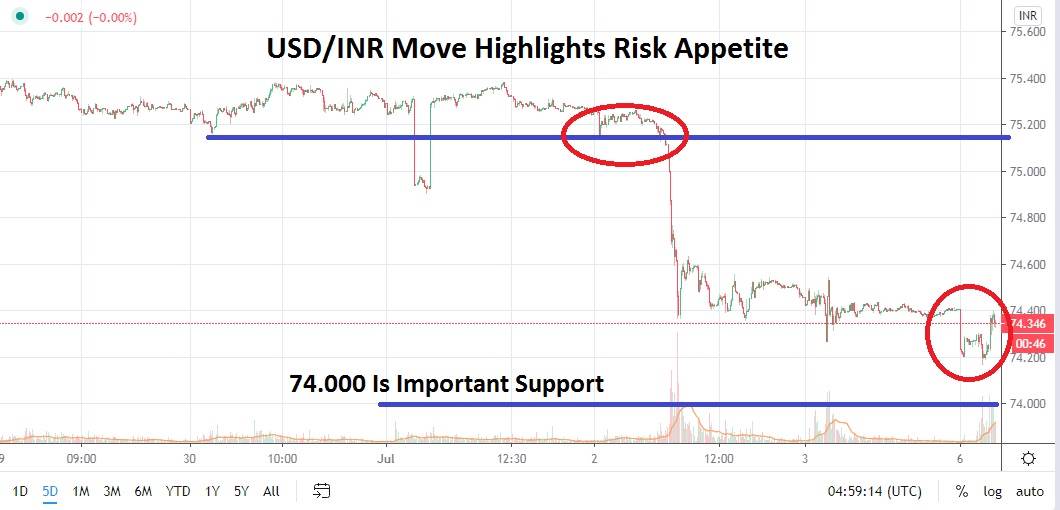

The Indian Rupee has seen a surge of USD/INR selling emerge the past two trading days and the currency pair finds itself within the realms of a very important support level. The marks between 74.000 and 74.200 have proven resilient before and speculators will have to carefully gauge how much risk appetite they have when deciding if they want to try and follow the bearish short term trend of the USD/INR.

The last time the 74.000 support level was tested was in late April, and this was met by buyers of the USD/INR who have since then created a rather dynamic range between 74.300 and 75.700 with the occasional test of higher resistance and weaker support ratios. While risk appetite traders appear ready to launch a new wave of speculation in the global markets, speculators may want to ask themselves how long this rally will play out. However, day traders with a taste for adventure may believe the coming few days may produce more bearish opportunities for the USD/INR and look to sell the currency pair.

It is a big ‘if’, but if the USD/INR can actually break the 74.000 support level and build momentum, short-sellers could trigger values for the Indian Rupee not experienced since the month of March. Trading in March saw a fairly stable range between the 73.500 and 74.000 junctures for a solid duration. However, the proverbial piece of straw that broke this strong value range of the Indian Rupee has questions and concerns regarding coronavirus.

Sentiment is a fragile perception in the global markets still. Traders need to ask themselves if they believe investors worldwide are going to create enough foundations to introduce vast amounts of risk appetite into the financial markets. The USD/INR has created nice trends for speculators to take advantage of the past handful of months, but its current value juncture may prove dangerous for short term traders who are not cautious.

Speculators need to use risk management if they are going to pursue short selling of the USD/INR and try to wager further tests of support that will continue the next few days. A selling position near the current values of the USD/INR cannot be faulted. However, traders may also keep their eyes open for reversals upwards to quickly emerge if important support is targeted and proves resilient again.

Indian Rupee Short Term Outlook:

Current Resistance: 74.600

Current Support: 74.200

High Target: 75.200

Low Target: 73.900