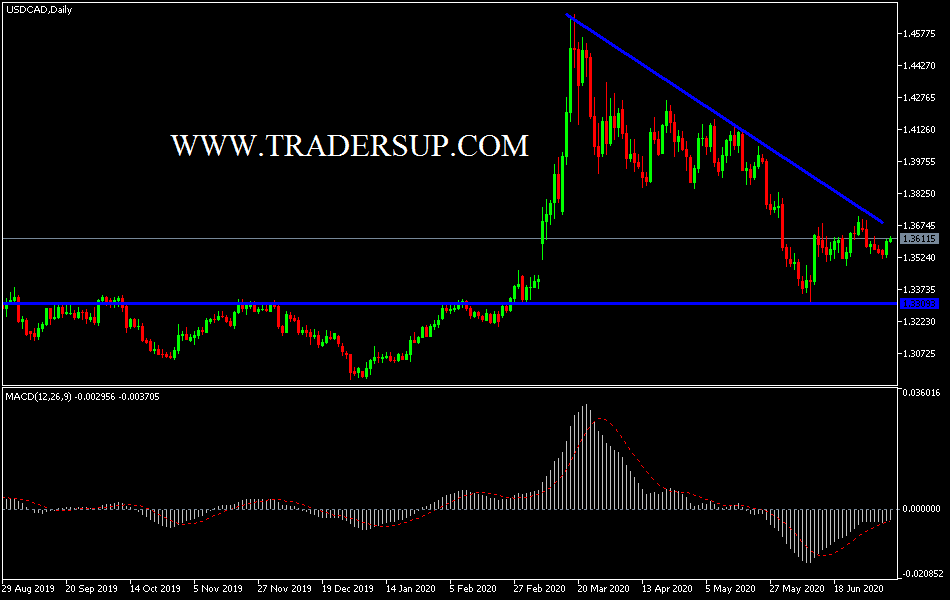

For the second consecutive day, the USD/CAD is trying to achieve an upward correction after sharp losses that recently pushed it to the 1.3519 support, and it settles around the 1.3620 level at the time of writing. Rebound attempts are still weak, as global crude oil prices, which support the CAD, are facing obstacles to complete the path of achieving gains.This is in light of fears of weak global demand with increasing numbers of new coronavirus cases, increasing pressure on the global economy, which recently abandoned economic closure measures implemented months ago, which caused a global recession, that was the strongest since the 1930s.

It appears that the USD/CAD pair may continue to move in a narrow range until the announcement of Canadian employment figures on Friday. Recently, the Bank of Canada business survey showed a decrease of -7.0 from -0.5 in the first quarter, the lowest reading since 2009. Expectations now indicate that the Canadian economy may succeed in adding about 700,000 more jobs in July. Strong employment growth along with lower unemployment rates could trigger a bullish reaction to the CAD performance against other major currencies, as it boosts bids for more financial support. Moreover, the current improvement in the labor market may keep the Bank of Canada's impact on its monetary policy unchanged.

On the other hand, the Bank of Canada appears to be focusing on maintaining the current policy at the next meeting. The meeting is scheduled for July 15, and officials expect the country's economic recovery to begin in the third quarter. The bank is likely to continue to wait and see the strategy over the next few months. Any additional policy measures will be designed in such a way as to provide the required degree of necessary adjustment required for monetary policy to achieve the inflation target.

In this regard, updates to the Fiscal Policy Report may reveal a less pessimistic forward approach, as the Canadian Central Bank will begin to support the further employment and output growth. Generally speaking, significant developments from Canada may also affect the short-term overview of the USD/CAD rate if the Bank of Canada tames all speculations for more financial support.

However, Bank of Canada Governor Tiff Macklem rules out the possibility of a V-shaped recovery. If the central bank does the same, it could lead to a Canadian dollar retreat while maintaining the bank’s commitment to go on with large-scale purchases of assets until the economy recovers.

Until that happens, the general direction of the USD/CAD pair will remain under downward pressure as is the performance on the daily chart below, and there will be no real reversal of bear’s control without the pair moving towards the resistance levels at 1.3730 and 1.3845, respectively. On the other hand, moving below the 1.3520 support would strengthen the bear's control over the performance as it is now. The pair is not expecting any important economic data today, it will only interact with the announcement of the US oil stocks numbers, which affect the global crude oil prices and thus the Canadian dollar.