Rural India, where agriculture is the primary economic component, is experiencing a surge in demand for farm equipment. Sales for tractors and motorcycles have recovered and, in some cases, exceeded pre-Covid-19 levels. A combination of much-needed rain led to a robust crop output, while the government's support for farmworkers added to the revival. Rural India is home to approximately 70% of the population and contributes roughly 50% of GDP. Economists warn that if urban growth does not pick-up, the consumption-led $2.7 trillion-economy will suffer. The green shoots provide bearish pressures on the USD/INR, which is well-positioned to accelerate its breakdown sequence.

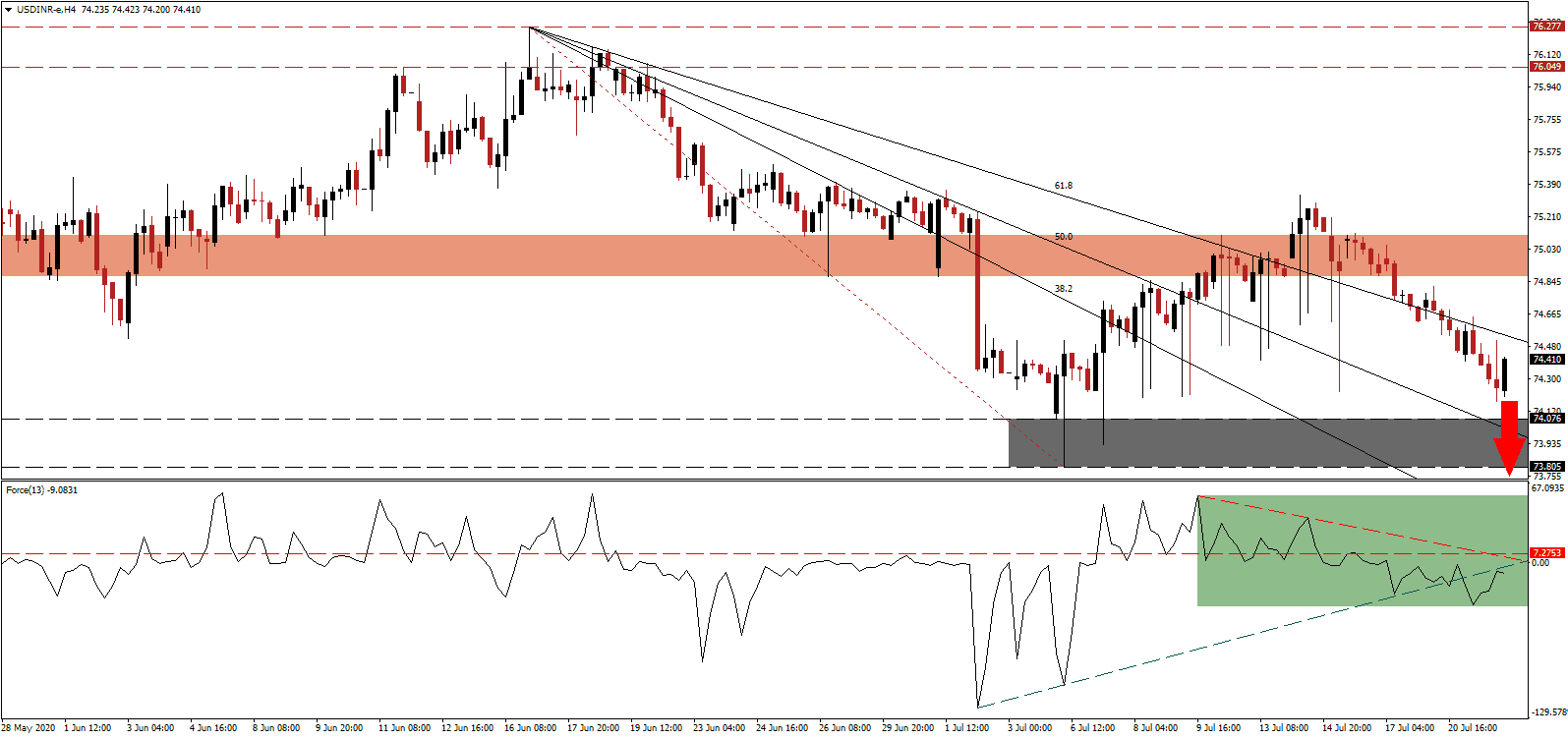

The Force Index, a next-generation technical indicator, points towards expanding bearish momentum following the collapse below its ascending support level, as marked by the green rectangle. It maintains its position below the horizontal resistance level, with the descending resistance level increasing downside pressure. This technical indicator is also in negative territory, ensuring bears are in complete control of the USD/INR.

One key driver for the Indian post-Covid-19 economy is Indian Railways. It spans over 68,000 kilometers but is due for an intensive modernization cycle. In a sign of implemented reforms, upgrades will include public-private partnerships (PPP) to attract the best technology, resources, and operational practices. Estimates suggest an optimized rail network can add 1.0% to GDP. After the USD/INR corrected below its short-term resistance zone located between 74.872 and 75.108, as marked by the red rectangle, US Dollar weakness is likely to inspire more selling moving forward.

A plan for over 109 new routes and 151 trains exists, which will create essential jobs. With implemented reforms, one hurdle to growth remains in rising real inflation. The core WPI has increased since Shaktikanta Das become Governor of the Reserve Bank of Indian, a development masked by the contraction in retail inflation. The USD/INR continues to correct, with bearish pressures increasing following the conversion of its descending 61.8 Fibonacci Retracement Fan Support Level into resistance. Price action is now on course to challenge its support zone located between 73.805 and 74.076, from where a breakdown extension into its next support zone between 72.433 and 73.214 is favored to materialize.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 74.400

Take Profit @ 73.200

Stop Loss @ 74.700

Downside Potential: 12,000 pips

Upside Risk: 3,000 pips

Risk/Reward Ratio: 4.00

Should the Force Index accelerate above its descending resistance level, the USD/INR could enter a limited reversal. Any advance from present levels will grant Forex Traders a secondary short-selling opportunity. Adding to downside pressure is the worsening economic outlook in the US, with prospects of more debt and an uncertain political climate. The upside potential is limited to its intra-day high of 75.330

USD/INR Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 74.900

Take Profit @ 75.300

Stop Loss @ 74.700

Upside Potential: 4,000 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 2.00