The US dollar initially tried to rally during the trading session on Friday against the Brazilian real, but has given back quite a bit of the gains. By forming the candlestick shape that it has, it lends a little bit more credence to the idea that we are ready to go lower. That being said, when you talk about the Brazilian real, you are also talking about emerging markets in general, so that is something that you need to pay close attention to. After all, the emerging markets have been particularly hard-hit by the economic contraction globally, so it makes quite a bit of sense that people are still a little bit skittish when it comes to buying the currencies there.

To make things worse, the Brazilian economy was particularly hit hard due to the coronavirus infection rate, so this is why the United States dollar had spiked all the way to the 6.00 Real level. I think at this point things have changed though, as we have seen the US dollar pummeled against almost everything else, with the most obvious measure of the US dollar weakness being the fact that the EUR/USD pair has reached as high as 1.16 over the last couple of days. Remember, the US dollar tends to move in the same direction against most currencies over time, so I think that is part of what is going on here.

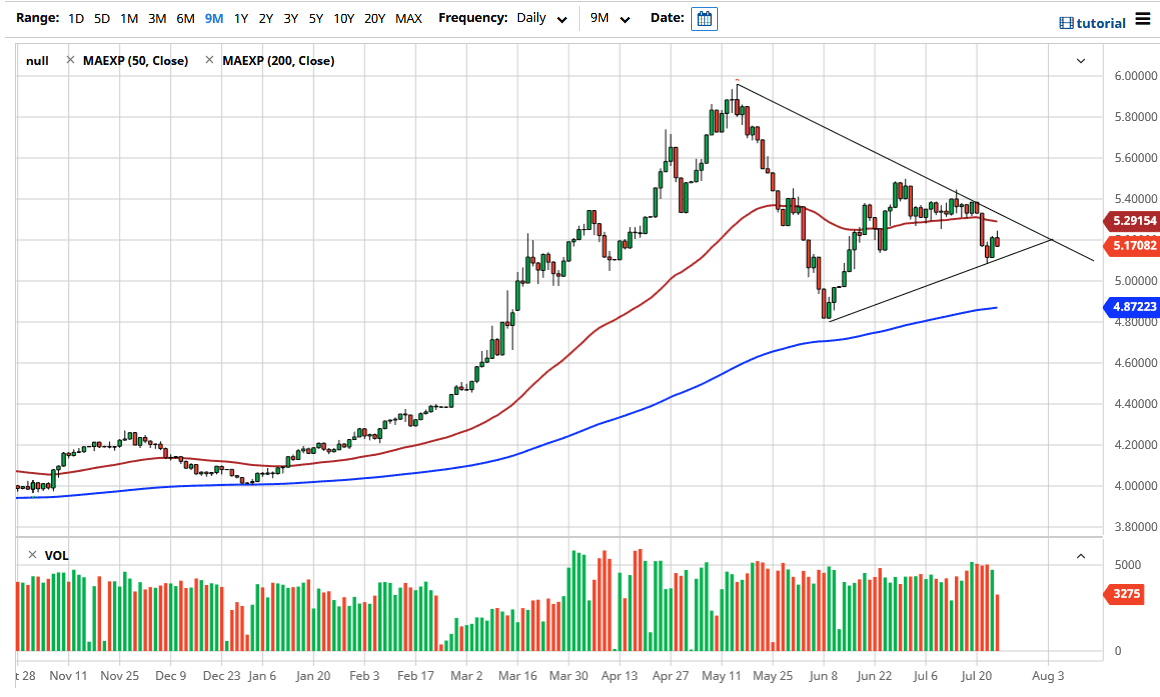

There is a slight uptrend line that we have just below, but I think we are going to test the 5.00 Real level underneath as it is such a juicy target for traders. To the upside, the 50 day EMA near the 5.29 level is going to cause resistance. At this point, we are seeing the market squeeze a little bit so we should see a pretty significant move in one direction or the other, once we bust out of this larger wedge. In the short term though, you would have to think that it still favors the downside as the US dollar has been on its back foot against most currencies. Even if we do rally, the 5.40 level should end up being massive resistance, as we have clearly flipped on the US dollar recently, as seen against most other currencies. Furthermore, if we do see a bit of recovery in Latin America, that will push this pair lower as well.