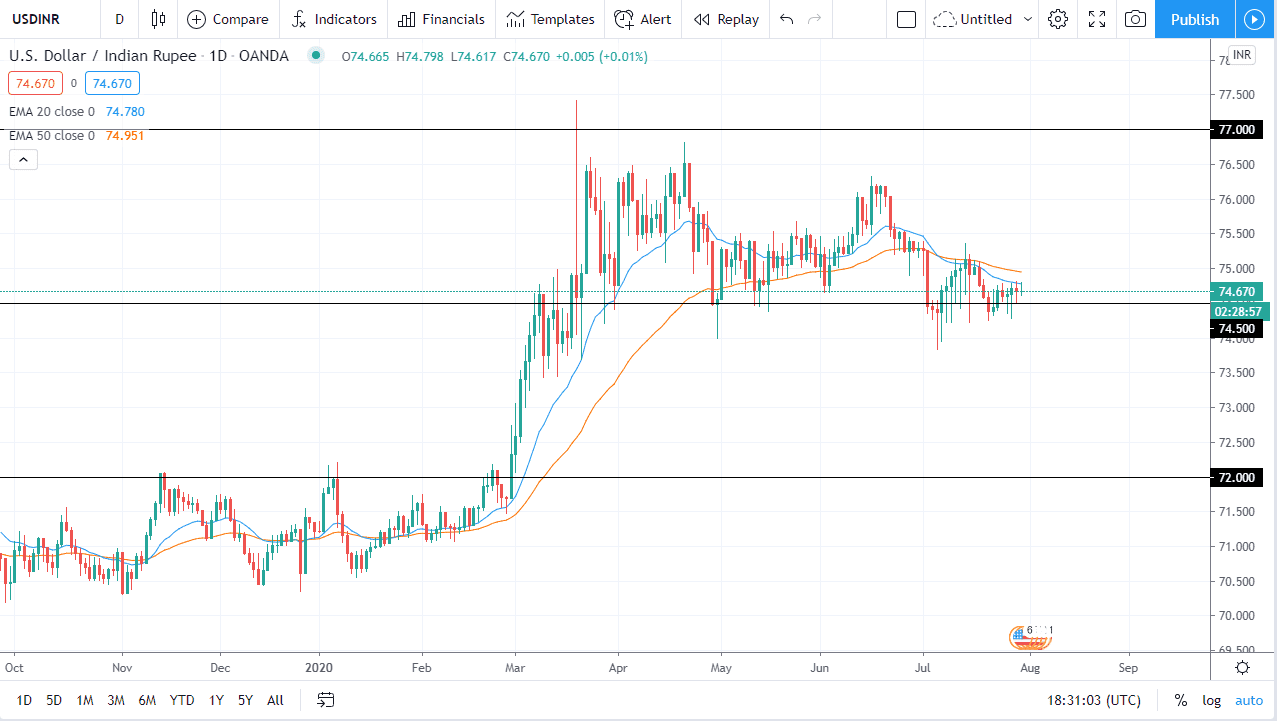

The Indian rupee has done very little over the last couple of days as we continue to dance around the ₹74.50 level, and as a result it is likely that the market is going to continue to be very difficult to make big moves, but if you have the ability to scalp this market you may be able to make quite a bit of profit. Having said that, there are most certainly going to be a lot of reasons to pay attention to this chart, mainly due to the fact that the Indian rupee is a great proxy for emerging markets in general. Because of this, pay attention to the overall risk appetite around the world, and of course what's going on with the US dollar by itself.

The Federal Reserve continues to flood the markets with liquidity and that can often cause quite a bit of noise in the US dollar, as people are literally choking on cheap greenbacks. This obviously has an effect on the Indian rupee, but India is a bit of a different situation as the coronavirus numbers in that country are most certainly very high in relation to other major economies. Because of this, you could see a scenario where the Indian rupee drags a bit against the US dollar while the rest of the world continues to gain. However, when I look at the technical analysis on the chart, I can see clearly that if we can break down below the ₹74 level, the market is likely to drop down towards the ₹72 level. If we break to the upside and clear the ₹75 level, then it is likely that the market goes looking towards ₹76 and then of course ₹77.

This is probably more about the US dollar than anything else and that can probably say about most currency pairs are now. The choppiness that we have seen has been a bit of a “push pull” type of attitude due to the fact of the coronavirus and the Federal Reserve directly conflicting with each other. When you look around the world, there are several currencies that are absolutely crushing the greenback, so one thinks it is only a matter of time before we break down here. However, India is an entirely different situation, so it is worth watching that ₹75 handle.