MAPFRE Economics, in its latest study, predicts the Brazilian economy to contract between 8.9% and 9.8% in 2020. The assessment is significantly more bearish than that of the Banco Central do Brasil, which currently foresees a decrease of 6.1%, revised higher from the previous outlook of a 6.5% drop. It resulted in a 75 basis points interest rate cut to 2.25%, as the government of President Jair Bolsonaro will guaranteed business loans to small and medium-sized enterprises (SMEs). The USD/BRL sell-off is expected to accelerate following the rejection of a counter-trend advance by its resistance zone.

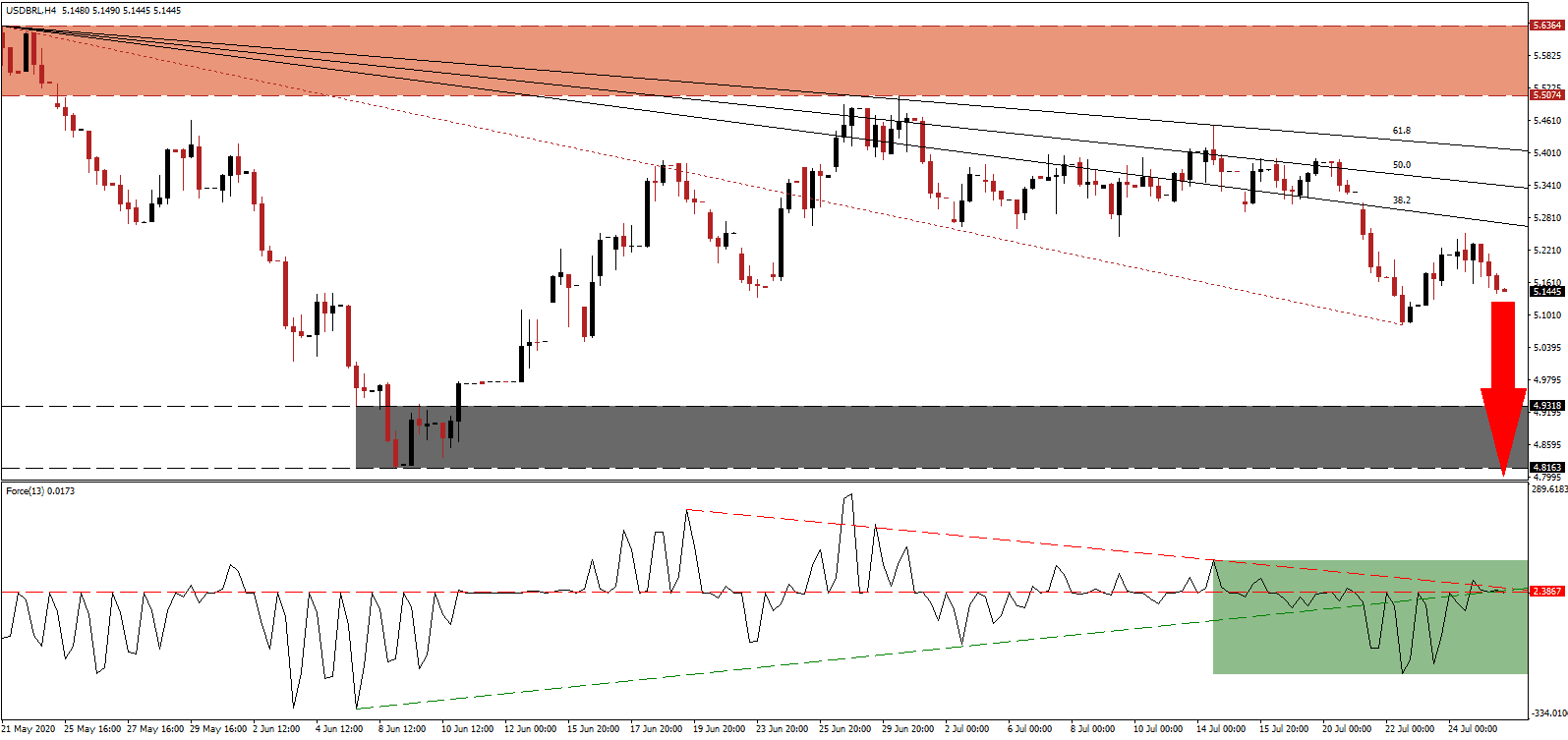

The Force Index, a next-generation technical indicator, briefly pierced its descending resistance level to the upside but is presently reversing below its horizontal resistance level. Adding to downside pressures is the slide below its ascending support level, as marked by the green rectangle. Bears wait for this technical indicator to move below the 0 center-line to regain complete control over the USD/BRL.

Brazil launched a new credit program labeled Pronampe to support SMEs. It will guarantee 80% of loans to companies with revenues between R$360,000 and R$300,000,000, made via the Investment Guarantee Fund (FGI) of the Banco Nacional de Desenvolvimento Econômico e Social (BNDES), the development Bank of Brazil. SMEs account for 99% of all entities in Brazil, but only contribute 20% of GDP while creating 60% of all formal jobs in the economy. The rejection in the USD/BRL by its resistance zone located between 5.5074 and 5.6364, as marked by the red rectangle, confirmed the well-established breakdown pattern.

US Senate Majority Leader Mitch McConnell announced details of the proposed fifth stimulus as a result of the Covid-19 pandemic. It includes a second direct deposit of $1,200 to consumers and a weekly subsidy reduction for the unemployed from $600 to $200. It is uncertain if Democrats will agree to the bill, but it suggests that economic problems in the US will intensify. Price action is expected to be guided lower by its descending Fibonacci Retracement Fan sequence until the USD/BRL can challenge its support zone located between 4.8163 and 4.9318, as identified by the grey rectangle, with more downside likely.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5.1450

Take Profit @ 4.8000

Stop Loss @ 5.2550

Downside Potential: 3,450 pips

Upside Risk: 1,100 pips

Risk/Reward Ratio: 3.14

A breakout in the Force Index above its descending resistance level may lead the USD/BRL into a temporary reversal. The upside potential is confined to the bottom range of its downward revised resistance zone due to an increasingly bearish outlook for the US Dollar and the economy. Therefore, Forex traders should consider any rallies from present levels as an excellent selling opportunity.

USD/BRL Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 5.3450

Take Profit @ 5.5050

Stop Loss @ 5.2550

Upside Potential: 1,600 pips

Downside Risk: 900 pips

Risk/Reward Ratio: 1.78