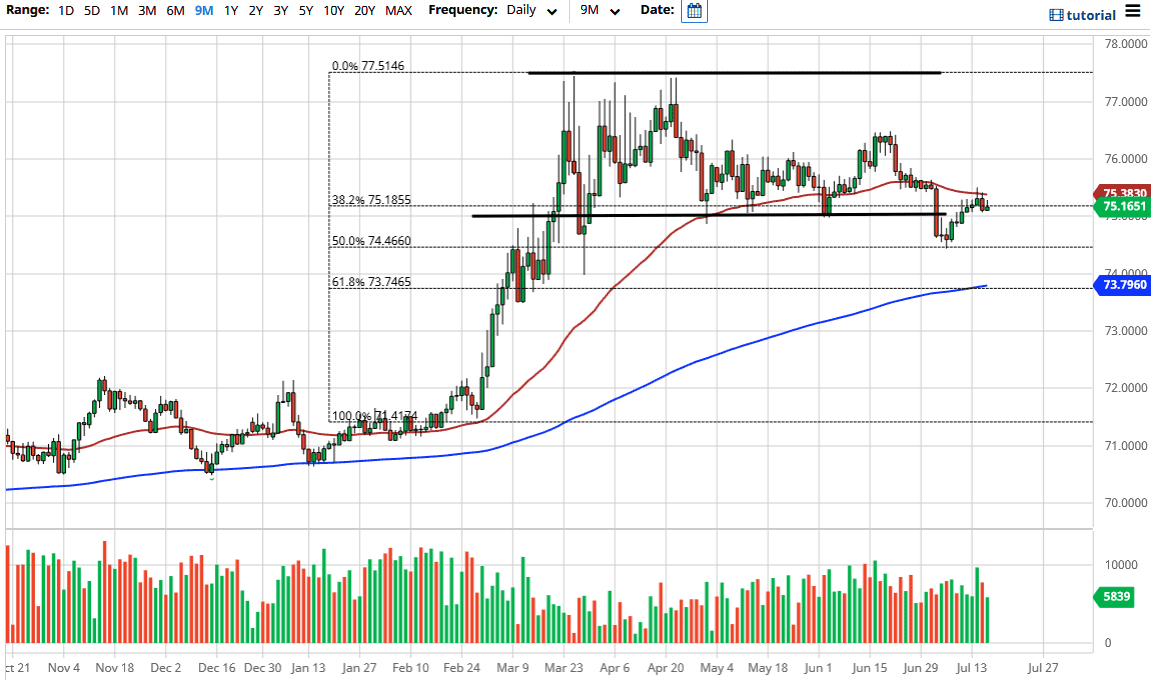

The Indian rupee initially lost a bit of ground against the US dollar during the trading session on Thursday, but continues to find a little bit of strength, or perhaps the better way to look at this pair is that we continue to see US dollar weakness. Because of this I believe that this market may continue to drift a bit lower, because we did break down below the ₹75 level, an area that I had talked about previously as being potentially important. As you can see, the market has since revisited that area and now we are starting to drift a little lower.

If you look at the candlestick from the Tuesday session, you can see that there has been a shooting star that formed just below the 50 day EMA. That to me suggests that we are looking at a scenario where we are starting to see a little bit of a trend change, which makes quite a bit of sense considering that the US dollar has been hammered against multiple other currencies. With that in mind, it could provide a little bit of cover for emerging market currencies like the Indian rupee, but I still think it is going to be an exceedingly difficult fight for the emerging market currencies to continue strengthening. This would need to see a significant amount of “risk on” around the world to really start to pick up speed. That being said, you can make an argument that perhaps the US dollar is overvalued against not only the rupee, but just about everything else. In fact, I think a lot of people would probably agree with that sentiment. With that in mind, I think that we continue to see a gentle grind lower, perhaps back down towards the ₹74.50 level that we had recently visited. That could offer a little bit of short-term support, but I would not look for it to be a big deal one way or the other as the market probably will be much more interested in the 200 day EMA which is currently sitting at the ₹73.79 handle.

Keep in mind that this is a very risk sensitive market, so if we get some type of freak out in the other markets around the world, you may see this market rally again, but right now it looks as if the 50 day EMA is offering dynamic resistance. With that in mind I think we probably continue to slump ever so slightly.