The Indonesian Rupiah has maintained a tight range the past day after testing important resistance. Interestingly the mark of 14550.0 proved to be a strong battle ground in the early days of the coronavirus pandemic. Late February of this year saw the USD/IDR test this value before global sentiment went negative and most currencies began to lose ground to the USD in forex.

The current range of the USD/IDR provides speculators with the opportunity to test both sides of the risk sentiment coin. The Indonesian government continues to provide solid transparency as it wages its battle against coronavirus domestically. Yes, there has been some criticism the government needs to spend more to help the economy, but every nation faces the same concerns and debate, as they try to figure out a way to keep their populations employed and manage their banking systems to engage investment.

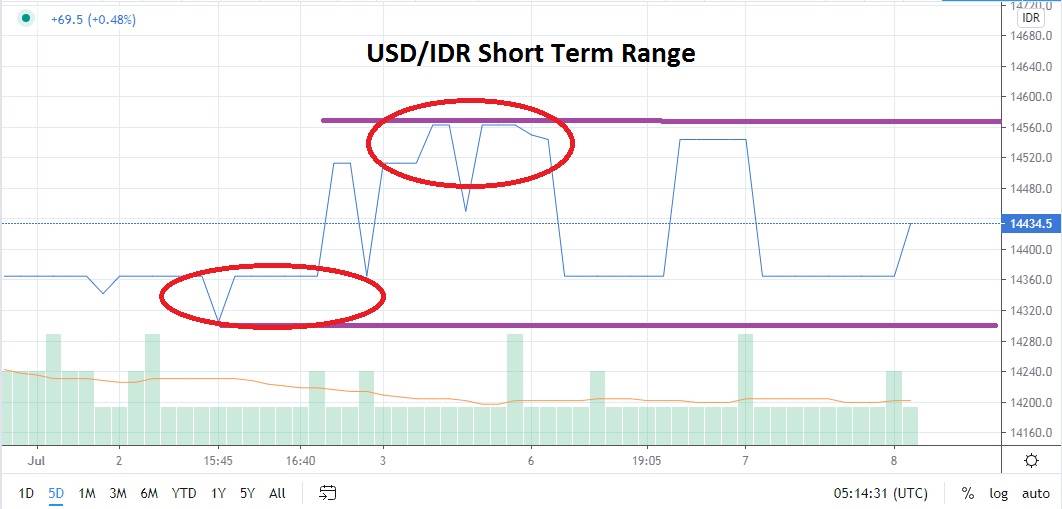

Traders who look at short term technical charts will see an ability to test limit orders today. The current range of the USD/IDR has traded between 14360.0 and 14550.0 the past two trading sessions. Depending on a trader’s perception of momentum, a selling position of the USD/IDR at its current price levels near the 14440.0 level offers the ability to seek reversals lower.

The question is if risk sentiment will improve in the short term and create a renewed test of support? What may entice short sellers is a glimpse of the June trading range when the USD/IDR largely moved between 14000.0 and 14300.0. A return to this value range if support is broken lower is not out of the question if risk appetite increases incrementally.

The rather consolidated range of the USD/IDR may be a signal that a breakout against its current values is about to develop. Resistance near the 14520.0 must be monitored closely and used, traders may be willing to speculate the USD/IDR has the potential for a downward reversal after putting in some rather polite upside this morning. If the short term range of the Indonesian Rupiah holds, selling the USD/IDR near the 14450.0 mark as a possibility and searching for support lower could prove worthwhile for speculative traders.

Indonesian Rupiah Short Term Outlook:

Current Resistance: 14520.0

Current Support: 14360.0

High Target: 14620.0

Low Target: 14280.0