India, presently the third-most infected country with Covid-19, is on course to join the US and Brazil with over 1,000,000 confirmed cases. The population of India, the second-most populous country behind China, is more than twice that of the US and Brazil combined, suggesting that without a vaccine or cure, new infections may accelerate into the winter months and rise to the top of the global list. India started to ease lockdown measures gradually to revive the economy, but initial positive signs are fading. The USD/INR is vulnerable to a profit-taking sell-off following the end of a healthy counter-trend advance.

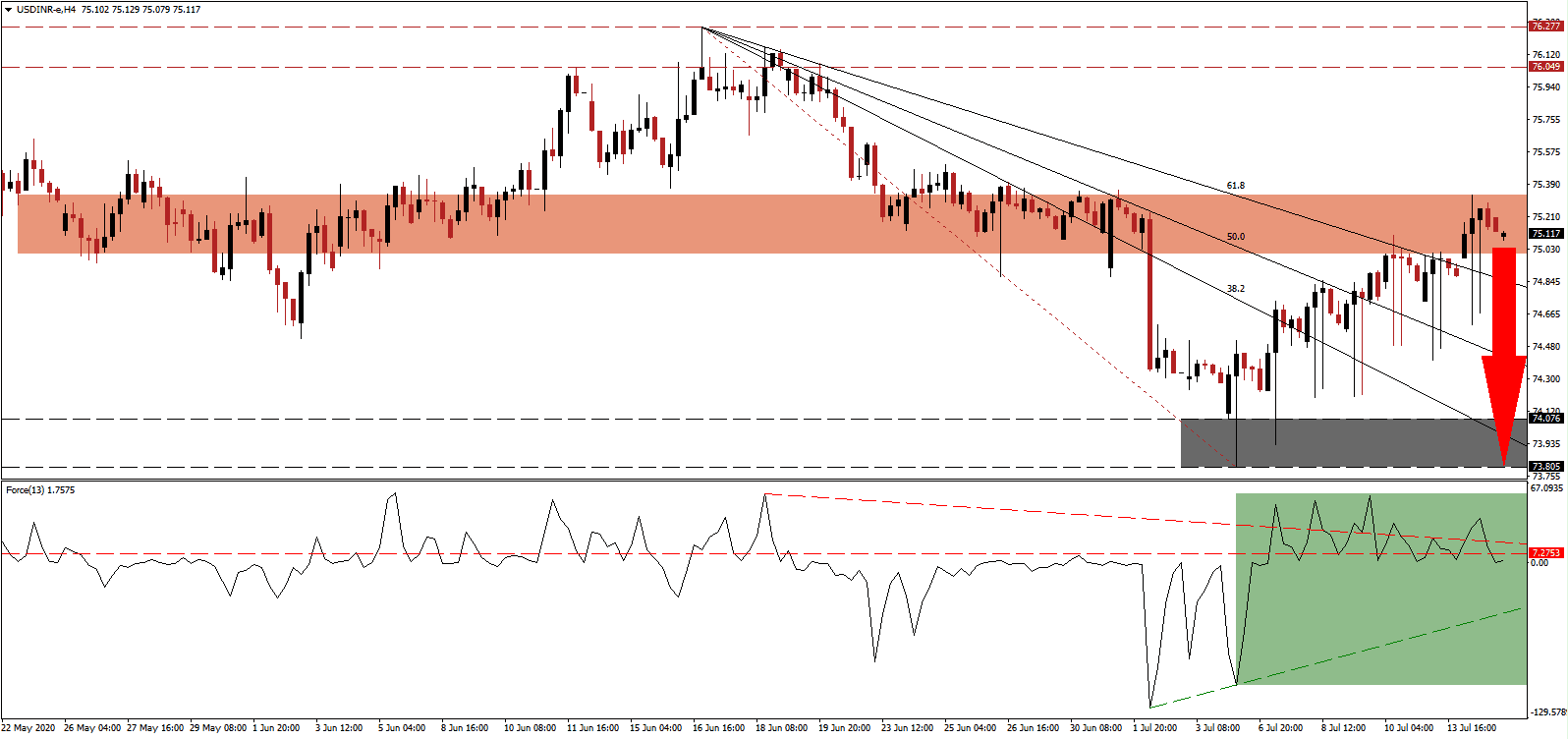

The Force Index, a next-generation technical indicator, formed a series of lower highs while this currency drifted higher. It resulted in the formation of a negative divergence, suggesting a pending price action reversal. Bearish pressures forced this technical indicator to retreated below its horizontal resistance level, as marked by the green rectangle. The descending resistance level is now expected to guide the Force Index below the 0 center-line and its ascending support level, granting bears complete control over the USD/INR.

India’s economy was struggling before the global pandemic forced the most massive lockdown in history. Several states are reimposing restrictions as new Covid-19 cases are straining the healthcare system. India’s most recent anti-China stance may encourage a local manufacturing revolution on a minor scale, but it is unlikely to deliver the required results to decouple their economies. The USD/INR started to drift lower inside of its short-term resistance zone located between 75.003 and 75.330, as identified by the red rectangle.

Presently, the US is struggling with an out-of-control virus and a public that ignores the recommendations of healthcare experts. With the federal government not willing to implement a law to enforce the usage of face coverings outdoors while accelerating its campaign to discredit healthcare officials who criticize the response, it is unlikely the conditions will improve. The USD/INR remains under rising bearish pressures, and a collapse in price action below its descending 61.8 Fibonacci Retracement Fan Support Level is anticipated to extend the breakdown sequence into its support zone located between 73.805 and 74.076, as marked by the grey rectangle.

USD/INR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 75.100

Take Profit @ 73.800

Stop Loss @ 75.500

Downside Potential: 13,000 pips

Upside Risk: 4,000 pips

Risk/Reward Ratio: 3.25

A breakout in the Force Index above its descending resistance level could pressure the USD/INR to seek more upside. Forex traders are recommended to consider any advance from present levels as an excellent selling opportunity. The economic outlook for the US is increasingly bearish, and third-quarter GDP well-positioned to disappoint. Until the Covid-19 pandemic is treatable with a cure, downside pressures remain, and the upside potential is confined to its resistance zone located between 76.049 and 76.277.

USD/INR Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 75.700

Take Profit @ 76.050

Stop Loss @ 75.500

Upside Potential: 3,500 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 1.75