Brazil’s Ministry of Economy announced 331,901 formal job losses in May, adding to the devastating blow the Covid-19 pandemic has on the economy. While there are significantly less than the record 860,503 eliminated positions reported in April, the labor market remains depressed. Over 1.14 million employees lost their jobs due to the virus, creating a massive problem for President Jair Bolsonaro to tackle. Today’s US June NFP report is positioned for disappointment, adding to the breakdown in the USD/BRL below its short-term resistance zone.

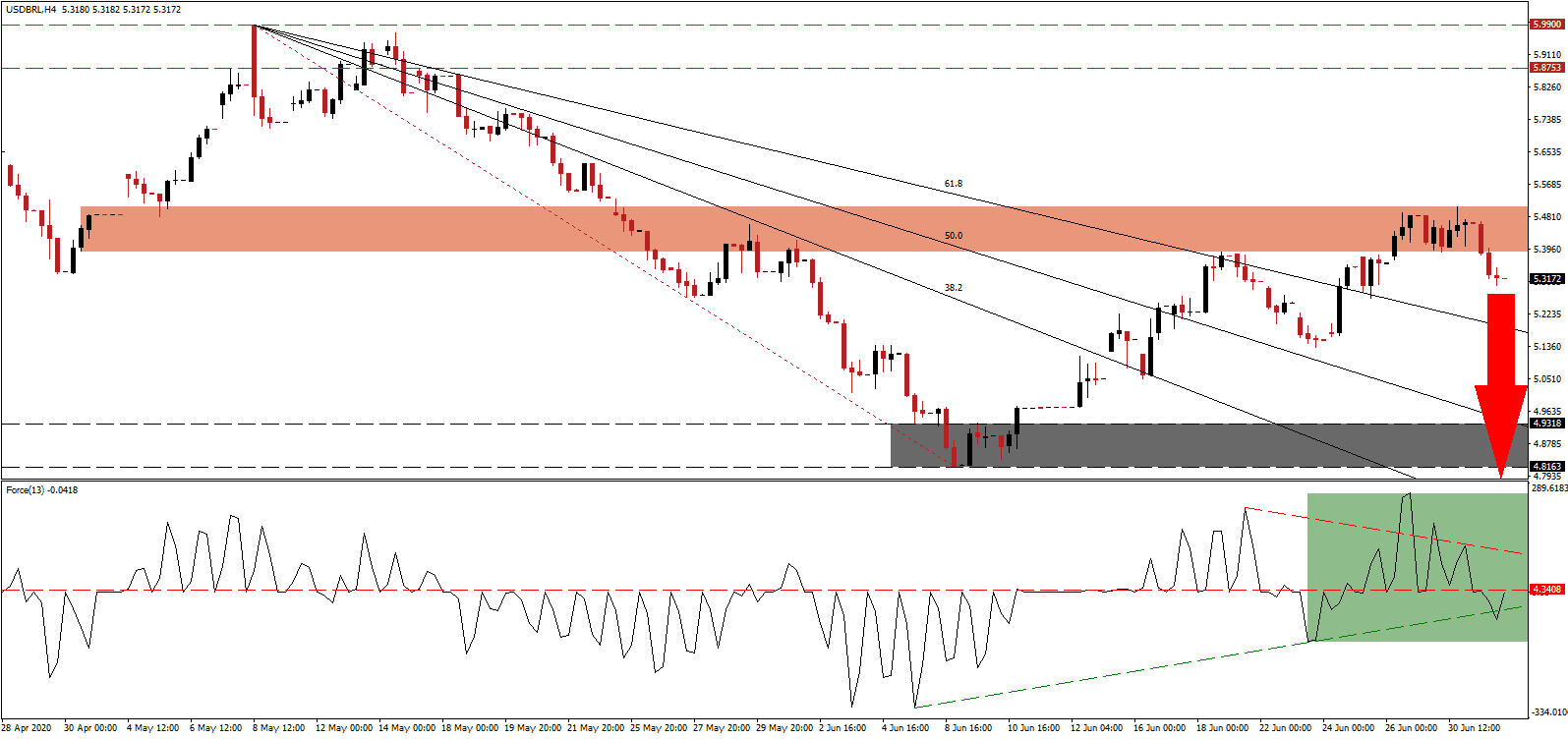

The Force Index, a next-generation technical indicator, reversed its brief spike above the descending resistance level and collapsed through its horizontal support level, converting it into resistance. It dipped below its ascending support level, as marked by the green rectangle, but has since recovered and is now testing its horizontal resistance level from where rejection is expected. Bears are in full control of the USD/BRL with this technical indicator in negative territory.

Adding to positive progress for the Brazilian Real is the recovery in the manufacturing sector in June, with the PMI clocking in at 51.6, confirming expansion. Magnifying bullish pressures is the June trade surplus of $7.5 billion, the second-highest on record, trailing only the $7.7 billion reported in May 2017. Exports rose to $17.9 billion while imports totaled $10.4 billion. It brought the first-year surplus to $23.0 billion, prompting the Ministry of Economy to raise its full-year forecast from $46.6 billion to $55.4 billion. More downside is favored in the USD/BRL after the breakdown below its short-term resistance zone located between 5.3865 and 5.5074, as marked by the red rectangle.

While the Covid-19 pandemic is raging across Brazil, it is out of control in the US. The Congressional testimony by the Director of the National Institute of Allergy and Infectious Diseases, Anthony Fauci, and the Director of the Centers for Disease Control and Prevention, Robert Redfield, together with other top health officials, confirmed the local, state, and federal government’s failure in handling the worsening situation. The USD/BRL is on course to correct below its descending 61.8 Fibonacci Retracement Fan Support Level, from where an accelerated sell-off into its support zone located between 4.8163 and 4.9318, as identified by the grey rectangle, is anticipated. More downside is probable, guided lower by the 38.2 Fibonacci Retracement Fan Support Level.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5.3175

Take Profit @ 4.8000

Stop Loss @ 5.4700

Downside Potential: 5,175 pips

Upside Risk: 1,525 pips

Risk/Reward Ratio: 3.39

In the event the Force Index accelerates above its descending resistance level, the USD/BRL could follow with a reversal. With US daily infections surpassing 50,000, the US government deliberates to spike its unsustainable debt load further to issue more stimuli, including a second direct payout to consumers. The upside potential for a short-term breakout is reduced to the bottom range of its resistance zone located between 5.8753 and 5.9900, pending a downward revision, and offering Forex traders a secondary selling opportunity.

USD/BRL Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 5.6250

Take Profit @ 5.8700

Stop Loss @ 5.4700

Upside Potential: 2,450 pips

Downside Risk: 1,550 pips

Risk/Reward Ratio: 1.58