zone between 72.433 and 73.214 is expected.

USD/INR Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 74.700

Take Profit @ 73.200

Stop Loss @ 75.000

Downside Potential: 15,000 pips

Upside Risk: 3,000 pips

Risk/Reward Ratio: 5.00

In case the ascending support level pushes the Force Index higher, the USD/INR may attempt a breakout. Forex traders should consider any advance from present levels as an excellent secondary selling opportunity, driven by a worsening economic condition out of the US. The upside potential remains confined to its intra-day high of 75.330, the previous peak of a counter-trend advance.

USD/INR Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 75.100

Take Profit @ 75.300

Stop Loss @ 75.000

Upside Potential: 2,000 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.00