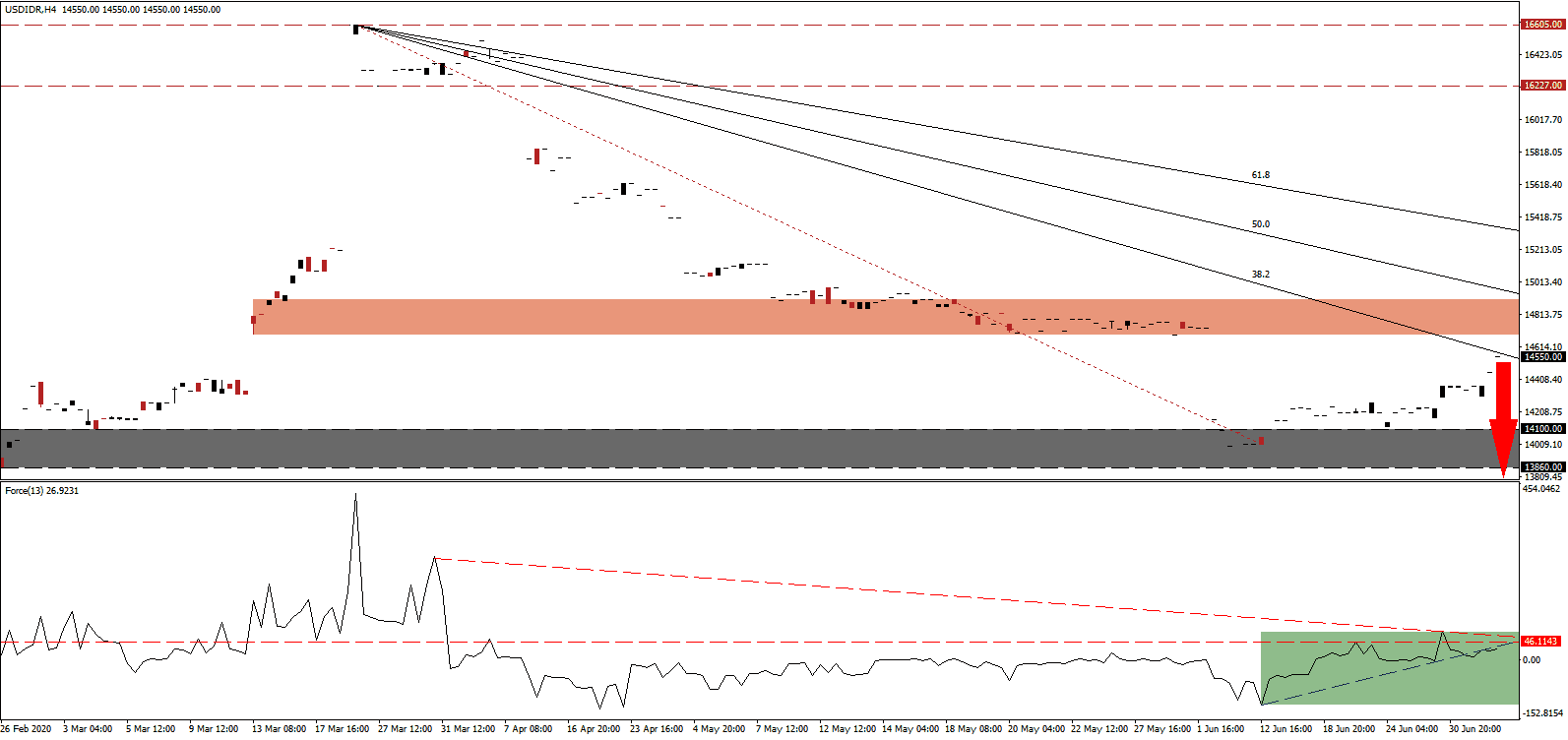

Indonesian President Joko Widodo pushes ahead with plans to build a new national capital on Borneo, at an estimated cost of Rp450 trillion, confirmed by Planning Minister Suharso Monoarfa. It was proposed in 2019 to ease issues with flood-plagued Jakarta, but plans were halted due to the Covid-19 pandemic. The government delivered an economic relief package, worth Rp695 trillion, to fight the fallout from the collapse in global trade, tourism, and the economy as a whole. The USD/IDR spiked into its descending 38.2 Fibonacci Retracement Fan Resistance Level from where the correction is poised to resume.

The Force Index, a next-generation technical indicator, faces rejection by its ascending support level, serving as resistance. Following a brief advance above its horizontal resistance level, a swift reversal materialized. The descending resistance level is increasing downside pressures, as marked by the green rectangle. Bears wait for this technical indicator to collapse into negative territory to regain complete control over the USD/IDR.

Private sector investment to construct the yet unnamed capital is essential to promoting a post-Covid-19 economic recovery. The government will build primary infrastructure, while private sector capital will finance the city construction. An area of 256,000 hectares in East Kalimantan was identified as the location where the government hopes to commence phased relocation by 2024. Bearish momentum in the USD/IDR is expanding, with a pending downward revision to the short-term resistance zone, presently located between 14,683 and 14,905, as marked by the red rectangle, confirming breakdown pressures.

While the massive construction project is anticipated to boost the economy via job creation and investment, another sector favored to increase dominance over the Indonesian GDP is the emerging bioeconomy. Sustainable and green economic activity will fulfill an essential role, and Indonesia is using sustainable forestry and biomass production as a pillar for future growth. It adds to long-term bullish progress in the Indonesian Rupiah. The USD/IDR is likely to complete a breakdown below its support zone located between 13,685 and 14,010, as identified by the grey rectangle. From there, an extension into its support zone between 13,560 and 13,600 is probable.

USD/IDR Technical Trading Set-Up - Breakdown Resumption Scenario

Long Entry @ 14,550

Take Profit @ 13,560

Stop Loss @ 14,800

Upside Potential: 990 pips

Downside Risk: 250 pips

Risk/Reward Ratio: 3.96

A sustained breakout in the Force Index above its ascending support level may pressure the USD/IDR into a breakout. Forex traders are recommended to take advantage of any extension to the upside with new net short positions in this thinly traded currency pair. Ongoing bearish progress in the US Dollar confines the upside potential to its descending 61.8 Fibonacci Retracement Fan Resistance Level, likely to maintain the corrective phase.

USD/IDR Technical Trading Set-Up - Confined Breakout Scenario

Short Entry @ 14,950

Take Profit @ 15,300

Stop Loss @ 14,800

Downside Potential: 350 pips

Upside Risk: 150 pips

Risk/Reward Ratio: 2.33