The US dollar has broken down significantly against the Brazilian Real, as we have seen the US dollar get hammered against almost everything. It appears that something has broken in the US dollar itself, as multiple currency pairs have signaled that they are ready to start selling off the greenback. This is most likely a reaction to the Federal Reserve and the pumping of liquidity into the system. It is quite telling that the US dollar even lost against the Brazilian Real, as it is an area and an economy that is struggling drastically with the coronavirus infection.

The Brazilian Real is very sensitive to global risk appetite, and commodities. All things being equal the US dollar is being crushed due to the Federal Reserve pumping out liquidity into the marketplace. Quite frankly, it looks as if the Federal Reserve is doing everything it can to bring down the value of the US dollar, and therefore it is likely that we continue to see the Brazilian Real gain, despite the fact that there is no fundamental reason for Brazil to gain.

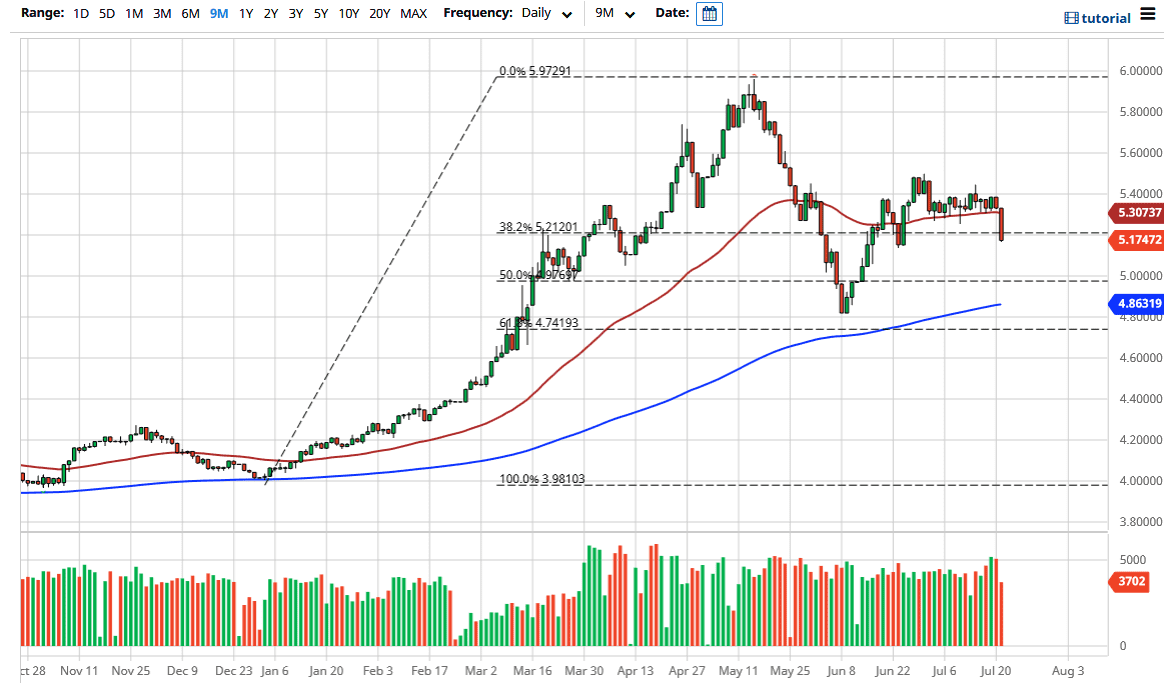

During the trading session on Wednesday, the market broke down below the 5.20 Real level, and even the 50 day EMA. I think this is a market that will continue to sell off and therefore I like the idea of fading short-term rallies that show signs of exhaustion. At this point, it looks like the market is probably going to go looking towards the 200 day EMA underneath, which is just below the 5 Real level. After all, the US dollar continues to be looked at upon with suspicion as the Federal Reserve simply buys everything you can, and it would not be a huge surprise to see the Federal Reserve step in and start buying stocks next. With the Federal Reserve out of control, the US dollar will be punished, and the most telling picture of this is not necessarily this pair, but the fact that the Euro broke above the 1.15 level finally. Remember, the Euro is the “anti-dollar”, and therefore it is bought if the US dollar is sold off. Ultimately, I think this is a market that continues to see a lot of volatility, but I do believe that the 200 day EMA will be tested given enough time.