Indonesia crossed the 100,000 Covid-19 infection mark as Southeast Asia’s largest economy continues to struggle with the virus. It is now the most-infected country among ASEAN members, and the International Monetary Fund predicts a 0.3% GDP contraction for 2020. While it appears benign as compared to developed countries, it represents significant challenges for the emerging economy of Indonesia, primarily due to the high percentage of informal employment. Despite the current issues, the outlook remains more bullish than that of the US, creating a bearish catalyst for the thinly traded USD/IDR, which is anticipated to extend its corrective phase following the breakdown below its short-term resistance zone.

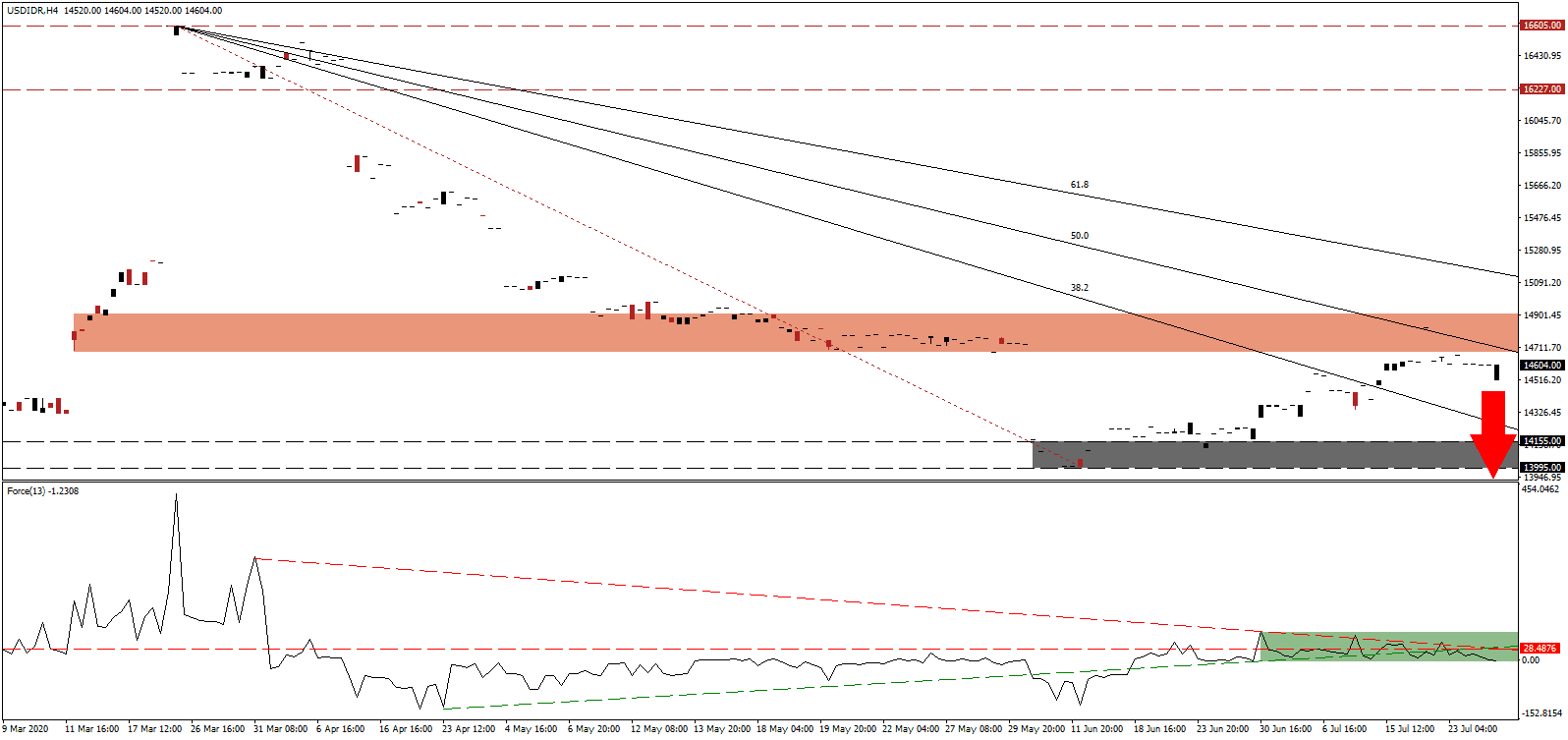

The Force Index, a next-generation technical indicator, confirms the increase in bearish momentum with the formation of a series of lower highs, as marked by the green rectangle. After the breakdown below its ascending support level, it is now moving further away from its horizontal resistance level. The descending resistance level is adding to downside pressures, and bears are in full control of the USD/IDR with this technical indicator in negative territory.

Since May 27th, per data from Kementerian Ketenagakerjaan (Ministry of Manpower), over 3.06 million Indonesians were either laid-off of furloughed. By the end of 2020, it is forecast to increase to 5.50 million, and a majority of job losses are in the informal sector. President Joko Widodo's plan to build a new national capital on Borneo, at an estimated cost of Rp450 trillion, remains a significant job creator. The retreat in the USD/IDR below its short-term resistance zone located between 14,683 and 14,905, as identified by the red rectangle, ended the healthy counter-trend advance.

Finance Minister Sri Mulyani Indrawati announced Rp11.5 trillion in fresh state funding to regional development banks and loans to provincial governments to combat the Covid-19 pandemic and assist with the economic recovery. It follows the Rp30.0 trillion in government financial aid to state lenders with the same objective. Jakarta and West Java will receive an additional Rp15.0 trillion capital injection. The descending 50.0 Fibonacci Retracement Fan Resistance Level is well-positioned to force a breakdown in the USD/IDR below its support zone located between 13,995 and 14,155, as marked by the grey rectangle. Price action will face its next support zone between 13,560 and 13,625.

USD/IDR Technical Trading Set-Up - Breakdown Extension Scenario

Long Entry @ 14,600

Take Profit @ 13,560

Stop Loss @ 14,800

Upside Potential: 1,040 pips

Downside Risk: 200 pips

Risk/Reward Ratio: 5.20

Should the Force Index push through its ascending support level, serving as resistance, the USD/INR may attempt a breakout. The US debates a cut to the weekly subsidy for the unemployed, from $600 to $200, in the fifth Covid-19 stimulus package. It will add significant stress on the economy and the US Dollar, with a magnified bearish outlook. Forex traders are recommended to sell any rallies in price action, with the upside potential confined to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/IDR Technical Trading Set-Up - Limited Breakout Scenario

Short Entry @ 14,900

Take Profit @ 15,060

Stop Loss @ 14,800

Downside Potential: 160 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 1.60